Shift SPAC Presentation Deck

Transaction Summary

●

●

.

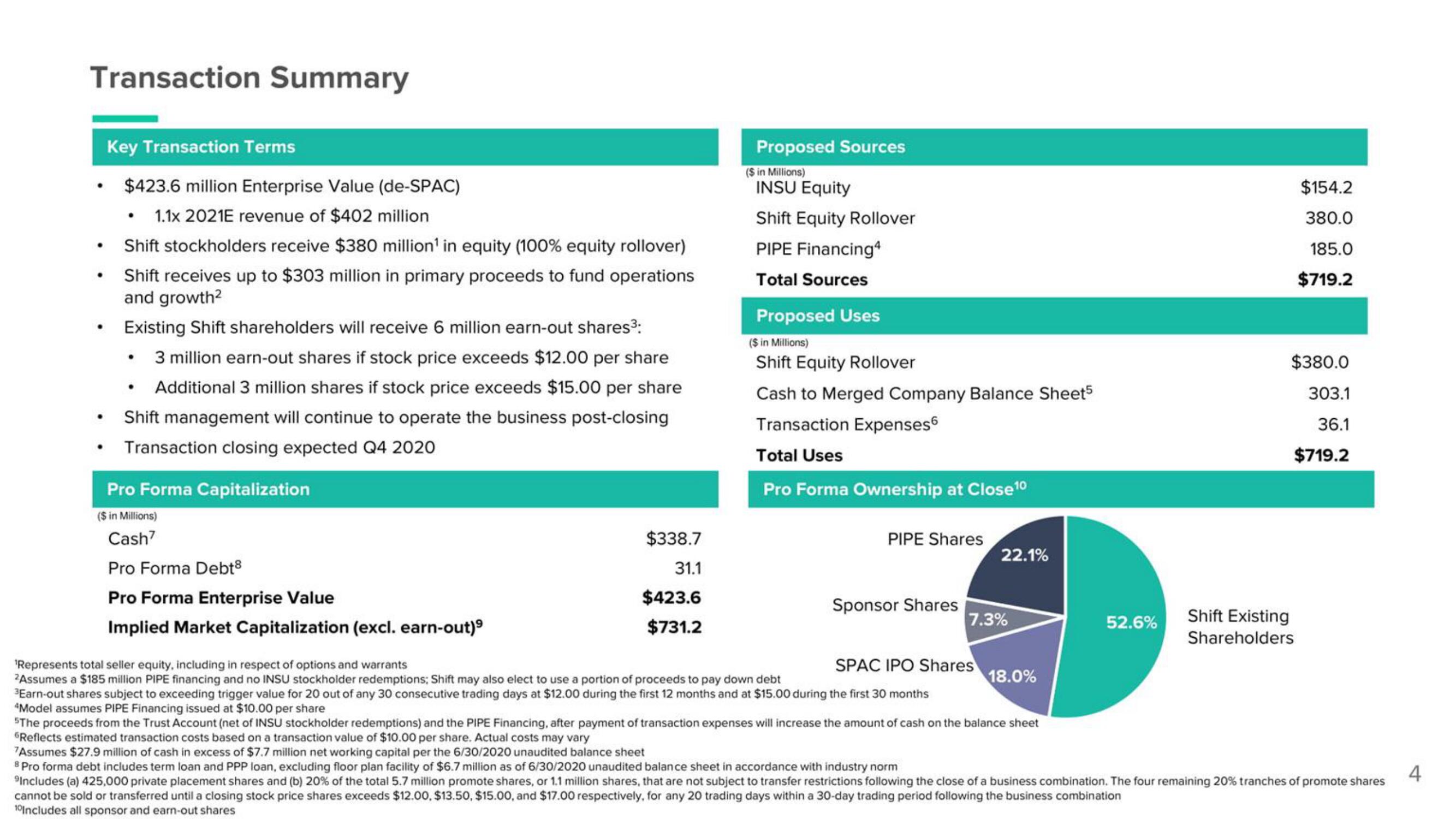

Key Transaction Terms

$423.6 million Enterprise Value (de-SPAC)

• 1.1x 2021E revenue of $402 million

Shift stockholders receive $380 million¹ in equity (100% equity rollover)

Shift receives up to $303 million in primary proceeds to fund operations

and growth²

Existing Shift shareholders will receive 6 million earn-out shares³:

• 3 million earn-out shares if stock price exceeds $12.00 per share

Additional 3 million shares if stock price exceeds $15.00 per share

Shift management will continue to operate the business post-closing

Transaction closing expected Q4 2020

Pro Forma Capitalization

($ in Millions)

Cash7

Pro Forma Debt

Pro Forma Enterprise Value

Implied Market Capitalization (excl. earn-out)⁹

$338.7

31.1

$423.6

$731.2

Proposed Sources

($ in Millions)

INSU Equity

Shift Equity Rollover

PIPE Financing4

Total Sources

Proposed Uses

($ in Millions)

Shift Equity Rollover

Cash to Merged Company Balance Sheet5

Transaction Expenses

Total Uses

Pro Forma Ownership at Close ¹0

PIPE Shares

Sponsor Shares

22.1%

7.3%

SPAC IPO Shares

¹Represents total seller equity, including in respect of options and warrants

2Assumes a $185 million PIPE financing and no INSU stockholder redemptions; Shift may also elect to use a portion of proceeds to pay down debt

3Earn-out shares subject to exceeding trigger value for 20 out of any 30 consecutive trading days at $12.00 during the first 12 months and at $15.00 during the first 30 months

4Model assumes PIPE Financing issued at $10.00 per share

18.0%

5The proceeds from the Trust Account (net of INSU stockholder redemptions) and the PIPE Financing, after payment of transaction expenses will increase the amount of cash on the balance sheet

"Reflects estimated transaction costs based on a transaction value of $10.00 per share. Actual costs may vary

7Assumes $27.9 million of cash in excess of $7.7 million net working capital per the 6/30/2020 unaudited balance sheet

52.6%

$154.2

380.0

185.0

$719.2

$380.0

303.1

36.1

$719.2

Shift Existing

Shareholders

8 Pro forma debt includes term loan and PPP loan, excluding floor plan facility of $6.7 million as of 6/30/2020 unaudited balance sheet in accordance with industry norm

Includes (a) 425,000 private placement shares and (b) 20% of the total 5.7 million promote shares, or 1.1 million shares, that are not subject to transfer restrictions following the close of a business combination. The four remaining 20% tranches of promote shares

cannot be sold or transferred until a closing stock price shares exceeds $12.00, $13.50, $15.00, and $17.00 respectively, for any 20 trading days within a 30-day trading period following the business combination

10 Includes all sponsor and earn-out shares

4View entire presentation