Morgan Stanley Investment Banking Pitch Book

Portions of this exhibit marked [*] are requested to be treated confidentially

.

.

Project Roosevelt

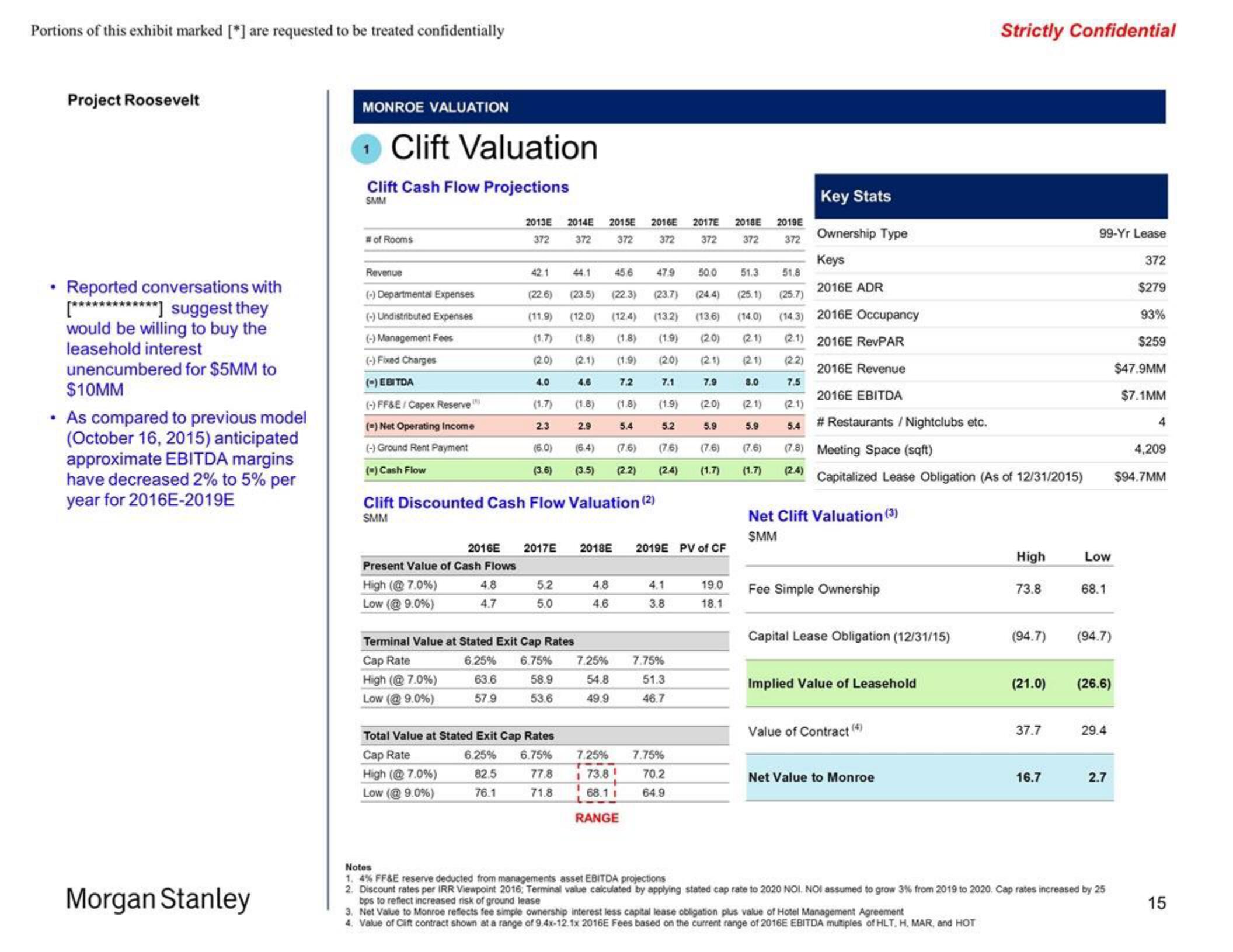

Reported conversations with

[*************] suggest they

would be willing to buy the

leasehold interest

unencumbered for $5MM to

$10MM

As compared to previous model

(October 16, 2015) anticipated

approximate EBITDA margins

have decreased 2% to 5% per

year for 2016E-2019E

Morgan Stanley

MONROE VALUATION

Clift Valuation

Clift Cash Flow Projections

SMM

# of Rooms

Revenue

(-) Departmental Expenses

(-)Undistributed Expenses

(-) Management Fees

(-) Fixed Charges

(=)EBITDA

(-) FF&E/ Capex Reserve

(-) Net Operating Income

(-) Ground Rent Payment

(-) Cash Flow

2016E

Present Value of Cash Flows

High (@ 7.0%)

4.8

Low (@9.0%)

4.7

2013E 2014E 2015E 2016E 2017E 2018E

372

372

372

372

372

372

42.1

Cap Rate

High (@7.0%)

Low (@9.0%)

(22.6) (23.5)

(11.9) (12.0)

(1.7) (1.8)

(2.0) (2.1)

4.0

4.6

(1.7) (1.8)

2.3

44.1

Clift Discounted Cash Flow Valuation (2)

SMM

2017E

5.2

5.0

(6.0) (6.4)

(7.6)

(7.6)

(3.6) (3.5) (2.2) (2.4)

Terminal Value at Stated Exit Cap Rates

2.9

58.9

53.6

Total Value at Stated Exit Cap Rates

Cap Rate

High (@7.0%)

6.25% 6.75%

82.5 77.8

76.1

71.8

Low (@ 9.0%)

(25.1)

45.6 47.9 50.0

(22.3) (23.7) (24.4)

(12.4) (13.2) (13.6)

(1.8) (1.9) (2.0) (2.1)

(1.9) (2.0) (2.1) (2.1)

(14.0)

7.2

(1.8)

7.1

