J.P.Morgan Software Investment Banking

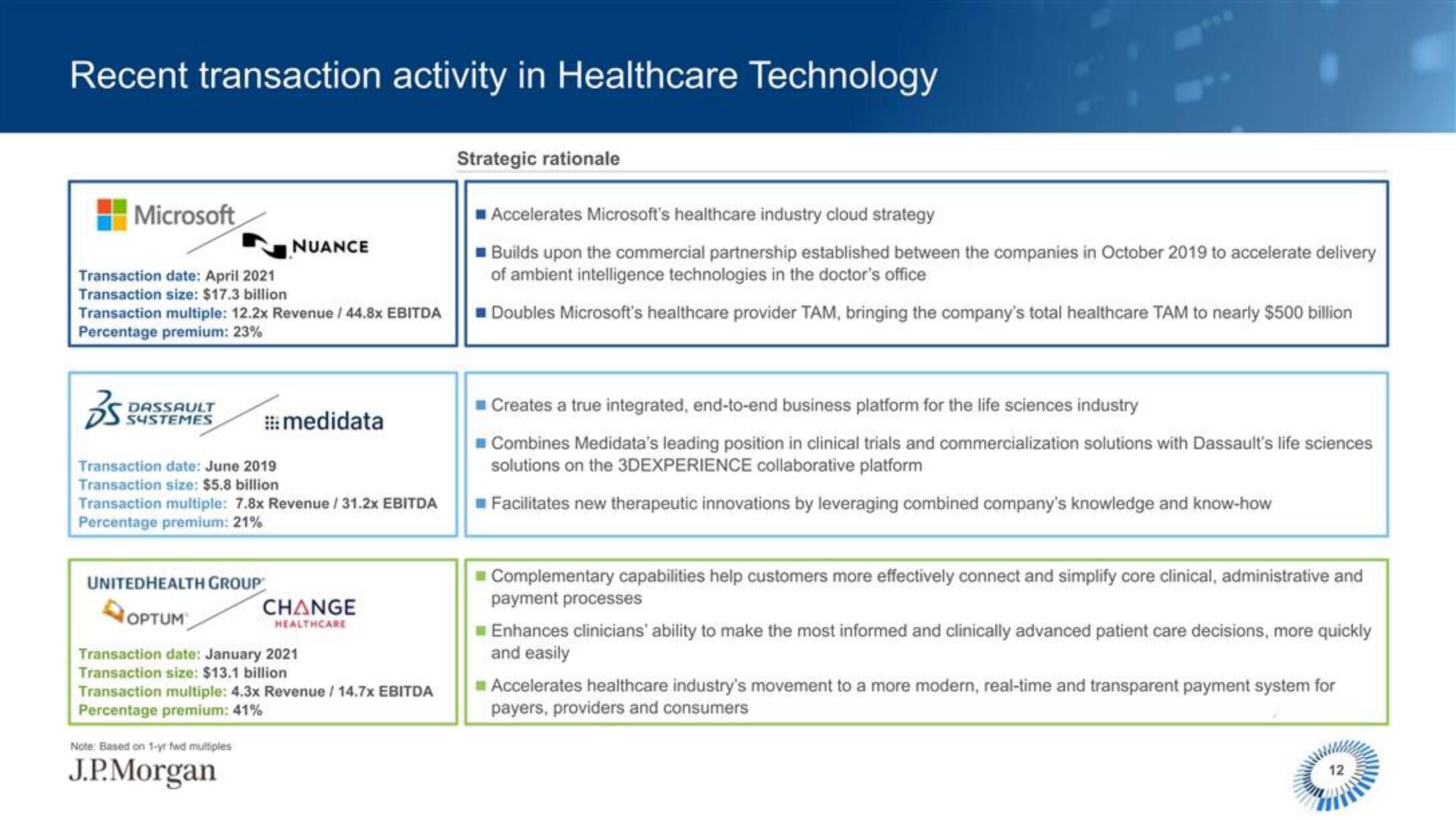

Recent transaction activity in Healthcare Technology

Microsoft

Transaction date: April 2021

Transaction size: $17.3 billion

Transaction multiple: 12.2x Revenue / 44.8x EBITDA

Percentage premium: 23%

DASSAULT

SYSTEMES

NUANCE

UNITEDHEALTH GROUP

OPTUM

Transaction date: June 2019

Transaction size: $5.8 billion

Transaction multiple: 7.8x Revenue/31.2x EBITDA

Percentage premium: 21%

medidata

Note: Based on 1-yr fwd multiples

J.P.Morgan

CHANGE

HEALTHCARE

Transaction date: January 2021

Transaction size: $13.1 billion

Transaction multiple: 4.3x Revenue / 14.7x EBITDA

Percentage premium: 41%

Strategic rationale

Accelerates Microsoft's healthcare industry cloud strategy

Builds upon the commercial partnership established between the companies in October 2019 to accelerate delivery

of ambient intelligence technologies in the doctor's office

Doubles Microsoft's healthcare provider TAM, bringing the company's total healthcare TAM to nearly $500 billion

Creates a true integrated, end-to-end business platform for the life sciences industry

Combines Medidata's leading position in clinical trials and commercialization solutions with Dassault's life sciences

solutions on the 3DEXPERIENCE collaborative platform

Facilitates new therapeutic innovations by leveraging combined company's knowledge and know-how

Complementary capabilities help customers more effectively connect and simplify core clinical, administrative and

payment processes

Enhances clinicians' ability to make the most informed and clinically advanced patient care decisions, more quickly

and easily

Accelerates healthcare industry's movement to a more modern, real-time and transparent payment system for

payers, providers and consumers

12View entire presentation