J.P.Morgan Results Presentation Deck

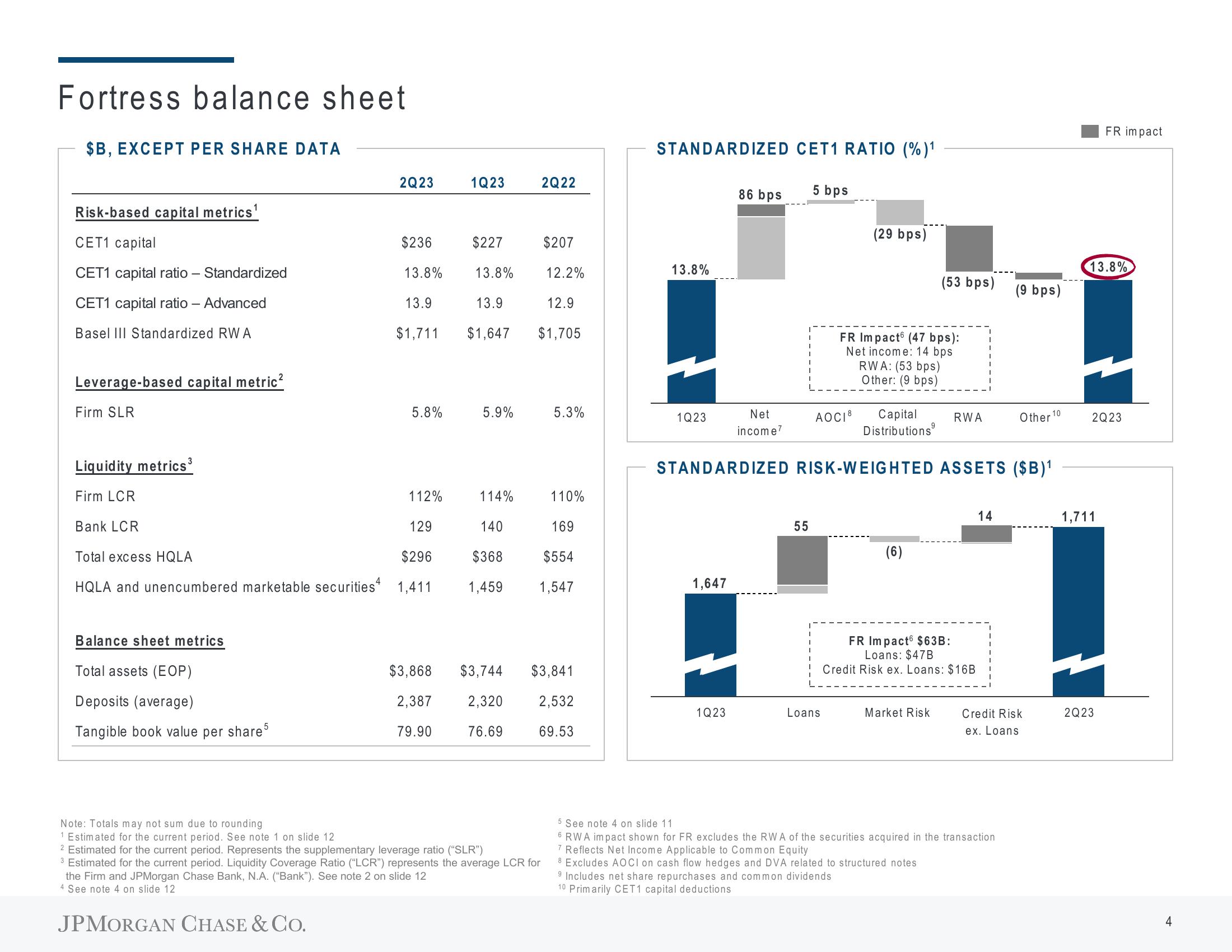

Fortress balance sheet

$B, EXCEPT PER SHARE DATA

Risk-based capital metrics¹

CET1 capital

CET1 capital ratio - Standardized

CET1 capital ratio - - Advanced

Basel III Standardized RWA

Leverage-based capital metric²

Firm SLR

Liquidity metrics³

Firm LCR

Bank LCR

Balance sheet metrics

Total assets (EOP)

Deposits (average)

Tangible book value per share5

2Q23

$236

13.8%

13.9

$1,711

JPMORGAN CHASE & CO.

5.8%

112%

$3,868

2,387

79.90

1Q23

114%

129

140

169

Total excess HQLA

$296

$368

$554

HQLA and unencumbered marketable securities 1,411 1,459 1,547

the Firm and JPMorgan Chase Bank, N.A. ("Bank"). See note 2 on slide 12

4 See note 4 on slide 12

$227

13.8%

13.9

12.9

$1,647 $1,705

5.9%

2Q22

$3,744

2,320

76.69

Note: Totals may not sum due to rounding

1 Estimated for the current period. See note 1 on slide 12

2 Estimated for the current period. Represents the supplementary leverage ratio ("SLR")

3 Estimated for the current period. Liquidity Coverage Ratio ("LCR") represents the average LCR for

$207

12.2%

5.3%

110%

$3,841

2,532

69.53

STANDARDIZED CET1 RATIO (%)¹

13.8%

1Q23

1,647

86 bps

1Q23

Net

income7

5 bps

55

AOCI 8

(29 bps)

Loans

FR Impact (47 bps):

Net income: 14 bps

RWA: (53 bps)

Other: (9 bps)

Capital

Distributions

STANDARDIZED RISK-WEIGHTED ASSETS ($B)¹

(6)

(53 bps)

Market Risk

RWA

FR Impact $63B:

Loans: $47B

Credit Risk ex. Loans: $16B

8 Excludes AOCI on cash flow hedges and DVA related to structured notes

9 Includes net share repurchases and common dividends

10 Primarily CET1 capital deductions

14

(9 bps)

5 See note 4 on slide 11

6 RWA impact shown for FR excludes the RWA of the securities acquired in the transaction

7 Reflects Net Income Applicable to Common Equity

Other 10

Credit Risk

ex. Loans

13.8%

FR impact

2Q23

1,711

2Q23

4View entire presentation