(1.9)

5.4

6.25% 6.75% 7.25%

63.6

54.8

57.9

49.9

4.8

4.6

5.2

7.25%

T

1 73.81

168.11

RANGE

2018E 2019E PV of CF

4.1

3.8

7.75%

51.3

46.7

7.75%

7.9

70.2

64.9

(2.0)

5.9

(7.6)

(1.7)

19.0

18.1

51.3

8.0

(2.1)

5.9

(7.6)

(1.7)

Key Stats

Ownership Type

Keys

2016E ADR

(25.7)

(143) 2016E Occupancy

(2.1) 2016E RevPAR

(22)

2016E Revenue

7.5

2016E EBITDA

# Restaurants / Nightclubs etc.

2019E

372

51.8

(2.1)

5.4

(7.8) Meeting Space (sqft)

(2.4)

Capitalized Lease Obligation (As of 12/31/2015)

Net Clift Valuation (3)

SMM

Fee Simple Ownership

Capital Lease Obligation (12/31/15)

Implied Value of Leasehold

Value of Contract (4)

Strictly Confidential

Net Value to Monroe

High

73.8

(94.7)

(21.0)

37.7

16.7

99-Yr Lease

372

$279

93%

$259

Low

68.1

(94.7)

(26.6)

29.4

2.7

Notes

1. 4% FF&E reserve deducted from managements asset EBITDA projections

2. Discount rates per IRR Viewpoint 2016; Terminal value calculated by applying stated cap rate to 2020 NOI. NOI assumed to grow 3% from 2019 to 2020. Cap rates increased by 25

bps to reflect increased risk of ground lease

3. Net Value to Monroe reflects fee simple ownership interest less capital lease obligation plus value of Hotel Management Agreement

4. Value of Clift contract shown at a range of 9.4x-12.1x 2016E Fees based on the current range of 2016E EBITDA multiples of HLT, H, MAR, and HOT

$47.9MM

$7.1MM

4

4,209

$94.7MM

15View entire presentation