Southland Holdings SPAC Presentation Deck

TRANSACTION SUMMARY

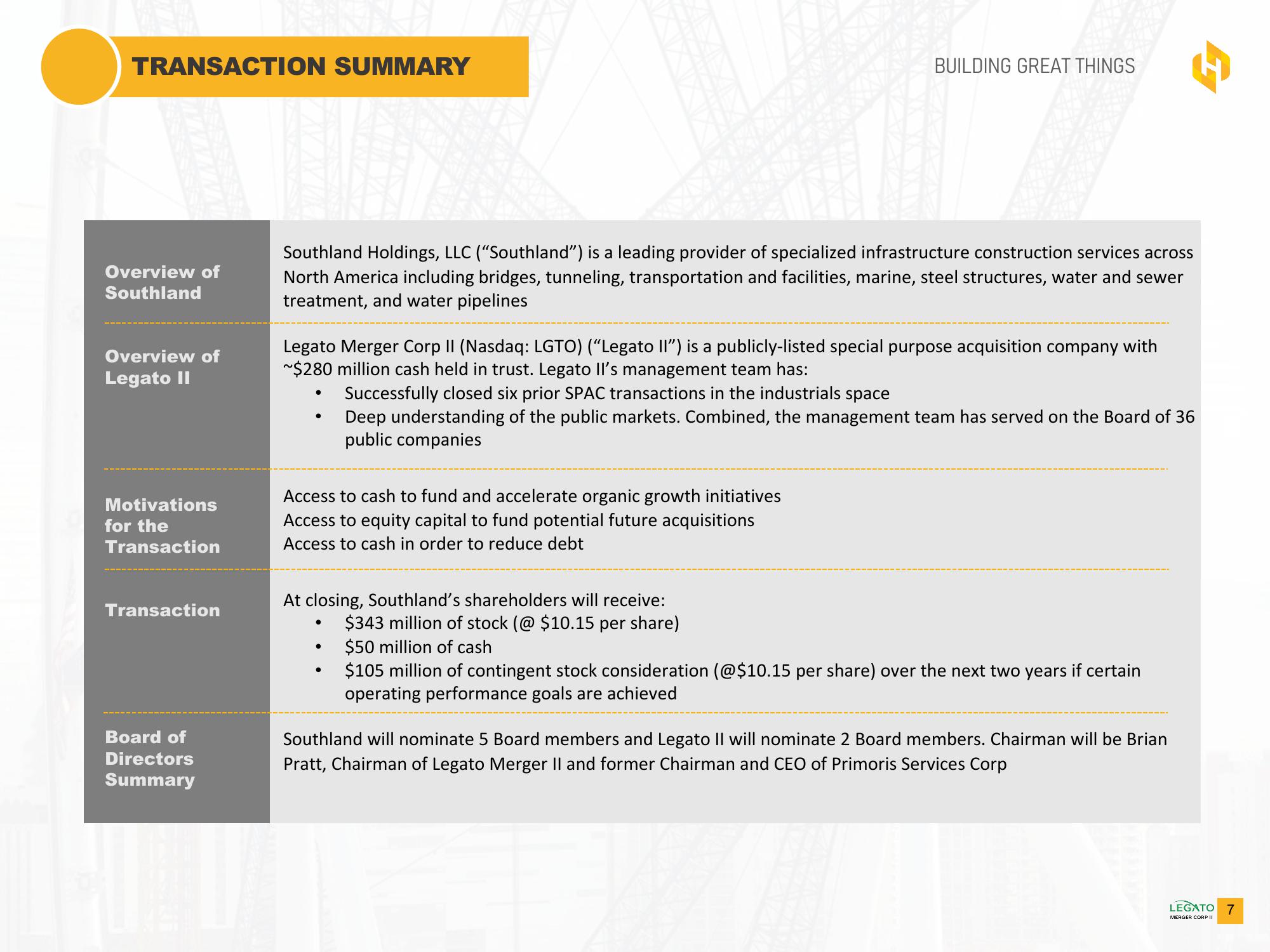

Overview of

Southland

Overview of

Legato II

Motivations

for the

Transaction

Transaction

Board of

Directors

Summary

Southland Holdings, LLC ("Southland") is a leading provider of specialized infrastructure construction services across

North America including bridges, tunneling, transportation and facilities, marine, steel structures, water and sewer

treatment, and water pipelines

Legato Merger Corp II (Nasdaq: LGTO) ("Legato II") is a publicly-listed special purpose acquisition company with

~$280 million cash held in trust. Legato Il's management team has:

Successfully closed six prior SPAC transactions in the industrials space

Deep understanding of the public markets. Combined, the management team has served on the Board of 36

public companies

●

●

Access to cash to fund and accelerate organic growth initiatives

Access to equity capital to fund potential future acquisitions

Access to cash in order to reduce debt

BUILDING GREAT THINGS

At closing, Southland's shareholders will receive:

$343 million of stock (@ $10.15 per share)

$50 million of cash

$105 million of contingent stock consideration (@$10.15 per share) over the next two years if certain

operating performance goals are achieved

●

●

Southland will nominate 5 Board members and Legato II will nominate 2 Board members. Chairman will be Brian

Pratt, Chairman of Legato Merger II and former Chairman and CEO of Primoris Services Corp

LEGATO 7

MERGER CORP IIView entire presentation