Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

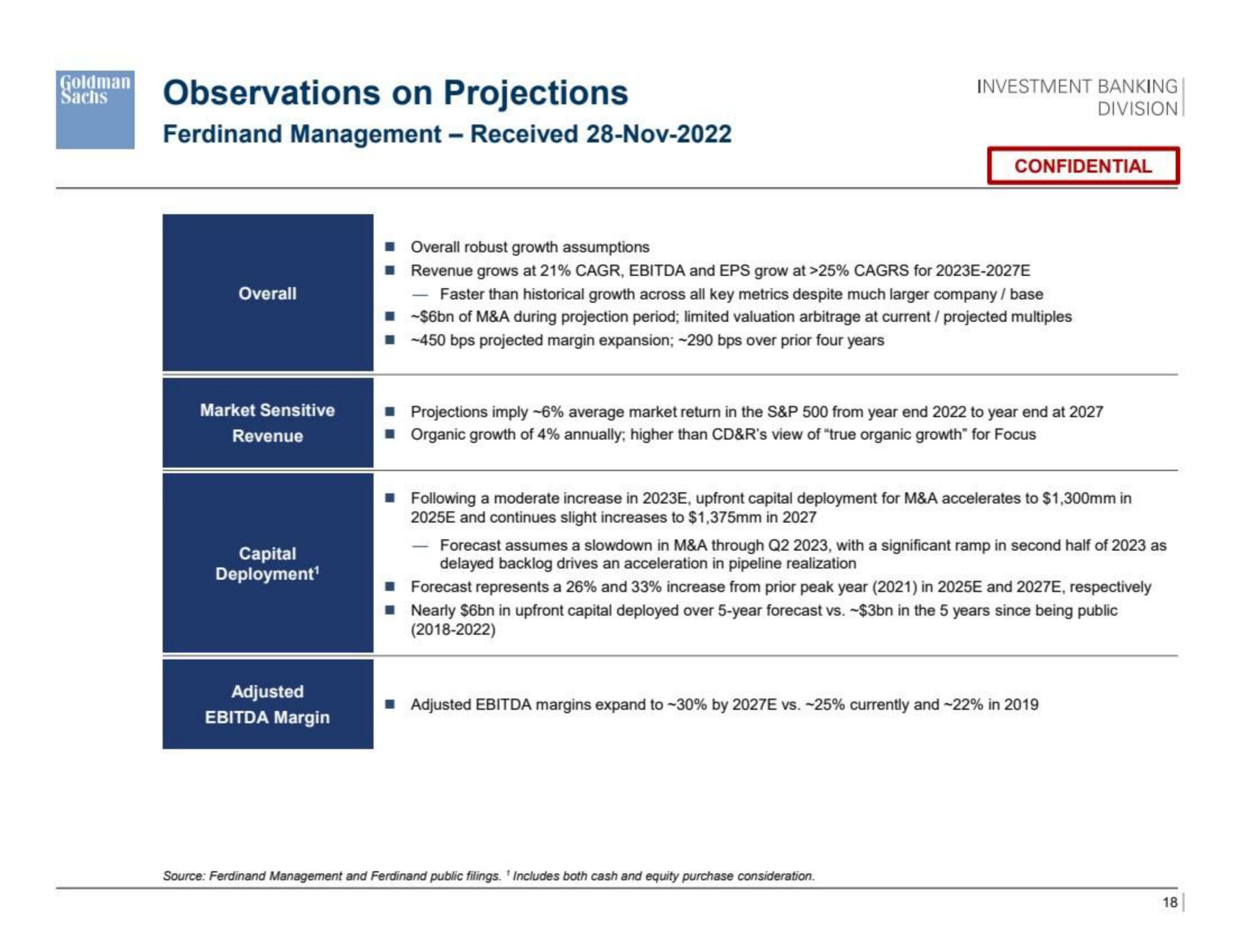

Observations on Projections

Ferdinand Management - Received 28-Nov-2022

Overall

Market Sensitive

Revenue

Capital

Deployment¹

Adjusted

EBITDA Margin

INVESTMENT BANKING

DIVISION

CONFIDENTIAL

Overall robust growth assumptions

■ Revenue grows at 21% CAGR, EBITDA and EPS grow at >25% CAGRS for 2023E-2027E

Faster than historical growth across all key metrics despite much larger company / base

-$6bn of M&A during projection period; limited valuation arbitrage at current / projected multiples

-450 bps projected margin expansion; -290 bps over prior four years

■ Projections imply -6% average market return in the S&P 500 from year end 2022 to year end at 2027

■ Organic growth of 4% annually; higher than CD&R's view of "true organic growth" for Focus

■ Following a moderate increase in 2023E, upfront capital deployment for M&A accelerates to $1,300mm in

2025E and continues slight increases to $1,375mm in 2027

Forecast assumes a slowdown in M&A through Q2 2023, with a significant ramp in second half of 2023 as

delayed backlog drives an acceleration in pipeline realization

Forecast represents a 26% and 33% increase from prior peak year (2021) in 2025E and 2027E, respectively

■ Nearly $6bn in upfront capital deployed over 5-year forecast vs. -$3bn in the 5 years since being public

(2018-2022)

Source: Ferdinand Management and Ferdinand public filings. Includes both cash and equity purchase consideration.

Adjusted EBITDA margins expand to -30% by 2027E vs. -25% currently and -22% in 2019

18View entire presentation