LanzaTech SPAC Presentation Deck

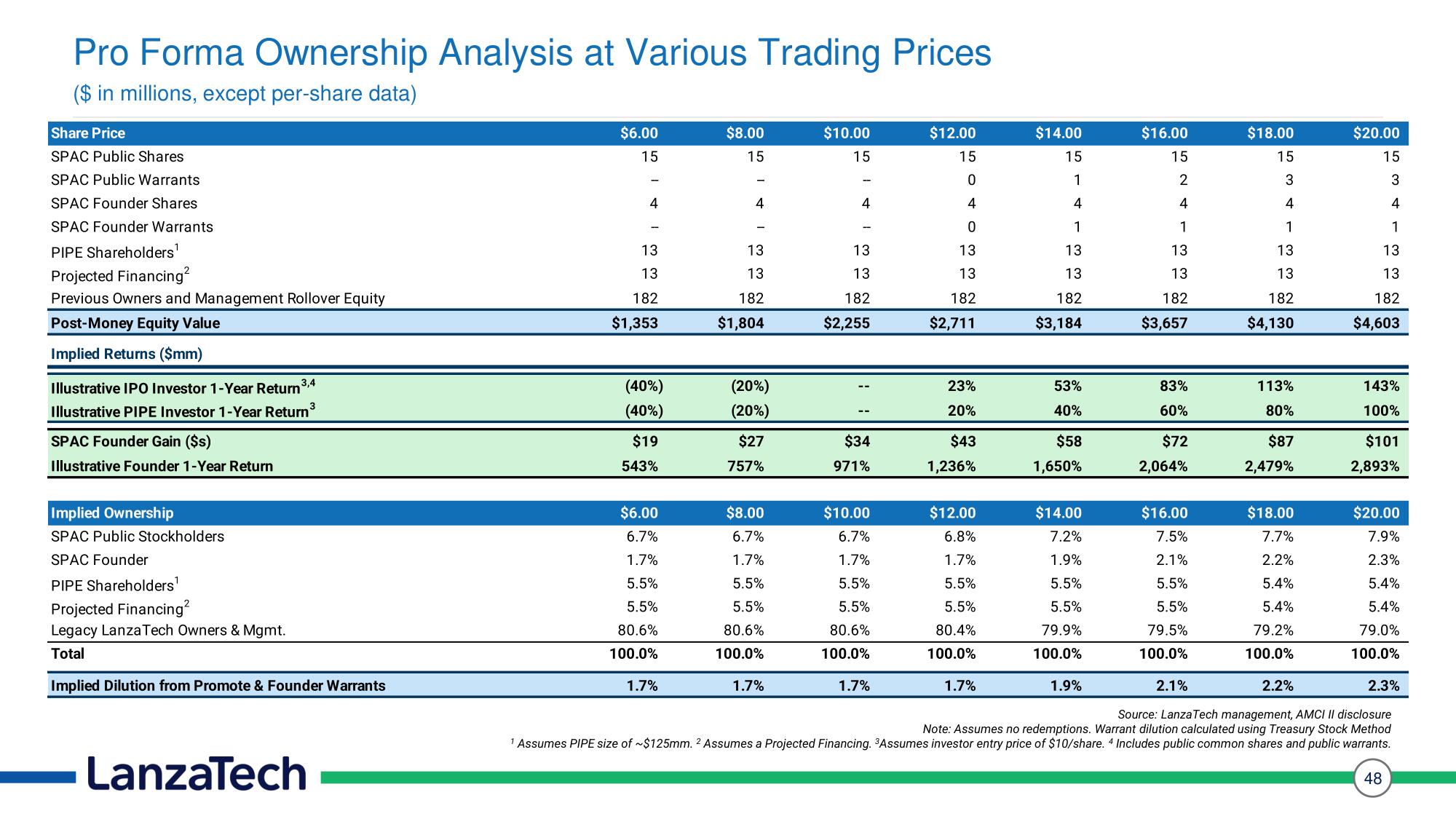

Pro Forma Ownership Analysis at Various Trading Prices

($ in millions, except per-share data)

Share Price

SPAC Public Shares

SPAC Public Warrants

SPAC Founder Shares

SPAC Founder Warrants

PIPE Shareholders¹

Projected Financing²

Previous Owners and Management Rollover Equity

Post-Money Equity Value

Implied Returns ($mm)

Illustrative IPO Investor 1-Year Return 3,4

Illustrative PIPE Investor 1-Year Return ³

SPAC Founder Gain ($s)

Illustrative Founder 1-Year Return

Implied Ownership

SPAC Public Stockholders

SPAC Founder

PIPE Shareholders¹

Projected Financing²

Legacy Lanza Tech Owners & Mgmt.

Total

Implied Dilution from Promote & Founder Warrants

LanzaTech

$6.00

15

4

13

13

182

$1,353

(40%)

(40%)

$19

543%

$6.00

6.7%

1.7%

5.5%

5.5%

80.6%

100.0%

1.7%

$8.00

15

4

13

13

182

$1,804

(20%)

(20%)

$27

757%

$8.00

6.7%

1.7%

5.5%

5.5%

80.6%

100.0%

1.7%

$10.00

15

4

13

13

182

$2,255

$34

971%

$10.00

6.7%

1.7%

5.5%

5.5%

80.6%

100.0%

1.7%

$12.00

15

0

4

0

13

13

182

$2,711

23%

20%

$43

1,236%

$12.00

6.8%

1.7%

5.5%

5.5%

80.4%

100.0%

1.7%

$14.00

15

1

4

1

13

13

182

$3,184

53%

40%

$58

1,650%

$14.00

7.2%

1.9%

5.5%

5.5%

79.9%

100.0%

1.9%

$16.00

15

2

4

1

13

13

182

$3,657

83%

60%

$72

2,064%

$16.00

7.5%

2.1%

5.5%

5.5%

79.5%

100.0%

2.1%

$18.00

15

3

4

1

13

13

182

$4,130

113%

80%

$87

2,479%

$18.00

7.7%

2.2%

5.4%

5.4%

79.2%

100.0%

2.2%

$20.00

15

3

4

1

13

13

182

$4,603

143%

100%

$101

2,893%

$20.00

7.9%

2.3%

5.4%

5.4%

79.0%

100.0%

2.3%

Source: LanzaTech management, AMCI II disclosure

Note: Assumes no redemptions. Warrant dilution calculated using Treasury Stock Method

¹ Assumes PIPE size of ~$125mm. 2 Assumes a Projected Financing. ³Assumes investor entry price of $10/share. 4 Includes public common shares and public warrants.

48View entire presentation