Azek Investor Presentation Deck

NON-GAAP RECONCILIATIONS

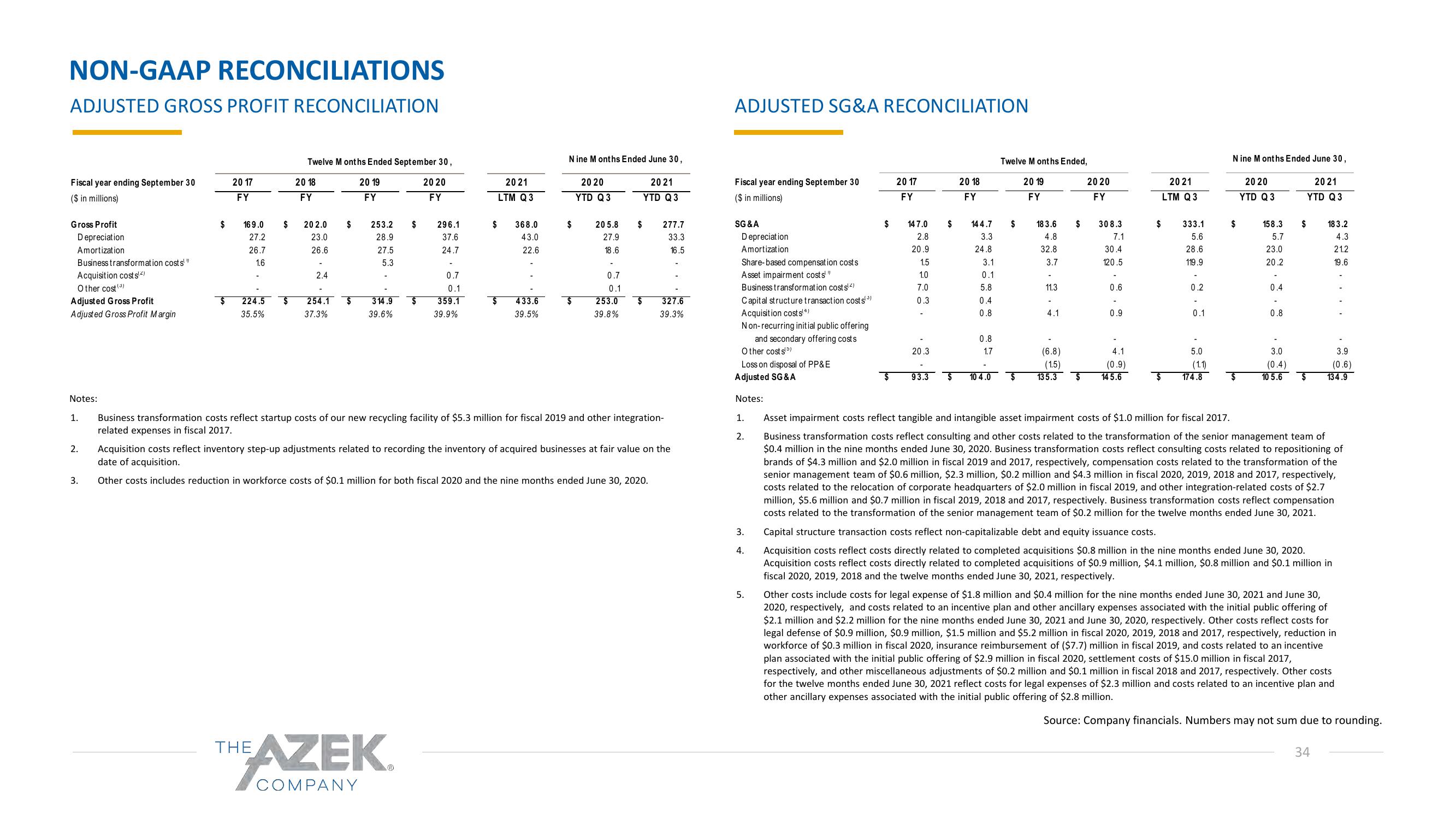

ADJUSTED GROSS PROFIT RECONCILIATION

Fiscal year ending September 30

($ in millions)

Gross Profit

Depreciation

Amortization

Business transformation costs!"

Acquisition costs(²)

Other cost (³)

Adjusted Gross Profit

Adjusted Gross Profit Margin

Notes:

1.

2.

3.

$

$

20 17

FY

169.0

27.2

26.7

1.6

$

224.5 $

35.5%

Twelve M onths Ended September 30,

20 19

20 20

FY

FY

2018

FY

202.0

23.0

26.6

2.4

254.1

37.3%

$

$

253.2

28.9

27.5

5.3

314.9

39.6%

$

$

THE AZEK.

