Oatly Results Presentation Deck

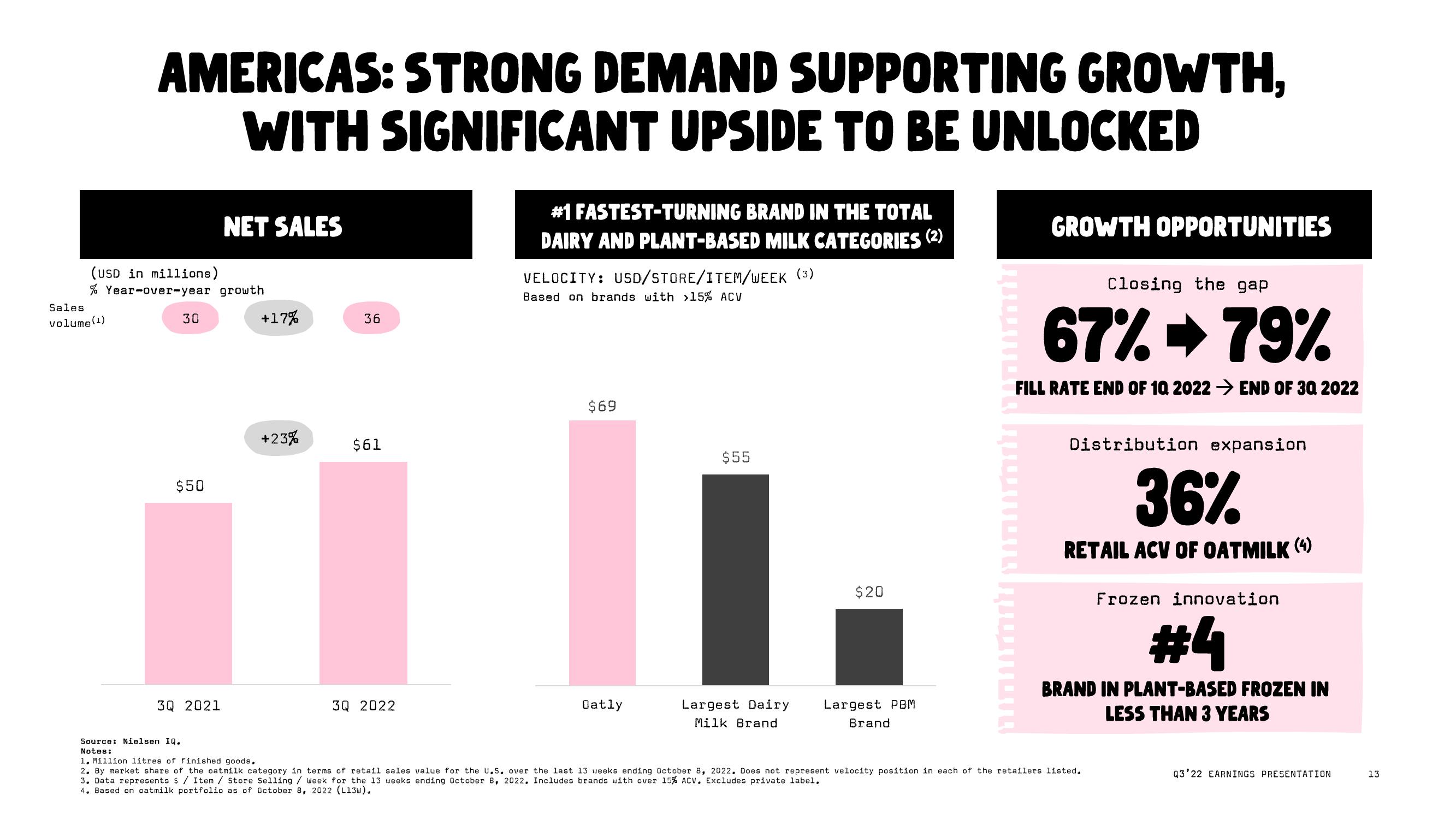

AMERICAS: STRONG DEMAND SUPPORTING GROWTH,

WITH SIGNIFICANT UPSIDE TO BE UNLOCKED

Sales

volume (¹)

(USD in millions)

% Year-over-year growth

30

$50

3Q 2021

Source: Nielsen IQ.

Notes:

NET SALES

+17%

+23%

36

$61

3Q 2022

#1 FASTEST-TURNING BRAND IN THE TOTAL

DAIRY AND PLANT-BASED MILK CATEGORIES (2)

VELOCITY: USD/STORE/ITEM/WEEK (3)

Based on brands with >15% ACV

$69

Oatly

$55

Largest Dairy

Milk Brand

$20

Largest PBM

Brand

GROWTH OPPORTUNITIES

Closing the gap

67% -79%

FILL RATE END OF 1Q 2022 → END OF 3Q 2022

Distribution expansion

36%

RETAIL ACV OF OATMILK (4)

Frozen innovation

#4

BRAND IN PLANT-BASED FROZEN IN

LESS THAN 3 YEARS

1. Million litres of finished goods.

2. By market share of the oatmilk category in terms of retail sales value for the U.S. over the last 13 weeks ending October 8, 2022. Does not represent velocity position in each of the retailers listed.

3. Data represents $/ Item / Store Selling / week for the 13 weeks ending October 8, 2022. Includes brands with over 15% ACV. Excludes private label.

4. Based on oatmilk portfolio as of October 8, 2022 (L13W).

Q3'22 EARNINGS PRESENTATION

13View entire presentation