Bausch+Lomb Results Presentation Deck

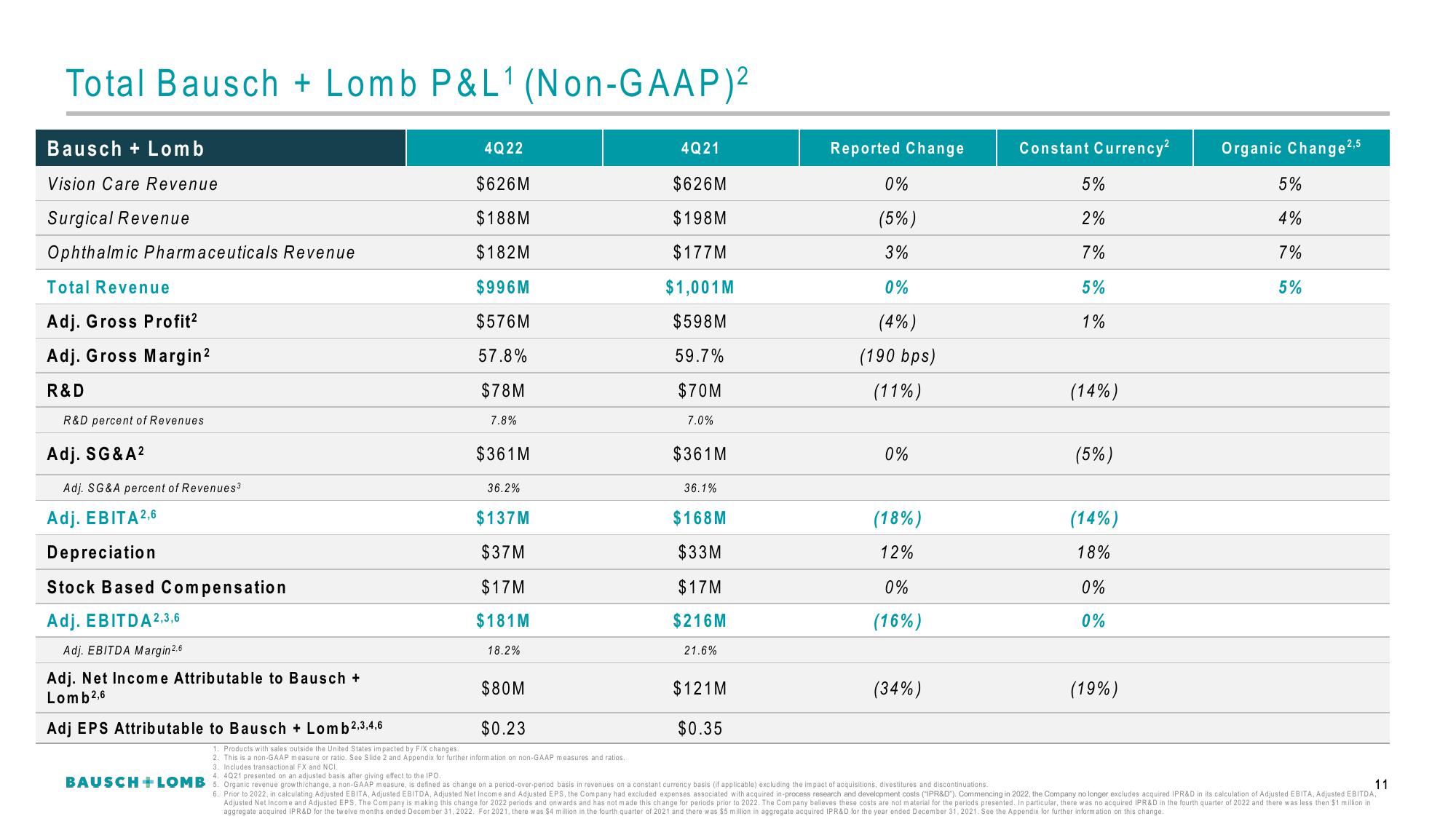

Total Bausch + Lomb P&L¹ (Non-GAAP)²

Bausch + Lomb

Vision Care Revenue

Surgical Revenue

Ophthalmic Pharmaceuticals Revenue

Total Revenue

Adj. Gross Profit²

Adj. Gross Margin ²

R&D

R&D percent of Revenues

Adj. SG&A²

Adj. SG&A percent of Revenues³

Adj. EBITA 2,6

Depreciation

Stock Based Compensation

Adj. EBITDA 2,3,6

Adj. EBITDA Margin 2,6

Adj. Net Income Attributable to Bausch +

Lomb 2,6

Adj EPS Attributable to Bausch+Lomb 2,3,4,6

4Q22

$626M

$188M

$182M

$996M

$576M

57.8%

$78M

7.8%

$361M

36.2%

$137M

$37M

$17M

$181 M

18.2%

$80M

$0.23

1. Products with sales outside the United States impacted by F/X changes.

2. This is a non-GAAP measure or ratio. See Slide 2 and Appendix for further information on non-GAAP measures and ratios,

4Q21

$626M

$198M

$177M

$1,001 M

$598M

59.7%

$70M

7.0%

$361M

36.1%

$168M

$33M

$17M

$216M

21.6%

$121M

$0.35

Reported Change

0%

(5%)

3%

0%

(4%)

(190 bps)

(11%)

0%

(18%)

12%

0%

(16%)

(34%)

3. Includes transactional FX and NCI.

4Q21 presented on an adjusted basis after giving effect to the IPO.

BAUSCH + LOMB 5. Organic revenue growth/change, a non-GAAP measure, is defined as change on a period-over-period basis in revenues on a constant currency basis (if applicable) excluding the impact of acquisitions, divestitures and discontinuations.

Constant Currency²

5%

2%

7%

5%

1%

(14%)

(5%)

(14%)

18%

0%

0%

(19%)

Organic Change 2,5

5%

4%

7%

5%

11

6. Prior to 2022, in calculating Adjusted EBITA, Adjusted EBITDA, Adjusted Net Income and Adjusted EPS, the Company had excluded expenses associated with acquired in-process research and development costs ("IPR&D"). Commencing in 2022, the Company no longer excludes acquired IPR&D in its calculation of Adjusted EBITA, Adjusted EBITDA,

Adjusted Net Income and Adjusted EPS. The Company is making this change for 2022 periods and onwards and has not made this change for periods prior to 2022. The Company believes these costs are not material for the periods presented. In particular, there was no acquired IPR&D in the fourth quarter of 2022 and there was less then $1 million in

aggregate acquired IPR&D for the twelve months ended December 31, 2022. For 2021, there was $4 million in the fourth quarter of 2021 and there was $5 million in aggregate acquired IPR&D for the year ended December 31, 2021. See the Appendix for further information on this change.View entire presentation