Vale Investor Day Presentation Deck

A world requiring green materials

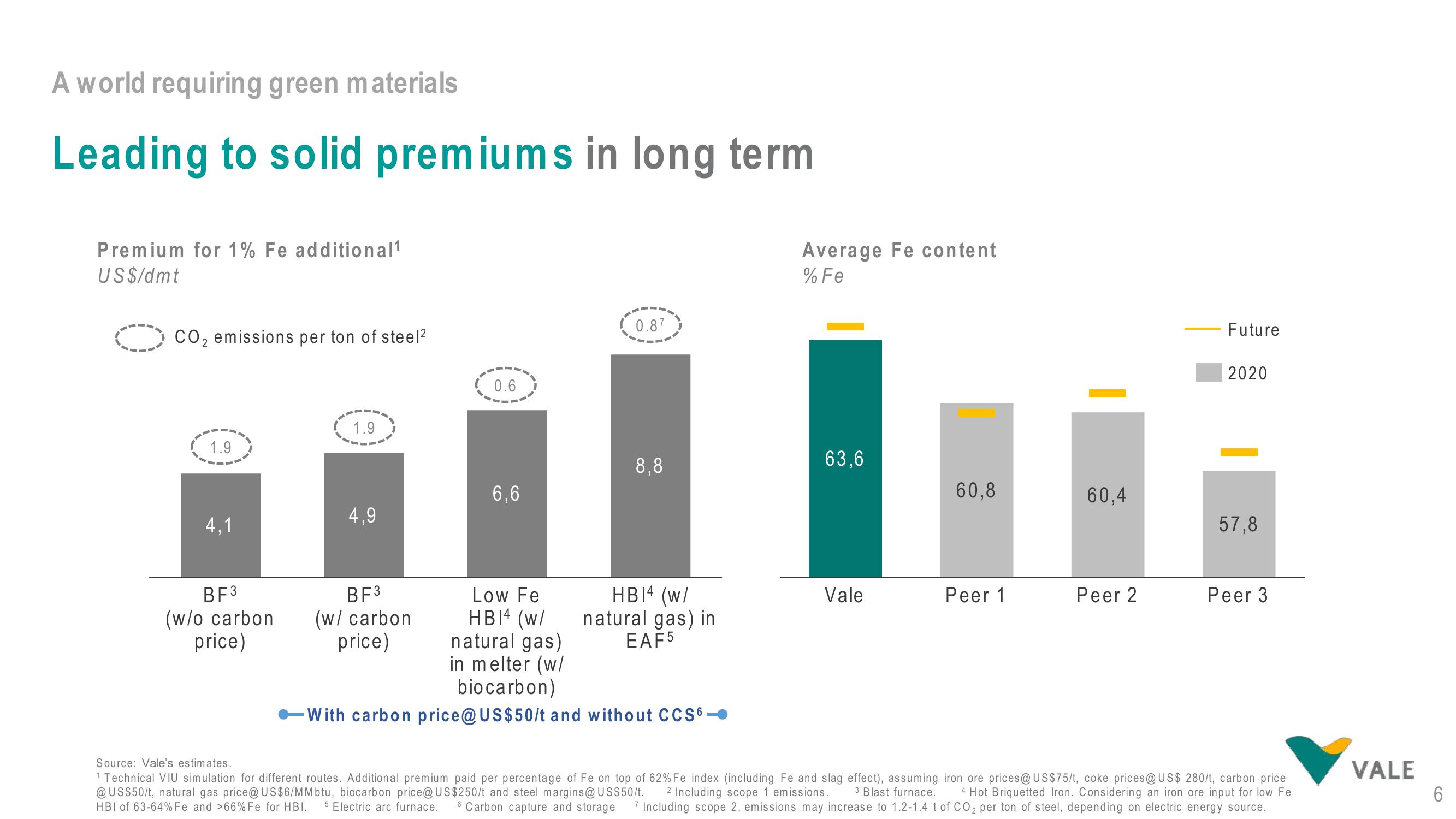

Leading to solid premiums in long term

Premium for 1% Fe additional¹

US$/dmt

CO₂ emissions per ton of steel²

1.9

4,1

BF3

(w/o carbon

price)

1.9

4,9

0.6

BF3

(w/ carbon

price)

6,6

0.87

8,8

Low Fe

HB14 (w/

natural gas)

in melter (w/

biocarbon)

With carbon price@US$50/t and without CCS6.

HB14 (w/

natural gas) in

EAF5

Average Fe content

% Fe

63,6

Vale

60,8

Peer 1

60,4

Peer 2

Future

2020

57.8

Peer 3

Source: Vale's estimates.

¹ Technical VIU simulation for different routes. Additional premium paid per percentage of Fe on top of 62% Fe index (including Fe and slag effect), assuming iron ore prices @ US$75/t, coke prices @ US$ 280/t, carbon price

@US$50/t, natural gas price@US$6/MMbtu, biocarbon price@US$250/t and steel margins@ US$50/t. 2 Including scope 1 emissions. 3 Blast furnace. 4 Hot Briquetted Iron. Considering an iron ore input for low Fe

HBI of 63-64% Fe and > 66% Fe for HBI. 5 Electric arc furnace. 6 Carbon capture and storage 7 Including scope 2, emissions may increase to 1.2-1.4 t of CO₂ per ton of steel, depending on electric energy source.

VALE

со

6View entire presentation