Bank of America Investment Banking Pitch Book

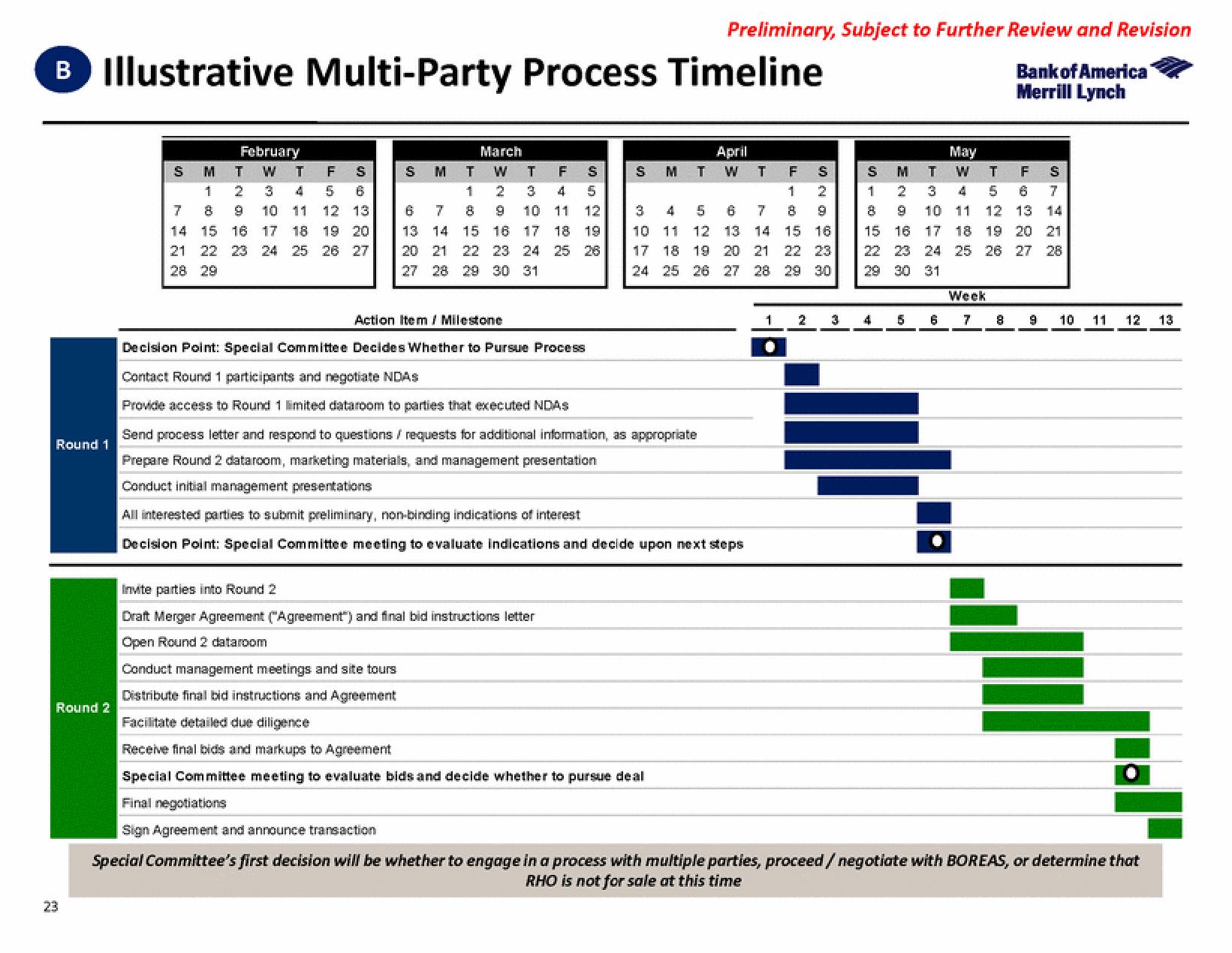

B Illustrative Multi-Party Process Timeline

Round 1

Round 2

23

February

W

M

T

F

S

1

3

5

6

7

8

9

10 11 12 13

14 15 16

20

17 18 19

21 22 23 24 25 26 27

28 29

S

T

March

T

W

1

2

6

8

9

15

13 14

16 17 18

20 21 22 23 24 25

27 28 29 30 31

S

M

T

F

S

3

4 5

10 11 12

19

26

S M

Invite parties into Round 2

Draft Merger Agreement ("Agreement") and final bid instructions letter

Open Round 2 dataroom

Preliminary, Subject to Further Review and Revision

Bank of America

Merrill Lynch

T

Conduct management meetings and site tours

Distribute final bid instructions and Agreement

Facilitate detailed due diligence

Receive final bids and markups to Agreement

Special Committee meeting to evaluate bids and decide whether to pursue deal

Final negotiations

Sign Agreement and announce transaction

April

W T

5 6 7

3 4

10 11 12 13 14

17 18 19 20 21

24 25 26 27 28

Action Item/ Milestone

Decision Point: Special Committee Decides Wheth to Pursue Process

Contact Round 1 participants and negotiate NDAS

Provide access to Round 1 limited dataroom to parties that executed NDAS

Send process letter and respond to questions / requests for additional information, as appropriate

Prepare Round 2 dataroom, marketing materials, and management presentation

Conduct initial management presentations

All interested parties to submit preliminary, non-binding indications of interest

Decision Point: Special Committee meeting to evaluate indications and decide upon next steps

1

F

1

S

15 16

22 23

29 30

2

3

S

1

M

15 16

22 23

29 30

4

5

May

T

W

3

4

10 11

17

24

31

6

T

5

12

18 19

25 26

Week

7

F

S

7

14

13

20

21

27 28

8 9 10 11 12 13

Special Committee's first decision will be whether to engage in a process with multiple parties, proceed/ negotiate with BOREAS, or determine that

RHO is not for sale at this timeView entire presentation