Evercore Investment Banking Pitch Book

Unitholder Tax Analysis

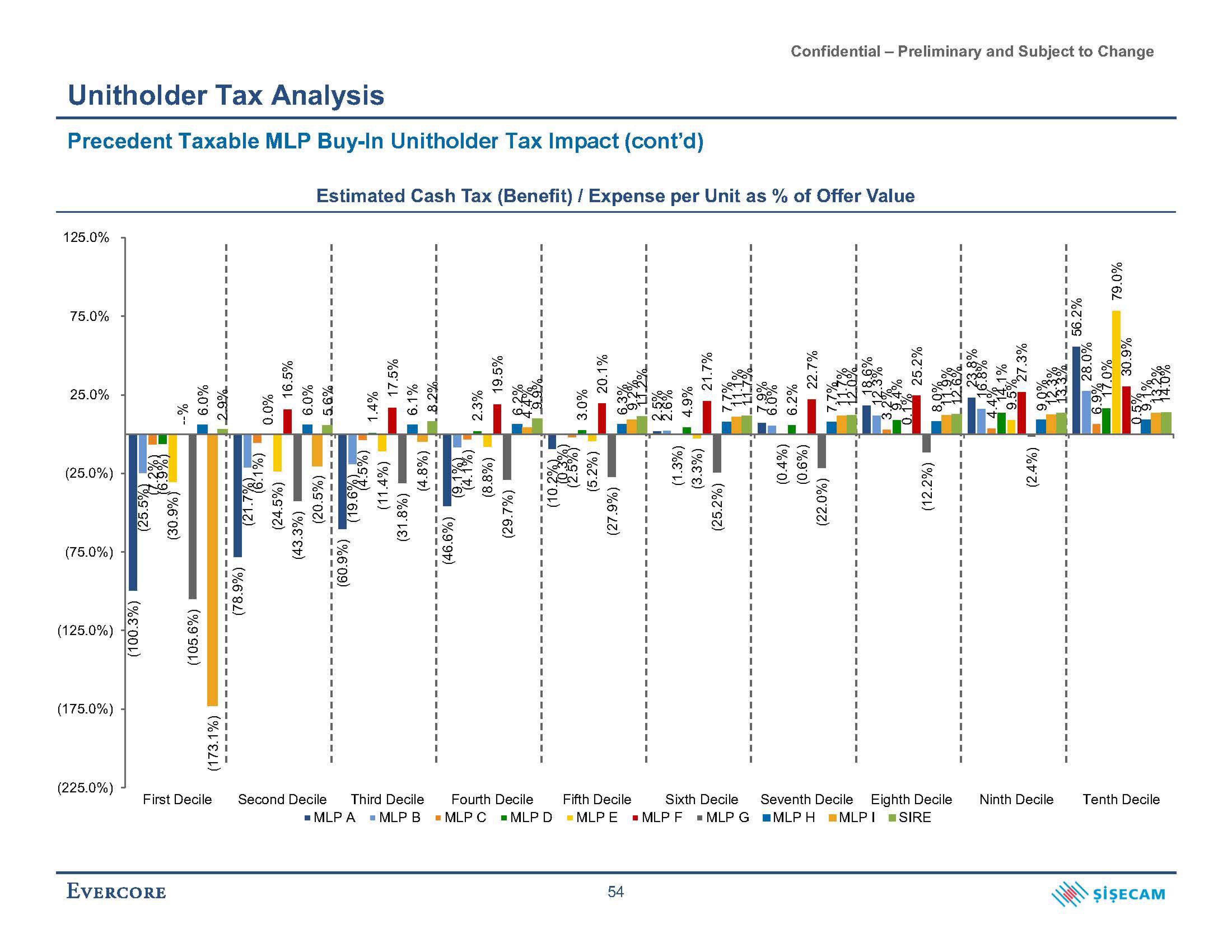

Precedent Taxable MLP Buy-In Unitholder Tax Impact (cont'd)

125.0%

75.0%

25.0%

(25.0%)

(75.0%)

(125.0%)

(175.0%)

(225.0%)

{6:3%)

(25.5%),

(100.3%)

--%

(30.9%)

EVERCORE

6.0%

(105.6%)

2.9%

(173.1%)

‒‒‒‒‒‒

0.0%

(78.9%)

16.5%

(21.7%81%)

(24.5%)

6.0%

(43.3%)

Estimated Cash Tax (Benefit) / Expense per Unit as % of Offer Value

%99----------

(20.5%)

1.4%

17.5%

6.1%

8.2%

(11.4%)

(60.9%) (19.6%25%)

(31.8%)

(4.8%)

First Decile Second Decile Third Decile

■MLP A MLP B

-----

2.3%

(%(8) 1/6)

(46.6%)

19.5%

(8.8%)

(29.7%)

(10.2%)

Fourth Decile

MLP C MLP D

3.0%

20.1%

(5.2%)

6.3%.

(27.9%)

12.8%

4.9%

54

21.7%

(1.3%)

(3.3%)

Confidential - Preliminary and Subject to Change

(25.2%)

6.2%

22.7%

(0.6%)

(0.4%)

704/2²

(22.0%)

18.6%

12.6%

12.3%

25.2%

8.0%.

(12.2%)

12.6%

Fifth Decile Sixth Decile Seventh Decile Eighth Decile

MLP E▪ MLP F ■ MLP G MLP HMLP I SIRE

23,8%

27.3%

1%

L 9,0%

(2.4%)

Ninth Decile

56.2%

79.0%

30.9%

.0%

1, 28.0%

13.3%

Tenth Decile

ŞİŞECAMView entire presentation