Kinnevik Results Presentation Deck

LIQUIDATION PREFERENCES AND CURRENCIES HAVE A SIGNIFICANTLY

POSITIVE EFFECT ON OUR CARRYING VALUES AS PER QUARTER-END

■

Q2 2022 Valuations of Unlisted Assets

Liquidation Preferences & Currencies

Liquidation preferences can provide some protection against downside in

sales or listings of businesses at a valuation lower than a previous private

funding round

Our valuation framework (IFRS 13 and the IPEV Guidelines) define fair value as the

price that would be received to sell an asset in an orderly transaction

We therefore take liquidation preferences into account when valuing our interests in

our investee companies

In constant currencies, the positive effect stemming from liquidation

preferences amounts to SEK 2.2bn per end of Q2 2022. In quarter-end

currency rates, the effect amounts to SEK 2.4bn

This means that as at end of June without preferences the fair value of our unlisted

assets would be SEK 2.4bn lower (around 8%), and that SEK 2.4bn in underlying

value appreciation is required before accruing an on-paper return on investment

This effect is centred around the new investments made in 2021 and early 2022

The Swedish krona has depreciated materially during 2022, in particular

against the US dollar

In Q2 2022, the dollar was up 10% against the krona, and during H1 2022 it

was up 13%

Had exchange rates been unchanged from end of 2021, the fair value of our

unlisted assets would be SEK 2.2bn lower (around 8%)

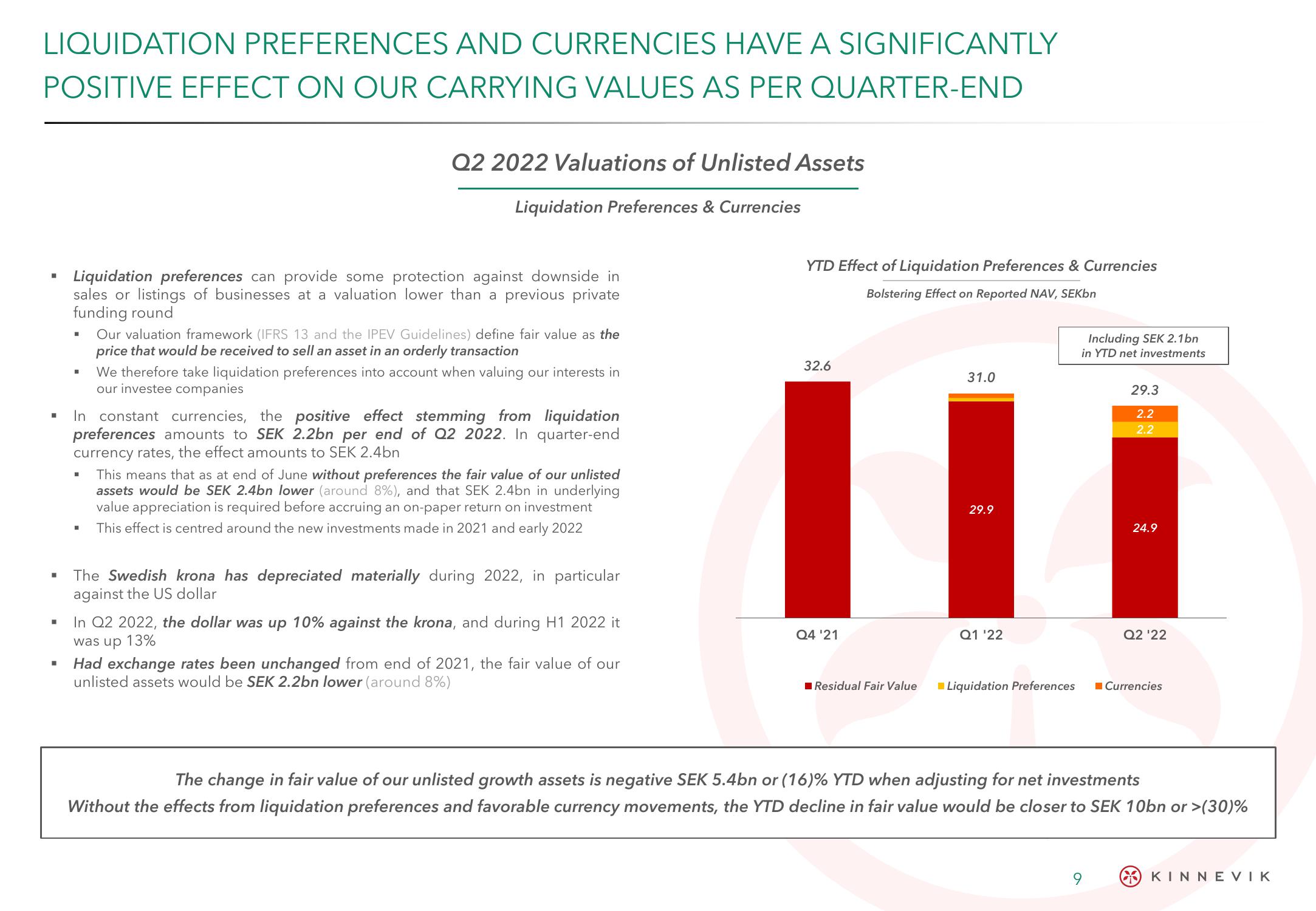

YTD Effect of Liquidation Preferences & Currencies

Bolstering Effect on Reported NAV, SEKbn

32.6

Q4 '21

Residual Fair Value

31.0

29.9

Q1 ¹22

Liquidation Preferences

Including SEK 2.1bn

in YTD net investments

29.3

2.2

2.2

9

24.9

Q2 '22

Currencies

The change in fair value of our unlisted growth assets is negative SEK 5.4bn or (16) % YTD when adjusting for net investments

Without the effects from liquidation preferences and favorable currency movements, the YTD decline in fair value would be closer to SEK 10bn or >(30)%

KINNEVIKView entire presentation