Investor Presentation

Cash Flow to Equity (CFe) - Contd.

(1) Items from the Statement of Cash Flows. Other items include: loss on disposal of property plant and equipment of US$ 0.2 million and US$ 0.2 million, share based

compensation of US$ 1.9 million and US$ 26.4 million, realized gain on investment of US$ 0.5 million and Nil, non-cash rent expense of US$ 1.2 million and US$ 1.8

million, allowance for doubtful debts of US$ 1.0 million and US$ 0.7 million, loan repayment charges of US$ 3.4 million and US$ 3.5 million, employee benefit US$

0.4 million and US$ 0.6 million and ARO accretion of US$ 0.5 million and US$ 0.4 million for the period ended December 31, 2019 and December 31, 2020

respectively.

(2) Repayments of term and other loans during the period ended December 31, 2020, was US$ 99.2 million (refer to the Statement of Cash Flows) which includes US$

92 million related to refinancing of loans or early repayment of debt before maturity and have been excluded to determine debt amortization of US$ 7.0 million.

Repayments of term and other loans during the period ended December 31, 2019, was US$ 419.2 million (refer to the Statement of Cash Flows) which includes US$

411.8 million related to refinancing of loans or early repayment of debt before maturity and has been excluded to determine debt amortization of US$ 7.4 million.

(3) Classification of Maintenance Capital Expenditures and Growth Capital Expenditures All our capital expenditures are considered Growth Capital Expenditures. In

broad terms, we expense all expenditures in the current period that would primarily maintain our businesses at current levels of operations, capability, profitability or

cash flow in operations and maintenance and therefore there are no Maintenance Capital Expenditures. Growth capital expenditures primarily provide new or

enhanced levels of operations, capability, profitability or cash flows.

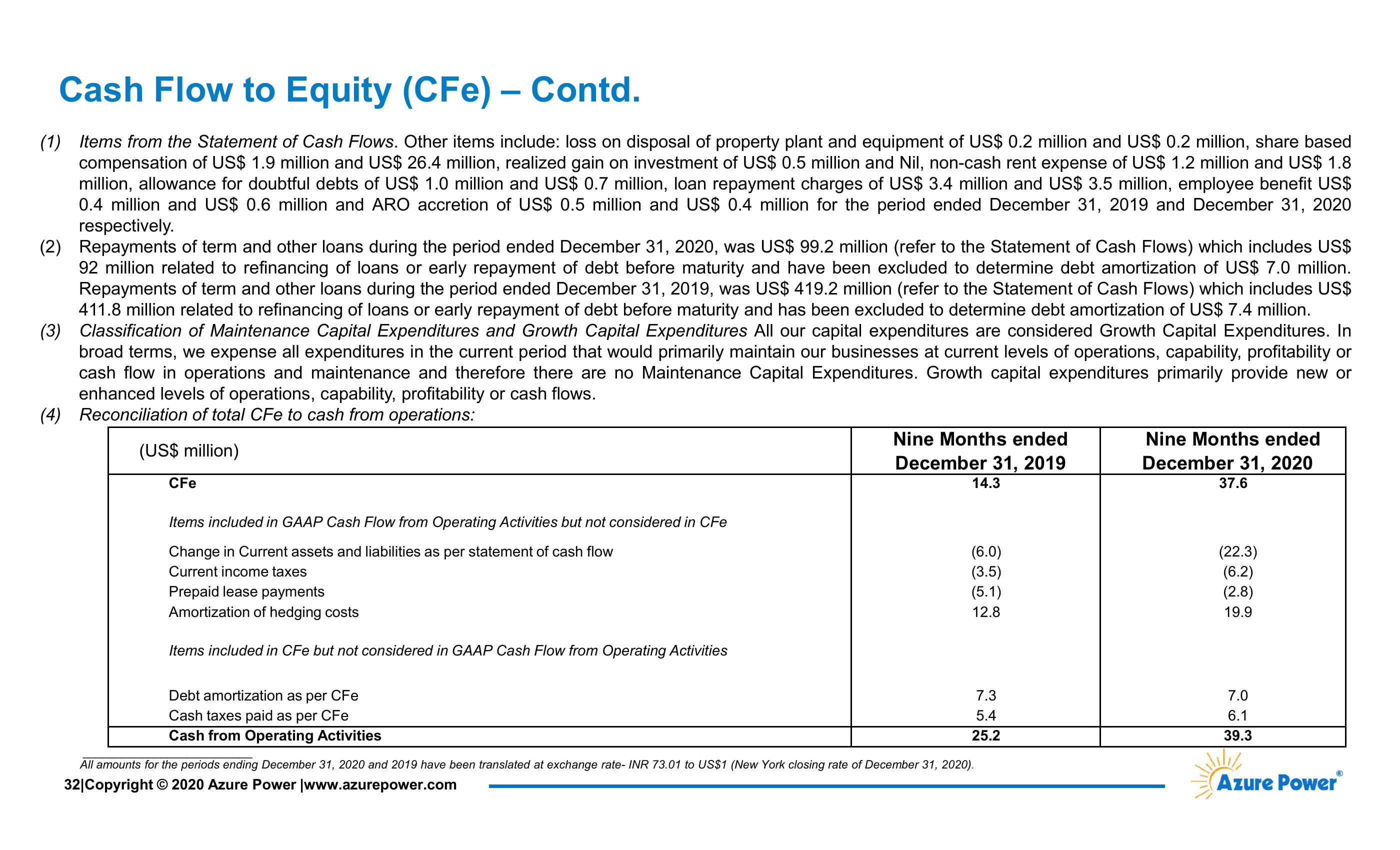

(4) Reconciliation of total CFe to cash from operations:

(US$ million)

CFe

Items included in GAAP Cash Flow from Operating Activities but not considered in CFe

Change in Current assets and liabilities as per statement of cash flow

Current income taxes

Prepaid lease payments

Amortization of hedging costs

Items included in CFe but not considered in GAAP Cash Flow from Operating Activities

Nine Months ended

December 31, 2019

14.3

Nine Months ended

December 31, 2020

37.6

(6.0)

(22.3)

(3.5)

(6.2)

(5.1)

(2.8)

12.8

19.9

Debt amortization as per CFe

Cash taxes paid as per CFe

Cash from Operating Activities

All amounts for the periods ending December 31, 2020 and 2019 have been translated at exchange rate- INR 73.01 to US$1 (New York closing rate of December 31, 2020).

32|Copyright © 2020 Azure Power |www.azurepower.com

7.3

7.0

5.4

6.1

25.2

39.3

Azure PowerⓇView entire presentation