Investor Presentation

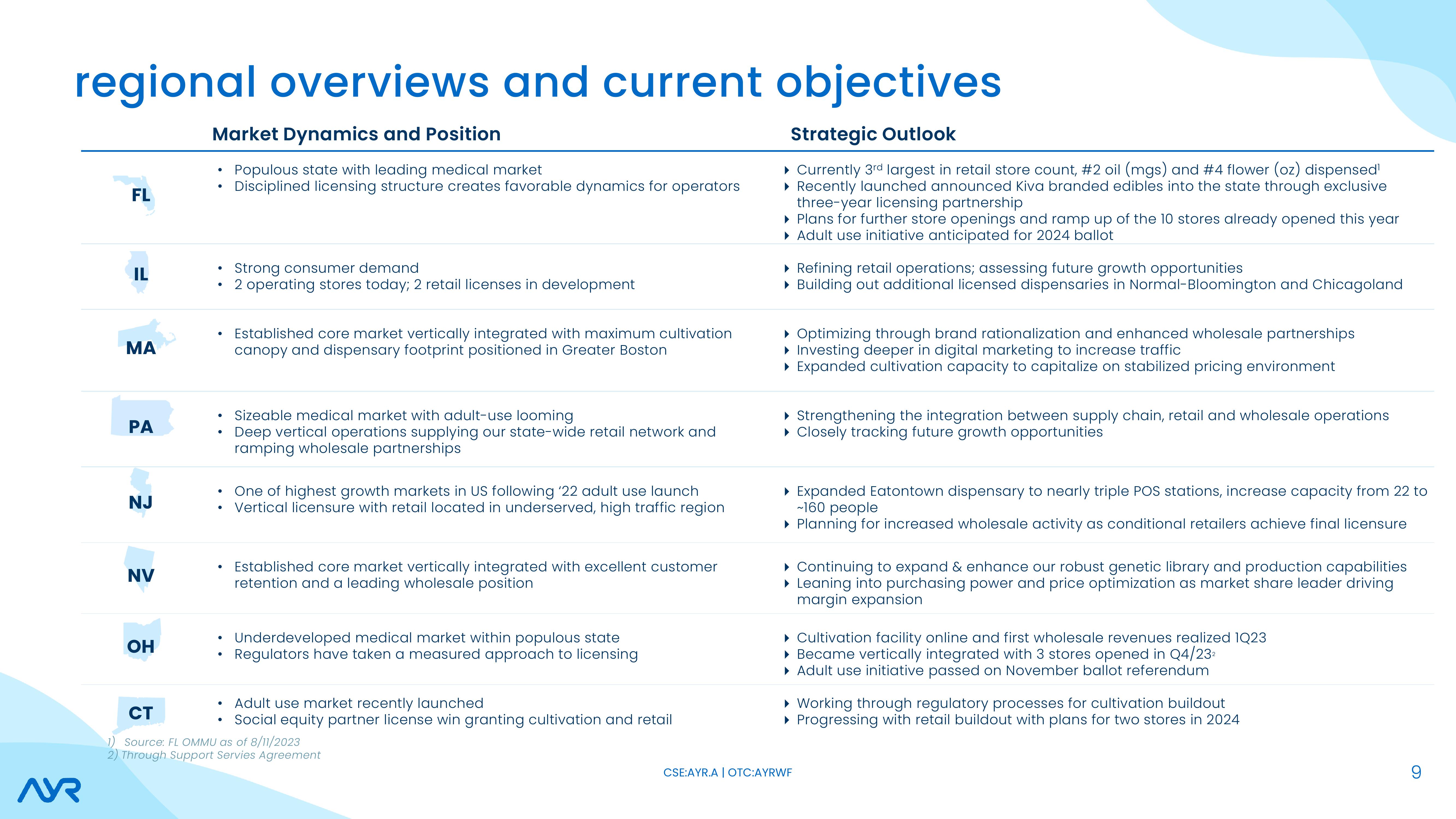

regional overviews and current objectives

Market Dynamics and Position

Populous state with leading medical market

Disciplined licensing structure creates favorable dynamics for operators

AR

FL

IL

MA

PA

NJ

NV

OH

• Strong consumer demand

2 operating stores today; 2 retail licenses in development

.

●

• One of highest growth markets in US following '22 adult use launch

Vertical licensure with retail located in underserved, high traffic region

Established core market vertically integrated with maximum cultivation

canopy and dispensary footprint positioned in Greater Boston

.

Sizeable medical market with adult-use looming

Deep vertical operations supplying our state-wide retail network and

ramping wholesale partnerships

●

Established core market vertically integrated with excellent customer

retention and a leading wholesale position

Adult use market recently launched

CT

Social equity partner license win granting cultivation and retail

Source: FL OMMU as of 8/11/2023

2) Through Support Servies Agreement

Underdeveloped medical market within populous state

Regulators have taken a measured approach to licensing

Strategic Outlook

▸ Currently 3rd largest in retail store count, #2 oil (mgs) and #4 flower (oz) dispensed¹

▸ Recently launched announced Kiva branded edibles into the state through exclusive

three-year licensing partnership

▸ Plans for further store openings and ramp up of the 10 stores already opened this year

▸ Adult use initiative anticipated for 2024 ballot

▸ Refining retail operations; assessing future growth opportunities

▸ Building out additional licensed dispensaries in Normal-Bloomington and Chicagoland

▸ Optimizing through brand rationalization and enhanced wholesale partnerships

▸ Investing deeper in digital marketing to increase traffic

▸ Expanded cultivation capacity to capitalize on stabilized pricing environment

▸ Strengthening the integration between supply chain, retail and wholesale operations

▸ Closely tracking future growth opportunities

▸ Expanded Eatontown dispensary to nearly triple POS stations, increase capacity from 22 to

~160 people

▸ Planning for increased wholesale activity as conditional retailers achieve final licensure

▸ Continuing to expand & enhance our robust genetic library and production capabilities

▸ Leaning into purchasing power and price optimization as market share leader driving

margin expansion

▸ Cultivation facility online and first wholesale revenues realized 1Q23

▸ Became vertically integrated with 3 stores opened in Q4/23²

▸ Adult use initiative passed on November ballot referendum

▸ Working through regulatory processes for cultivation buildout

▸ Progressing with retail buildout with plans for two stores in 2024

CSE:AYR.A | OTC:AYRWF

9View entire presentation