VinFast Investor Presentation Deck

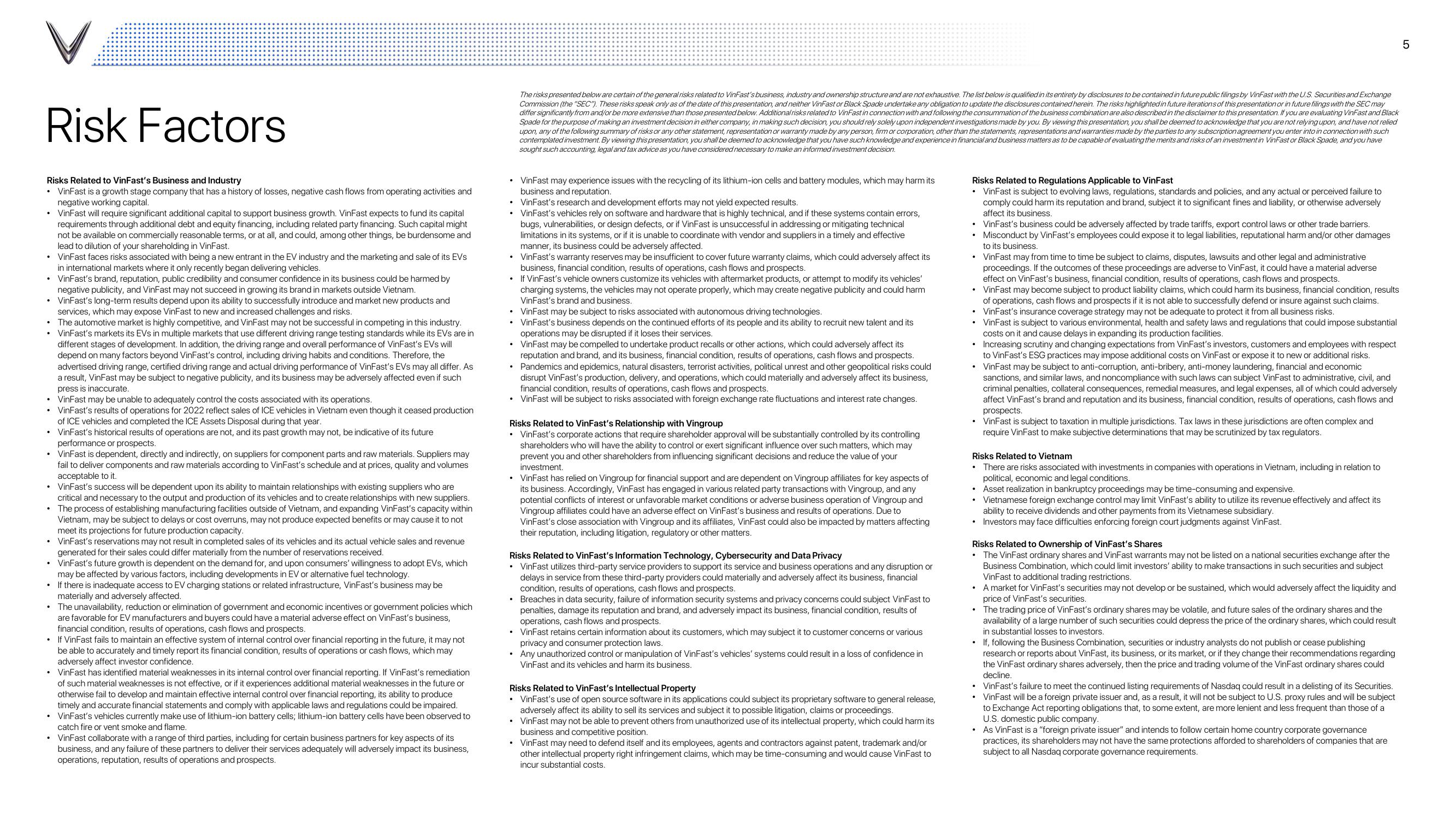

Risk Factors

Risks Related to VinFast's Business and Industry

• VinFast is a growth stage company that has a history of losses, negative cash flows from operating activities and

negative working capital.