COMPANY

296.1

37.6

24.7

0.7

0.1

359.1

39.9%

$

20 21

LTM Q3

368.0

43.0

22.6

433.6

39.5%

N ine M onths Ended June 30,

$

20 20

YTD Q3

20 5.8

27.9

18.6

0.7

0.1

$

20 21

YTD Q3

253.0 $

39.8%

277.7

33.3

16.5

327.6

39.3%

Business transformation costs reflect startup costs of our new recycling facility of $5.3 million for fiscal 2019 and other integration-

related expenses in fiscal 2017.

Acquisition costs reflect inventory step-up adjustments related to recording the inventory of acquired businesses at fair value on the

date of acquisition.

Other costs includes reduction in workforce costs of $0.1 million for both fiscal 2020 and the nine months ended June 30, 2020.

ADJUSTED SG&A RECONCILIATION

Fiscal year ending September 30

($ in millions)

SG&A

Depreciation

Amortization

Share-based compensation costs

Asset impairment costs"

Business transformation costs¹²)

Capital structure transaction costs(³)

Acquisition costs¹4)

Non-recurring initial public offering

and secondary offering costs

Other costs)

Loss on disposal of PP& E

Adjusted SG & A

Notes:

1.

2.

3.

4.

5.

$

2017

FY

147.0

2.8

20.9

1.5

1.0

7.0

0.3

20.3

2018

FY

$ 144.7

3.3

24.8

3.1

0.1

5.8

0.4

0.8

0.8

1.7

$ 93.3 $ 10 4.0

Twelve M onths Ended,

$

$

20 19

FY

183.6

4.8

32.8

3.7

11.3

-

4.1

(6.8)

(1.5)

135.3

$

20 20

FY

308.3

7.1

30.4

120.5

0.6

0.9

4.1

(0.9)

145.6

20 21

LTM Q3

$

333.1

5.6

28.6

119.9

0.2

-

0.1

5.0

(1.1)

174.8

N ine Months Ended June 30,

20 21

YTD Q3

$

$

20 20

YTD Q 3

158.3

5.7

23.0

20.2

-

0.4

-

0.8

3.0

(0.4)

10 5.6

$

18 3.2

4.3

21.2

19.6

3.9

(0.6)

$ 134.9

Asset impairment costs reflect tangible and intangible asset impairment costs of $1.0 million for fiscal 2017.

Business transformation costs reflect consulting and other costs related to the transformation of the senior management team of

$0.4 million in the nine months ended June 30, 2020. Business transformation costs reflect consulting costs related to repositioning of

brands of $4.3 million and $2.0 million in fiscal 2019 and 2017, respectively, compensation costs related to the transformation of the

senior management team of $0.6 million, $2.3 million, $0.2 million and $4.3 million in fiscal 2020, 2019, 2018 and 2017, respectively,

costs related to the relocation of corporate headquarters of $2.0 million in fiscal 2019, and other integration-related costs of $2.7

million, $5.6 million and $0.7 million in fiscal 2019, 2018 and 2017, respectively. Business transformation costs reflect compensation

costs related to the transformation of the senior management team of $0.2 million for the twelve months ended June 30, 2021.

Capital structure transaction costs reflect non-capitalizable debt and equity issuance costs.

Acquisition costs reflect costs directly related to completed acquisitions $0.8 million in the nine months ended June 30, 2020.

Acquisition costs reflect costs directly related to completed acquisitions of $0.9 million, $4.1 million, $0.8 million and $0.1 million in

fiscal 2020, 2019, 2018 and the twelve months ended June 30, 2021, respectively.

Other costs include costs for legal expense of $1.8 million and $0.4 million for the nine months ended June 30, 2021 and June 30,

2020, respectively, and costs related to an incentive plan and other ancillary expenses associated with the initial public offering of

$2.1 million and $2.2 million for the nine months ended June 30, 2021 and June 30, 2020, respectively. Other costs reflect costs for

legal defense of $0.9 million, $0.9 million, $1.5 million and $5.2 million in fiscal 2020, 2019, 2018 and 2017, respectively, reduction in

workforce of $0.3 million in fiscal 2020, insurance reimbursement of ($7.7) million in fiscal 2019, and costs related to an incentive

plan associated with the initial public offering of $2.9 million in fiscal 2020, settlement costs of $15.0 million in fiscal 2017,

respectively, and other miscellaneous adjustments of $0.2 million and $0.1 million in fiscal 2018 and 2017, respectively. Other costs

for the twelve months ended June 30, 2021 reflect costs for legal expenses of $2.3 million and costs related to an incentive plan and

other ancillary expenses associated with the initial public offering of $2.8 million.

Source: Company financials. Numbers may not sum due to rounding.

34View entire presentation