Ready Capital Investor Presentation Deck

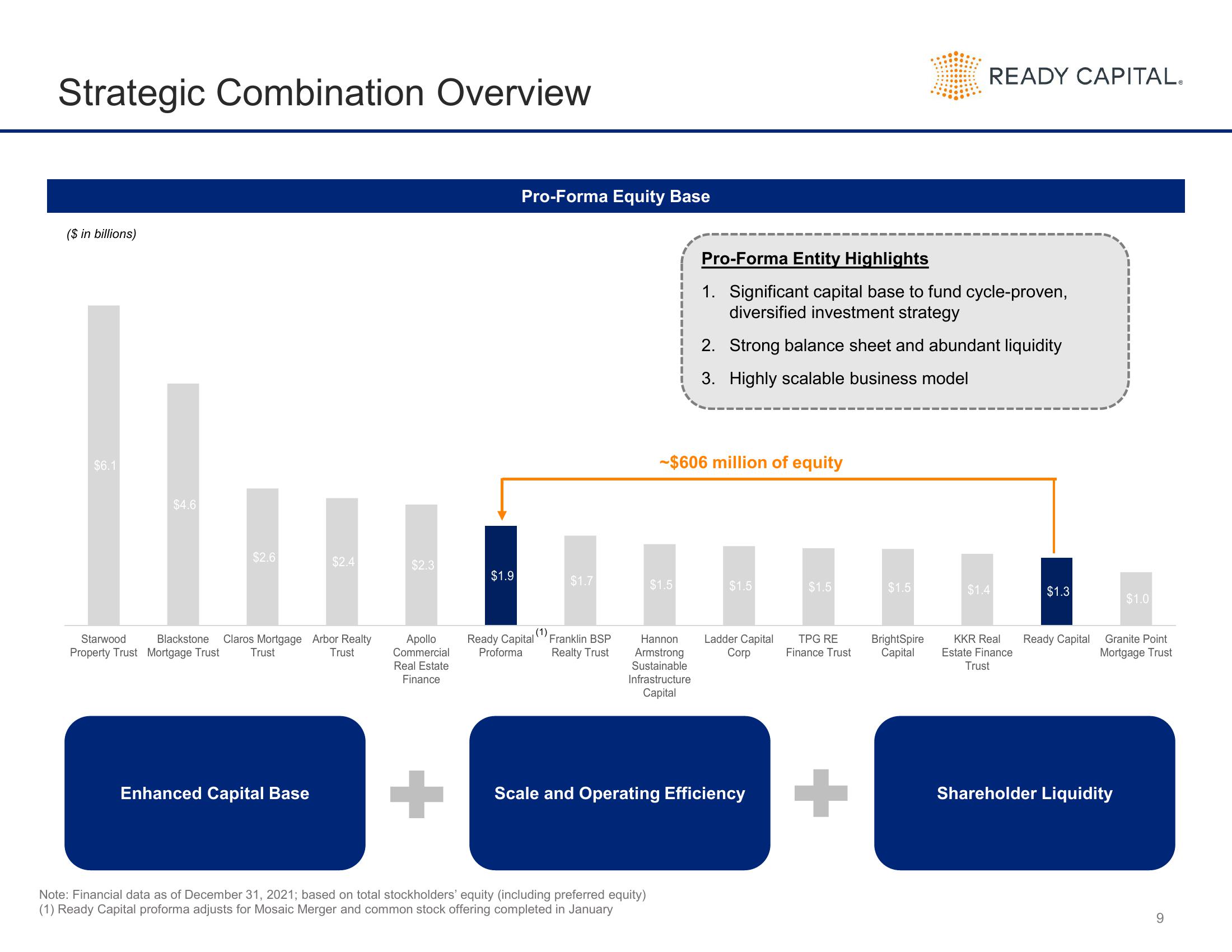

Strategic Combination Overview

($ in billions)

$6.1

$4.6

$2.6

$2.4

Starwood Blackstone Claros Mortgage Arbor Realty

Property Trust Mortgage Trust Trust

Trust

Enhanced Capital Base

$2.3

Apollo

Commercial

Real Estate

Finance

+

$1.9

Pro-Forma Equity Base

Ready Capital

Proforma

(1)

$1.7

Franklin BSP

Realty Trust

$1.5

Hannon

Armstrong

Sustainable

Infrastructure

Capital

Note: Financial data as of December 31, 2021; based on total stockholders' equity (including preferred equity)

(1) Ready Capital proforma adjusts for Mosaic Merger and common stock offering completed in January

~$606 million of equity

Pro-Forma Entity Highlights

1. Significant capital base to fund cycle-proven,

diversified investment strategy

2.

Strong balance sheet and abundant liquidity

3. Highly scalable business model

$1.5

Ladder Capital

Corp

Scale and Operating Efficiency

$1.5

TPG RE

Finance Trust

+

READY CAPITAL.

$1.5

BrightSpire

Capital

$1.4

$1.3

KKR Real Ready Capital

Estate Finance

Trust

$1.0

Granite Point

Mortgage Trust

Shareholder Liquidity

9View entire presentation