Lazard Investor Presentation Deck

INVESTOR PRESENTATION

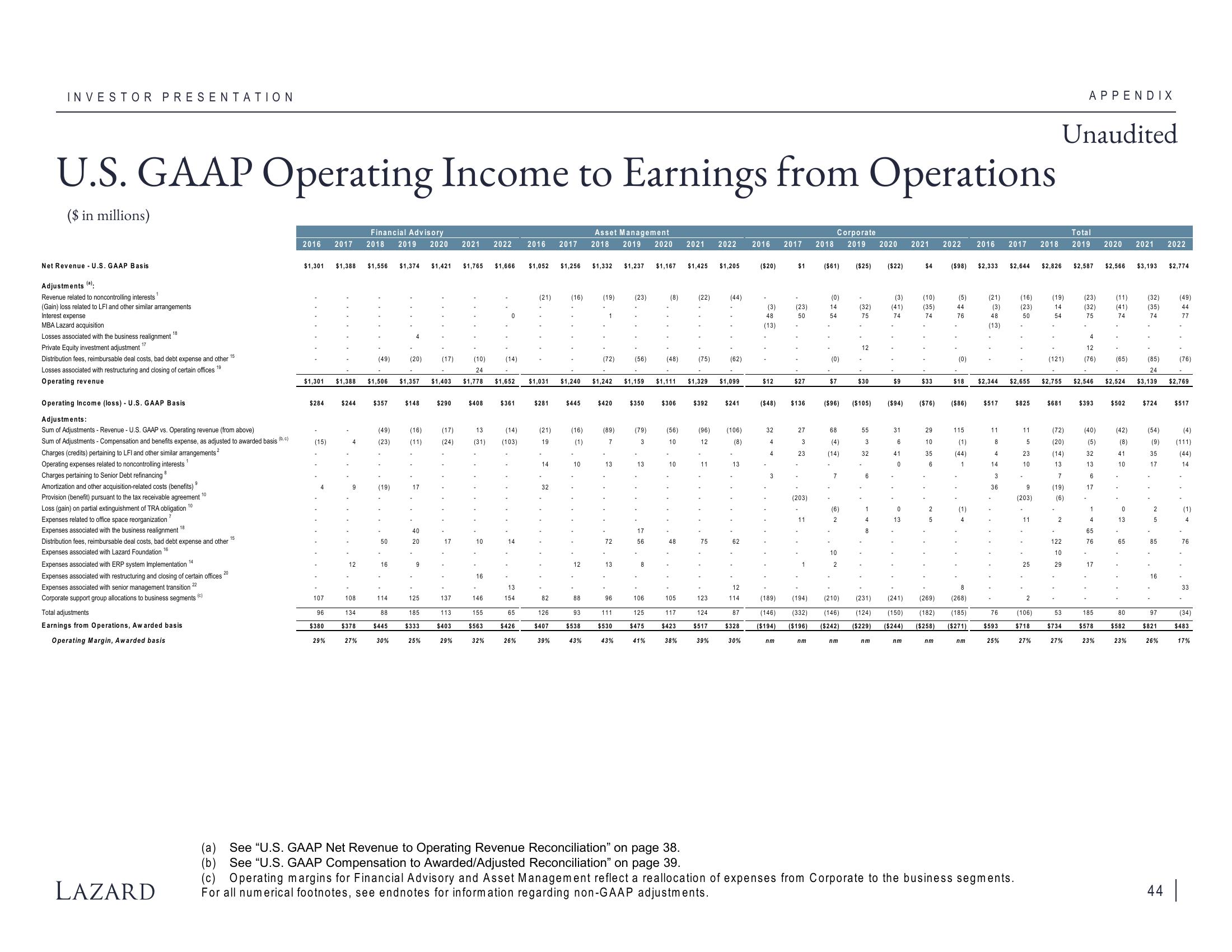

U.S. GAAP Operating Income to Earnings from Operations

($ in millions)

Net Revenue - U.S. GAAP Basis.

Adjustments (a).

