Apollo Global Management Investor Day Presentation Deck

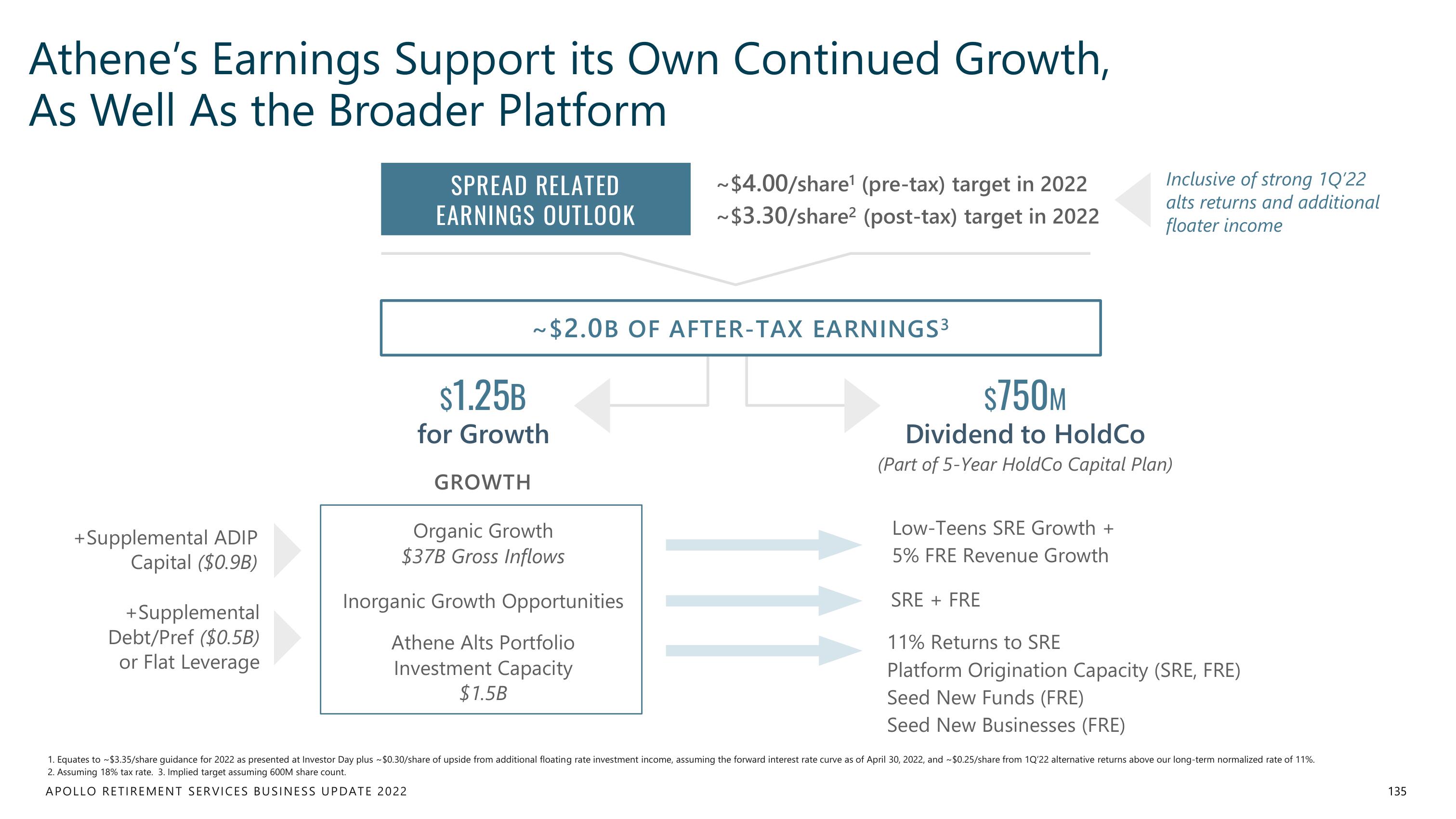

Athene's Earnings Support its Own Continued Growth,

As Well As the Broader Platform

+Supplemental ADIP

Capital ($0.9B)

+Supplemental

Debt/Pref ($0.5B)

or Flat Leverage

SPREAD RELATED

EARNINGS OUTLOOK

$1.25B

for Growth

GROWTH

~$2.0B OF AFTER-TAX EARNINGS³

Organic Growth

$37B Gross Inflows

Inorganic Growth Opportunities

Athene Alts Portfolio

Investment Capacity

$1.5B

~$4.00/share¹ (pre-tax) target in 2022

~$3.30/share² (post-tax) target in 2022

$750M

Dividend to HoldCo

(Part of 5-Year HoldCo Capital Plan)

Low-Teens SRE Growth +

5% FRE Revenue Growth

Inclusive of strong 10'22

alts returns and additional

floater income

SRE + FRE

11% Returns to SRE

Platform Origination Capacity (SRE, FRE)

Seed New Funds (FRE)

Seed New Businesses (FRE)

1. Equates to ~$3.35/share guidance for 2022 as presented at Investor Day plus ~$0.30/share of upside from additional floating rate investment income, assuming the forward interest rate curve as of April 30, 2022, and ~$0.25/share from 1Q'22 alternative returns above our long-term normalized rate of 11%.

2. Assuming 18% tax rate. 3. Implied target assuming 600M share count.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

135View entire presentation