• VinFast will require significant additional capital to support business growth. VinFast expects to fund its capital

requirements through additional debt and equity financing, including related party financing. Such capital might

not be available on commercially reasonable terms, or at all, and could, among other things, be burdensome and

lead to dilution of your shareholding in VinFast.

• VinFast faces risks associated with being a new entrant in the EV industry and the marketing and sale of its EVS

in international markets where it only recently began delivering vehicles.

VinFast's brand, reputation, public credibility and consumer confidence in its business could be harmed by

negative publicity, and VinFast may not succeed in growing its brand in markets outside Vietnam.

VinFast's long-term results depend upon its ability to successfully introduce and market new products and

services, which may expose VinFast to new and increased challenges and risks.

The automotive market is highly competitive, and VinFast may not be successful in competing in this industry.

• VinFast's markets its EVS in multiple markets that use different driving range testing standards while its EVs are in

different stages of development. In addition, the driving range and overall performance of VinFast's EVs will

depend on many factors beyond VinFast's control, including driving habits and conditions. Therefore, the

advertised driving range, certified driving range and actual driving performance of VinFast's EVs may all differ. As

a result, VinFast may be subject to negative publicity, and its business may be adversely affected even if such

press is inaccurate.

VinFast may be unable to adequately control the costs associated with its operations.

• VinFast's results of operations for 2022 reflect sales of ICE vehicles in Vietnam even though it ceased production

of ICE vehicles and completed the ICE Assets Disposal during that year.

VinFast's historical results of operations are not, and its past growth may not, be indicative of its future

performance or prospects.

• VinFast is dependent, directly and indirectly, on suppliers for component parts and raw materials. Suppliers may

fail to deliver components and raw materials according to VinFast's schedule and at prices, quality and volumes

acceptable to it.

• VinFast's success will be dependent upon its ability to maintain relationships with existing suppliers who are

critical and necessary to the output and production of its vehicles and to create relationships with new suppliers.

The process of establishing manufacturing facilities outside of Vietnam, and expanding VinFast's capacity within

Vietnam, may be subject to delays or cost overruns, may not produce expected benefits or may cause it to not

meet its projections for future production capacity.

• VinFast's reservations may not result in completed sales of its vehicles and its actual vehicle sales and revenue

generated for their sales could differ materially from the number of reservations received.

VinFast's future growth is dependent on the demand for, and upon consumers' willingness to adopt EVS, which

may be affected by various factors, including developments in EV or alternative fuel technology.

• If there is inadequate access to EV charging stations or related infrastructure, VinFast's business may be

materially and adversely affected.

The unavailability, reduction or elimination of government and economic incentives or government policies which

are favorable for EV manufacturers and buyers could have a material adverse effect on VinFast's business,

financial condition, results of operations, cash flows and prospects.

If VinFast fails to maintain an effective system of internal control over financial reporting in the future, it may not

be able to accurately and timely report its financial condition, results of operations or cash flows, which may

adversely affect investor confidence.

• VinFast has identified material weaknesses in its internal control over financial reporting. If VinFast's remediation

of such material weaknesses is not effective, or if it experiences additional material weaknesses in the future or

otherwise fail to develop and maintain effective internal control over financial reporting, its ability to produce

timely and accurate financial statements and comply with applicable laws and regulations could be impaired.

• VinFast's vehicles currently make use of lithium-ion battery cells; lithium-ion battery cells have been observed to

catch fire or vent smoke and flame.

• VinFast collaborate with a range of third parties, including for certain business partners for key aspects of its

business, and any failure of these partners to deliver their services adequately will adversely impact its business,

operations, reputation, results of operations and prospects.