Revenue related to noncontrolling interests

(Gain) loss related to LFI and other similar arrangements

Interest expense

MBA Lazard acquisition

Losses associated with the business realignment

Private Equity investment adjustment ¹7

15

Distribution fees, reimbursable deal costs, bad debt expense and other

Losses associated with restructuring and closing of certain offices 19

Operating revenue

Operating Income (loss) - U.S. GAAP Basis

Adjustments:

Sum of Adjustments - Revenue - U.S. GAAP vs. Operating revenue (from above)

Sum of Adjustments - Compensation and benefits expense, as adjusted to awarded basis (b. c)

Charges (credits) pertaining to LFI and other similar arrangements²

Operating expenses related to noncontrolling interests

Charges pertaining to Senior Debt refinancing

Amortization and other acquisition-related costs (benefits)

Provision (benefit) pursuant to the tax receivable agreement 10

Loss (gain) on partial extinguishment of TRA obligation 10

Expenses related to office space reorganization

Expenses associated with the business realignment ¹8

15

Distribution fees, reimbursable deal costs, bad debt expense and other

Expenses associated with Lazard Foundation 16

Expenses associated with ERP system Implementation ¹4

Expenses associated with restructuring and closing of certain offices

Expenses associated with senior management transition 22

Corporate support group allocations to business segments (*)

Total adjustments

Earnings from Operations, Awarded basis

Operating Margin, Awarded basis

LAZARD

20

2016

$1,301 $1,388 $1,556 $1,374 $1,421 $1,765

(10)

24

$1,301 $1,388 $1,506 $1,357 $1,403 $1,778

$284

(15)

107

96

Financial Advisory

2017 2018 2019 2020 2021 2022

$380

29%

$244

4

12

108

134

$378

(49)

27%

$357

(49)

(23)

(19)

50

16

114

88

$445

30%

(20)

$148

(16)

(11)

17

40

20

.

9

125

185

$333

(17)

25%

$290

(17)

(24)

17

137

113

$403

29%

13

(31)

10

$408 $361

16

.

146

$1,666

155

(14)

$1.652

(14)

(103)

13

154

65

$563 $426

32%

26%

2016 2017

$1,052

(21)

$281

(21)

19

-

14

32

82

$1,256

126

$407

39%

(16)

$445

(16)

(1)

10

12

88

$1,031 $1,240 $1.242 $1,159 $1.111 $1.329 $1,099

93

$538

Asset Management

Corporate

2018 2019 2020 2021 2022 2016 2017 2018 2019 2020 2021

43%

$1,332 $1,237 $1,167

(19)

(72)

$420

(89)

7

13

72

13

96

111

$530

(23)

43%

(56)

$350

(79)

3

13.

8

106

125

$475

(8)

41%

(48)

$306

(56)

10

10

48

105

117

$423

$1,425 $1,205

38%

(22)

(75)

$392

(96)

12

11

75

123

124

$517

(44)

39%

(62)

$241

(106)

(8)

13

12

114

87

$328

30%

($20)

(3)

48

(13)

$12

32

4

4

$1

(23)

50

($48) $136

nm

$27

27

3

23

(203)

11

($61) ($25) ($22)

nm

(0)

14

54

(0)

$7

68

(4)

(14)

($96) ($105)

7

(6)

2

10

2

(32)

75

12

nm

$30

55

3

32

(3)

(41)

74

nm

$9

($94)

31

6

41

0

13

$4

nm

(10)

(35)

74

$33

($76)

29

10

35

6

5

nm

($98) $2,333

Total

2022 2016 2017 2018 2019 2020 2021 2022

(5)

44

76

(0)

(189) (194) (210) (231) (241)

(269)

(268)

(146) (332) (146) (124) (150) (182) (185)

($194) ($196) ($242) ($229) ($244) ($258) ($271)

$18

($86)

115

(1)

(44)

1

(1)

nm

(21)

(3)

48

(13)

$2,344

$517

11

8

4

14

3

36

76

$593

25%

$2,644 $2,826 $2,587 $2,566 $3,193

(16)

(23)

50

(a)

See "U.S. GAAP Net Revenue to Operating Revenue Reconciliation" on page 38.

See "U.S. GAAP Compensation to Awarded/Adjusted Reconciliation" on page 39.

(b)

(c) Operating margins for Financial Advisory and Asset Management reflect a reallocation of expenses from Corporate to the business segments.

For all numerical footnotes, see endnotes for information regarding non-GAAP adjustments.

$825

11

5

23

10

9

(203)

11

25

Unaudited

$2,655 $2,755 $2,546 $2,524

2

(19)

14

54

(121)

$681

(72)

(20)

APPENDIX

(14)

13

7

(19)

(6)

2

122

10

29

(106)

53

$718 $734

27%

27%

(23)

(32)

75

4

12

(76)

$393

(40)

(5)

32

13

6

17

1

4

65

76

17

185

$578

(11)

(41)

74

23%

(65)

$502

(42)

(8)

41

10

0

13

65

80

$582

23%

(32)

(35)

74

(54)

(9)

(85)

24

$3,139 $2,769

35

17

$724 $517

2

-

5

85

16

97

$821

$2,774

26%

(49)

44

77

44

(76)

(4)

(111)

(44)

14

(1)

4

76

33

(34)

$483

17%View entire presentation