Ford Investor Conference Presentation Deck

U.S. FLOORPLAN SECURITIZATION

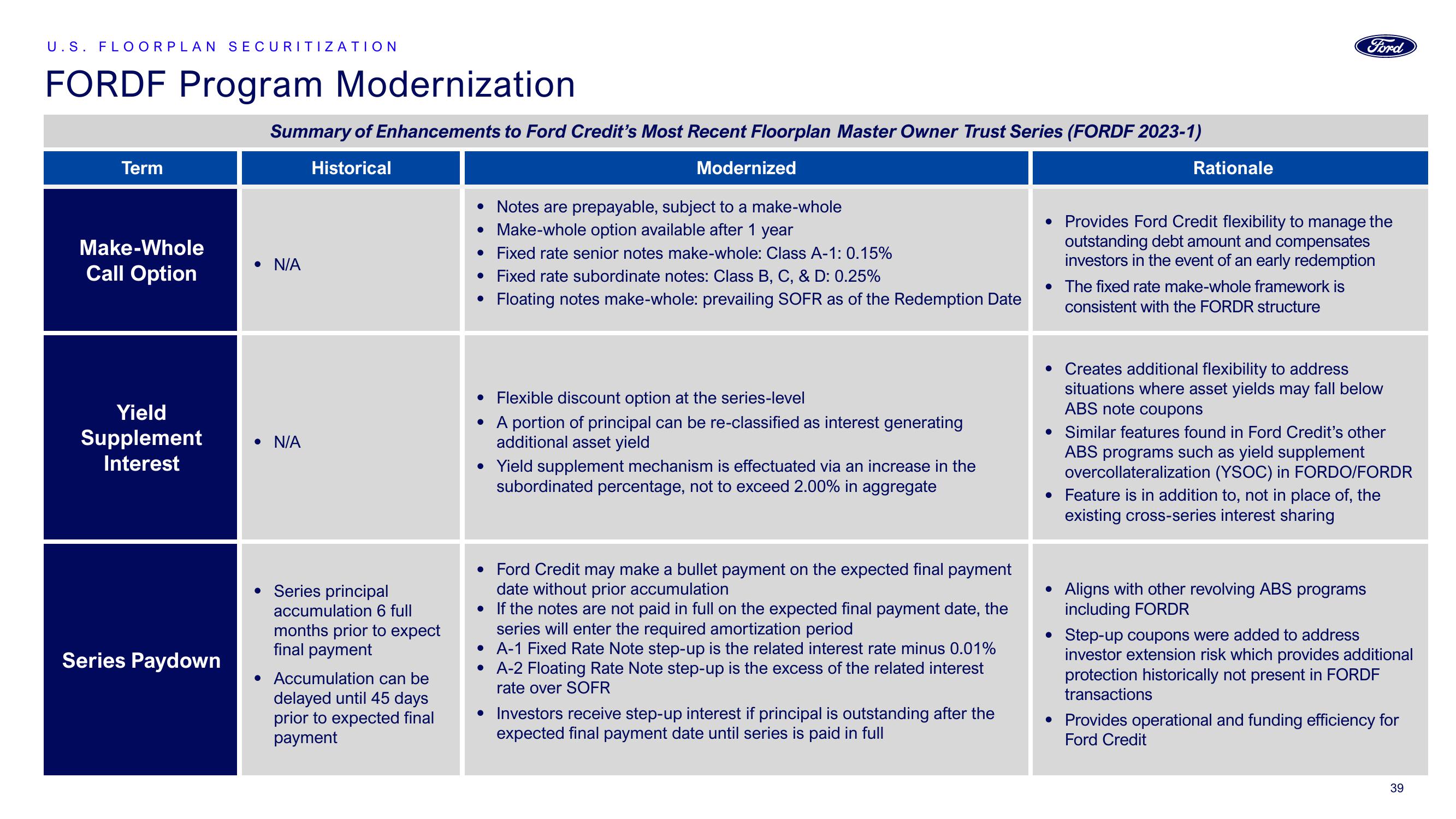

FORDF Program Modernization

Term

Make-Whole

Call Option

Yield

Supplement

Interest

Series Paydown

Summary of Enhancements to Ford Credit's Most Recent Floorplan Master Owner Trust Series (FORDF 2023-1)

Historical

• N/A

• N/A

• Series principal

accumulation 6 full

months prior to expect

final payment

• Accumulation can be

delayed until 45 days

prior to expected final

payment

Modernized

• Notes are prepayable, subject to a make-whole

• Make-whole option available after 1 year

• Fixed rate senior notes make-whole: Class A-1: 0.15%

• Fixed rate subordinate notes: Class B, C, & D: 0.25%

• Floating notes make-whole: prevailing SOFR as of the Redemption Date

• Flexible discount option at the series-level

• A portion of principal can be re-classified as interest generating

additional asset yield

• Yield supplement mechanism is effectuated via an increase in the

subordinated percentage, not to exceed 2.00% in aggregate

•

Ford Credit may make a bullet payment on the expected final payment

date without prior accumulation

•

If the notes are not paid in full on the expected final payment date, the

series will enter the required amortization period

• A-1 Fixed Rate Note step-up is the related interest rate minus 0.01%

A-2 Floating Rate Note step-up is the excess of the related interest

rate over SOFR

●

• Investors receive step-up interest if principal is outstanding after the

expected final payment date until series is paid in full

Rationale

Ford

• Provides Ford Credit flexibility to manage the

outstanding debt amount and compensates

investors in the event of an early redemption

The fixed rate make-whole framework is

consistent with the FORDR structure

• Creates additional flexibility to address

situations where asset yields may fall below

ABS note coupons

• Similar features found in Ford Credit's other

ABS programs such as yield supplement

overcollateralization (YSOC) in FORDO/FORDR

• Feature is in addition to, not in place of, the

existing cross-series interest sharing

• Aligns with other revolving ABS programs

including FORDR

• Step-up coupons were added to address

investor extension risk which provides additional

protection historically not present in FORDF

transactions

• Provides operational and funding efficiency for

Ford Credit

39View entire presentation