The risks presented below are certain of the general risks related to VinFast's business, industry and ownership structure and are not exhaustive. The list below is qualified in its entirety by disclosures to be contained in future public filings by VinFast with the U.S. Securities and Exchange

Commission (the "SEC"). These risks speak only as of the date of this presentation, and neither VinFast or Black Spade undertake any obligation to update the disclosures contained herein. The risks highlighted in future iterations of this presentation or in future filings with the SEC may

differ significantly from and/or be more extensive than those presented below. Additional risks related to VinFast in connection with and following the consummation of the business combination are also described in the disclaimer to this presentation. If you are evaluating VinFast and Black

Spade for the purpose of making an investment decision in either company, in making such decision, you should rely solely upon independent investigations made by you. By viewing this presentation, you shall be deemed to acknowledge that you are not relying upon, and have not relied

upon, any of the following summary of risks or any other statement, representation or warranty made by any person, firm or corporation, other than the statements, representations and warranties made by the parties to any subscription agreement you enter into in connection with such

contemplated investment. By viewing this presentation, you shall be deemed to acknowledge that you have such knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of an investment in VinFast or Black Spade, and you have

sought such accounting, legal and tax advice as you have considered necessary to make an informed investment decision.

• VinFast may experience issues with the recycling of its lithium-ion cells and battery modules, which may harm its

business and reputation.

• VinFast's research and development efforts may not yield expected results.

• VinFast's vehicles rely on software and hardware that is highly technical, and if these systems contain errors,

bugs, vulnerabilities, or design defects, or if VinFast is unsuccessful in addressing or mitigating technical

limitations in its systems, or if it is unable to coordinate with vendor and suppliers in a timely and effective

manner, its business could be adversely affected.

• VinFast's warranty reserves may be insufficient to cover future warranty claims, which could adversely affect its

business, financial condition, results of operations, cash flows and prospects.

If VinFast's vehicle owners customize its vehicles with aftermarket products, or attempt to modify its vehicles'

charging systems, the vehicles may not operate properly, which may create negative publicity and could harm

VinFast's brand and business.

VinFast may be subject to risks associated with autonomous driving technologies.

• VinFast's business depends on the continued efforts of its people and its ability to recruit new talent and its

operations may be disrupted if it loses their services.

• VinFast may be compelled to undertake product recalls or other actions, which could adversely affect its

reputation and brand, and its business, financial condition, results of operations, cash flows and prospects.

• Pandemics and epidemics, natural disasters, terrorist activities, political unrest and other geopolitical risks could

disrupt VinFast's production, delivery, and operations, which could materially and adversely affect its business,

financial condition, results of operations, cash flows and prospects.

• VinFast will be subject to risks associated with foreign exchange rate fluctuations and interest rate changes.

Risks Related to VinFast's Relationship with Vingroup

VinFast's corporate actions that require shareholder approval will be substantially controlled by its controlling

shareholders who will have the ability to control or exert significant influence over such matters, which may

prevent you and other shareholders from influencing significant decisions and reduce the value of your

investment.

VinFast has relied on Vingroup for financial support and are dependent on Vingroup affiliates for key aspects of

its business. Accordingly, VinFast has engaged in various related party transactions with Vingroup, and any

potential conflicts of interest or unfavorable market conditions or adverse business operation of Vingroup and

Vingroup affiliates could have an adverse effect on VinFast's business and results of operations. Due to

VinFast's close association with Vingroup and its affiliates, VinFast could also be impacted by matters affecting

their reputation, including litigation, regulatory or other matters.

Risks Related to VinFast's Information Technology, Cybersecurity and Data Privacy

• VinFast utilizes third-party service providers to support its service and business operations and any disruption or

delays in service from these third-party providers could materially and adversely affect its business, financial

condition, results of operations, cash flows and prospects.

Breaches in data security, failure of information security systems and privacy concerns could subject VinFast to

penalties, damage its reputation and brand, and adversely impact its business, financial condition, results of

operations, cash flows and prospects.

• VinFast retains certain information about its customers, which may subject it to customer concerns or various

privacy and consumer protection laws.

• Any unauthorized control or manipulation of VinFast's vehicles' systems could result in a loss of confidence in

VinFast and its vehicles and harm its business.

