J.P.Morgan Results Presentation Deck

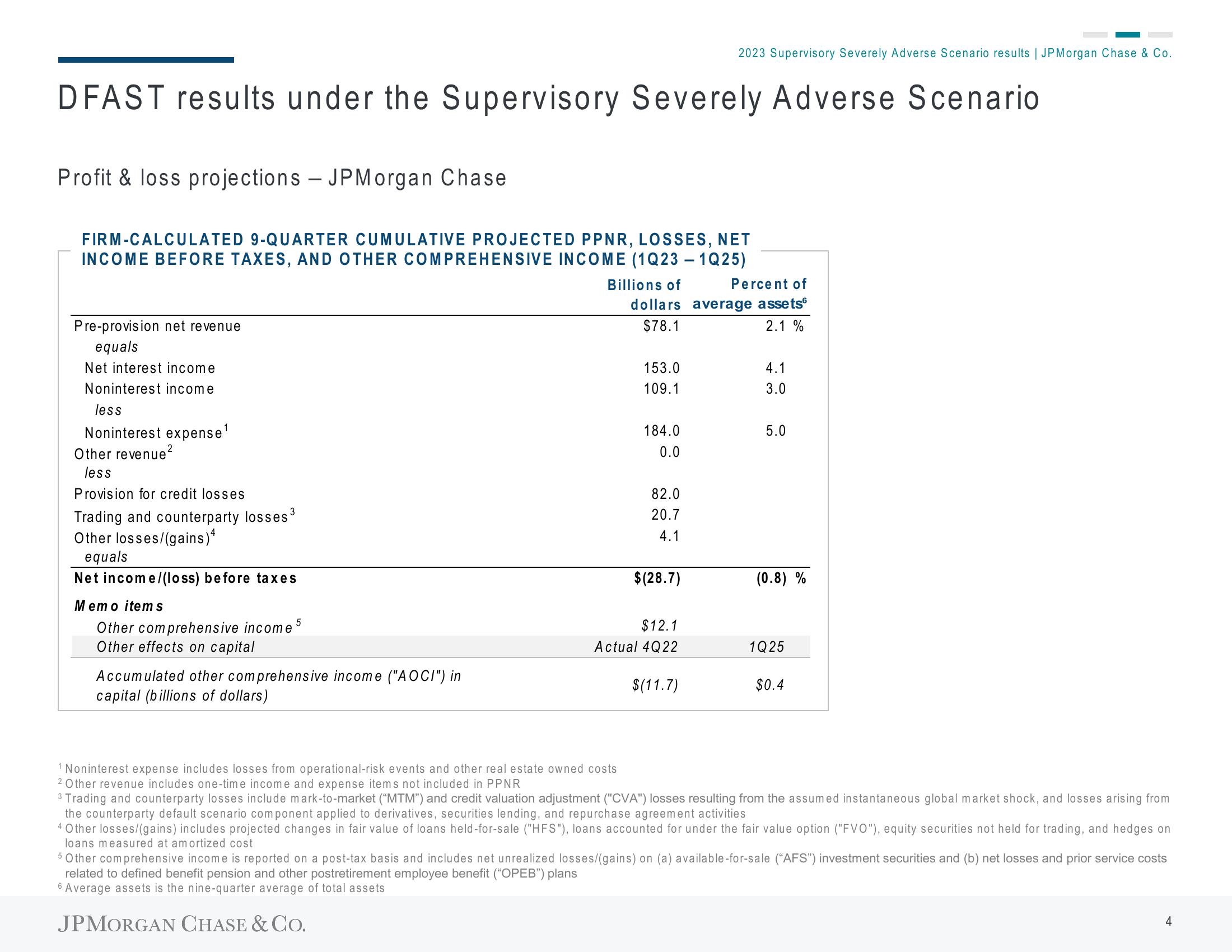

DFAST results under the Supervisory Severely Adverse Scenario

Profit & loss projections - JPMorgan Chase

FIRM-CALCULATED 9-QUARTER CUMULATIVE PROJECTED PPNR, LOSSES, NET

INCOME BEFORE TAXES, AND OTHER COMPREHENSIVE INCOME (1Q23 - 1Q25)

Billions of

Pre-provision net revenue

equals

Net interest income

Noninterest income

less

Noninterest expense¹

Other revenue²

less

Provision for credit losses

Trading and counterparty losses ³

Other losses/(gains) 4

equals

Net income/(loss) before taxes

Mem o items

Other comprehensive income 5

Other effects on capital

Accumulated other comprehensive income ("AOCI") in

capital (billions of dollars)

Percent of

dollars average assets

$78.1

2.1 %

153.0

109.1

184.0

0.0

82.0

20.7

4.1

2023 Supervisory Severely Adverse Scenario results | JPMorgan Chase & Co.

$(28.7)

$12.1

Actual 4Q22

$(11.7)

4.1

3.0

5.0

(0.8) %

1Q25

$0.4

¹ Noninterest expense includes losses from operational-risk events and other real estate owned costs

2 Other revenue includes one-time income and expense items not included in PPNR

3 Trading and counterparty losses include mark-to-market ("MTM") and credit valuation adjustment ("CVA") losses resulting from the assumed instantaneous global market shock, and losses arising from

the counterparty default scenario component applied to derivatives, securities lending, and repurchase agreement activities

4 Other losses/(gains) includes projected changes in fair value of loans held-for-sale ("HFS"), loans accounted for under the fair value option ("FVO"), equity securities not held for trading, and hedges on

loans measured at amortized cost

5 Other comprehensive income is reported on a post-tax basis and includes net unrealized losses/(gains) on (a) available-for-sale ("AFS") investment securities and (b) net losses and prior service costs

related to defined benefit pension and other postretirement employee benefit ("OPEB") plans

6 Average assets is the nine-quarter average of total assets

JPMORGAN CHASE & CO.

4View entire presentation