Evercore Investment Banking Pitch Book

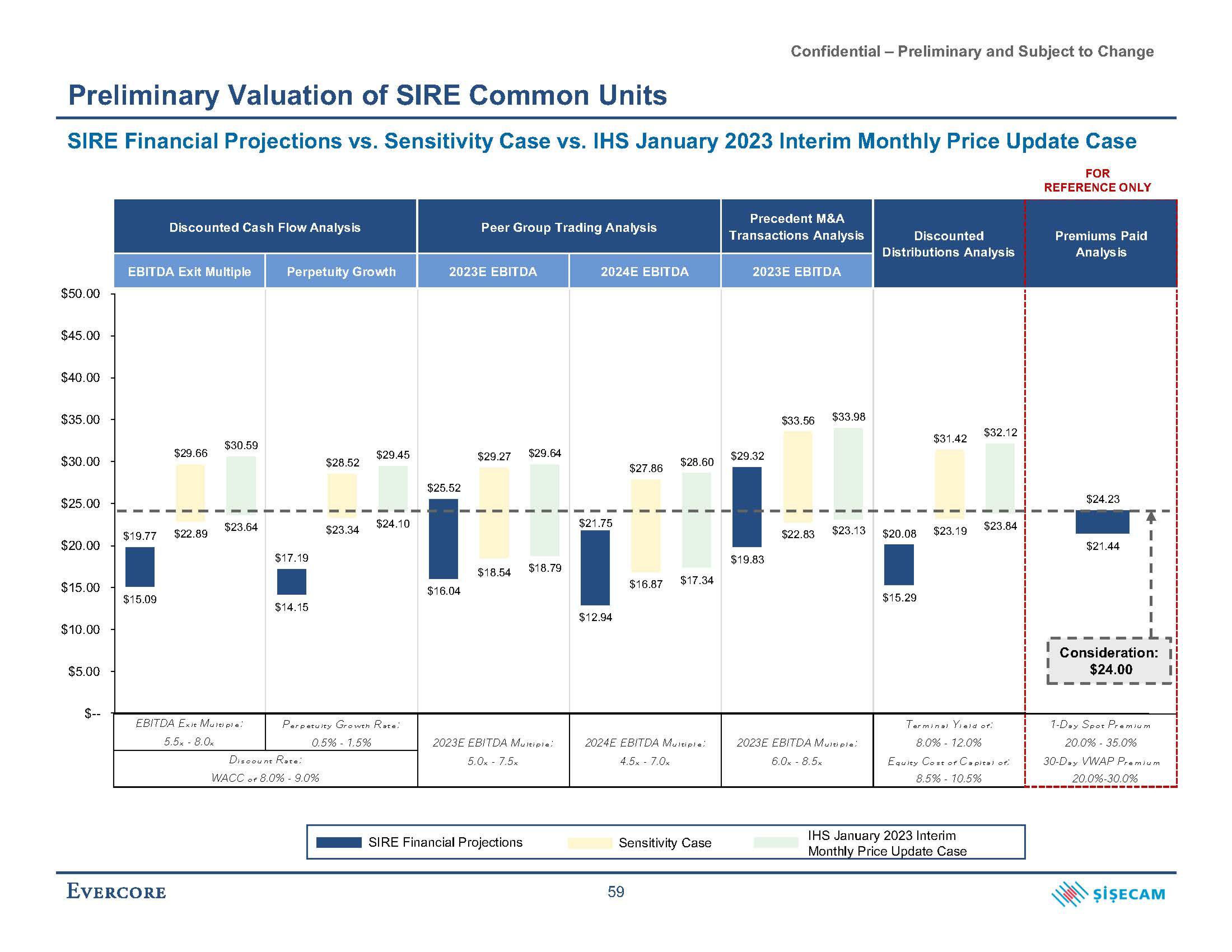

Preliminary Valuation of SIRE Common Units

SIRE Financial Projections vs. Sensitivity Case vs. IHS January 2023 Interim Monthly Price Update Case

$50.00

$45.00

$40.00

$35.00

$30.00

$25.00

$20.00

$15.00

$10.00

$5.00

$--

EBITDA Exit Multiple Perpetuity Growth

$19.77

$15.09

Discounted Cash Flow Analysis

EVERCORE

$29.66

$22.89

$30.59

$23.64

EBITDA Exit Multiple:

5.5x - 8.0x

$17.19

$14.15

$28.52

Discount Rate:

WACC of 8.0% - 9.0%

$23.34

$29.45

$24.10

Perpetuity Growth Rate:

0.5% -1.5%

2023E EBITDA

$25.52

Peer Group Trading Analysis

$16.04

$29.27

$18.54

$29.64

SIRE Financial Projections

$18.79

2023E EBITDA Multiple:

5.0x - 7.5x

2024E EBITDA

$21.75

$12.94

$27.86

$28.60

59

$16.87 $17.34

2024E EBITDA Multiple:

4.5x - 7.0x

Sensitivity Case

Confidential - Preliminary and Subject to Change

Precedent M&A

Transactions Analysis

2023E EBITDA

$29.32

$19.83

$33.56 $33.98

$22.83

$23.13

2023E EBITDA Multiple:

6.0x8.5x

Discounted

Distributions Analysis

$20.08

$15.29

$31.42

$23.19

$32.12

IHS January 2023 Interim

Monthly Price Update Case

$23.84

Terminal Yield of

8.0% - 12.0%

Equity Cost of Capital of

8.5% -10.5%

FOR

REFERENCE ONLY

Premiums Paid

Analysis

$24.23

$21.44

Consideration:

$24.00

1-Day Spot Premium

20,0% - 35.0%

30-Day VWAP Premium

20.0%-30.0%

ŞİŞECAMView entire presentation