Risks Related to VinFast's Intellectual Property

VinFast's use of open source software in its applications could subject its proprietary software to general release,

adversely affect its ability to sell its services and subject it to possible litigation, claims or proceedings.

• VinFast may not be able to prevent others from unauthorized use of its intellectual property, which could harm its

business and competitive position.

• VinFast may need to defend itself and its employees, agents and contractors against patent, trademark and/or

other intellectual property right infringement claims, which may be time-consuming and would cause VinFast to

incur substantial costs.

Risks Related to Regulations Applicable to VinFast

VinFast is subject to evolving laws, regulations, standards and policies, and any actual or perceived failure to

comply could harm its reputation and brand, subject it to significant fines and liability, or otherwise adversely

affect its business.

• VinFast's business could be adversely affected by trade tariffs, export control laws or other trade barriers.

• Misconduct by VinFast's employees could expose it to legal liabilities, reputational harm and/or other damages

to its business.

• VinFast may from time to time be subject to claims, disputes, lawsuits and other legal and administrative

proceedings. If the outcomes of these proceedings are adverse to VinFast, it could have a material adverse

effect on VinFast's business, financial condition, results of operations, cash flows and prospects.

VinFast may become subject to product liability claims, which could harm its business, financial condition, results

of operations, cash flows and prospects if it is not able to successfully defend or insure against such claims.

VinFast's insurance coverage strategy may not be adequate to protect it from all business risks.

VinFast is subject to various environmental, health and safety laws and regulations that could impose substantial

costs on it and cause delays in expanding its production facilities.

• Increasing scrutiny and changing expectations from VinFast's investors, customers and employees with respect

to VinFast's ESG practices may impose additional costs on VinFast or expose it to new or additional risks.

VinFast may be subject to anti-corruption, anti-bribery, anti-money laundering, financial and economic

sanctions, and similar laws, and noncompliance with such laws can subject VinFast to administrative, civil, and

criminal penalties, collateral consequences, remedial measures, and legal expenses, all of which could adversely

affect VinFast's brand and reputation and its business, financial condition, results of operations, cash flows and

prospects.

.

VinFast is subject to taxation in multiple jurisdictions. Tax laws in these jurisdictions are often complex and

require VinFast to make subjective determinations that may be scrutinized by tax regulators.

Risks Related to Vietnam

There are risks associated with investments in companies with operations in Vietnam, including in relation to

political, economic and legal conditions.

Asset realization in bankruptcy proceedings may be time-consuming and expensive.

• Vietnamese foreign exchange control may limit VinFast's ability to utilize its revenue effectively and affect its

ability to receive dividends and other payments from its Vietnamese subsidiary.

Investors may face difficulties enforcing foreign court judgments against VinFast.

Risks Related to Ownership of VinFast's Shares

The VinFast ordinary shares and VinFast warrants may not be listed on a national securities exchange after the

Business Combination, which could limit investors' ability to make transactions in such securities and subject

VinFast to additional trading restrictions.

A market for VinFast's securities may not develop or be sustained, which would adversely affect the liquidity and

price of VinFast's securities.

The trading price of VinFast's ordinary shares may be volatile, and future sales of the ordinary shares and the

availability of a large number of such securities could depress the price of the ordinary shares, which could result

in substantial losses to investors.

If, following the Business Combination, securities or industry analysts do not publish or cease publishing

research or reports about VinFast, its business, or its market, or if they change their recommendations regarding

the VinFast ordinary shares adversely, then the price and trading volume of the VinFast ordinary shares could

decline.

VinFast's failure to meet the continued listing requirements of Nasdaq could result in a delisting of its Securities.

VinFast will be a foreign private issuer and, as a result, it will not be subject to U.S. proxy rules and will be subject

to Exchange Act reporting obligations that, to some extent, are more lenient and less frequent than those of a

U.S. domestic public company.

As VinFast is a "foreign private issuer" and intends to follow certain home country corporate governance

practices, its shareholders may not have the same protections afforded to shareholders of companies that are

subject to all Nasdaq corporate governance requirements.

5View entire presentation