Presentation to Vermont Pension Investment Committee

Comparing Investment Cash Flow Profiles

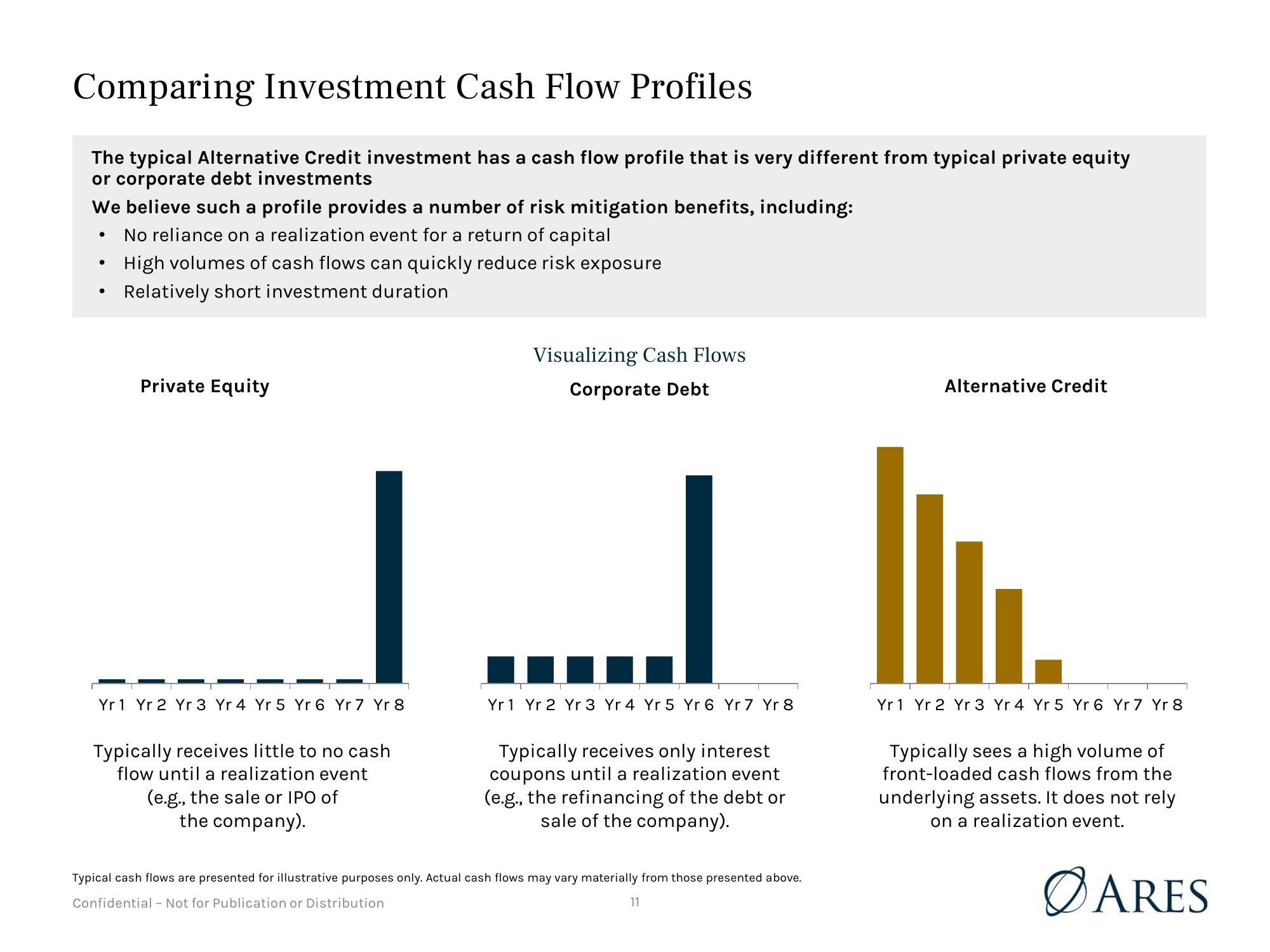

The typical Alternative Credit investment has a cash flow profile that is very different from typical private equity

or corporate debt investments

We believe such a profile provides a number of risk mitigation benefits, including:

No reliance on a realization event for a return of capital

High volumes of cash flows can quickly reduce risk exposure

Relatively short investment duration

●

●

Private Equity

Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Yr 7 Yr 8

Typically receives little to no cash

flow until a realization event

(e.g., the sale or IPO of

the company).

Visualizing Cash Flows

Corporate Debt

Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Yr 7 Yr 8

Typically receives only interest

coupons until a realization event

(e.g., the refinancing of the debt or

sale of the company).

Typical cash flows are presented for illustrative purposes only. Actual cash flows may vary materially from those presented above.

Confidential - Not for Publication or Distribution

11

Alternative Credit

Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Yr 7 Yr 8

Typically sees a high volume of

front-loaded cash flows from the

underlying assets. It does not rely

on a realization event.

ARESView entire presentation