Kinnevik Results Presentation Deck

Intro

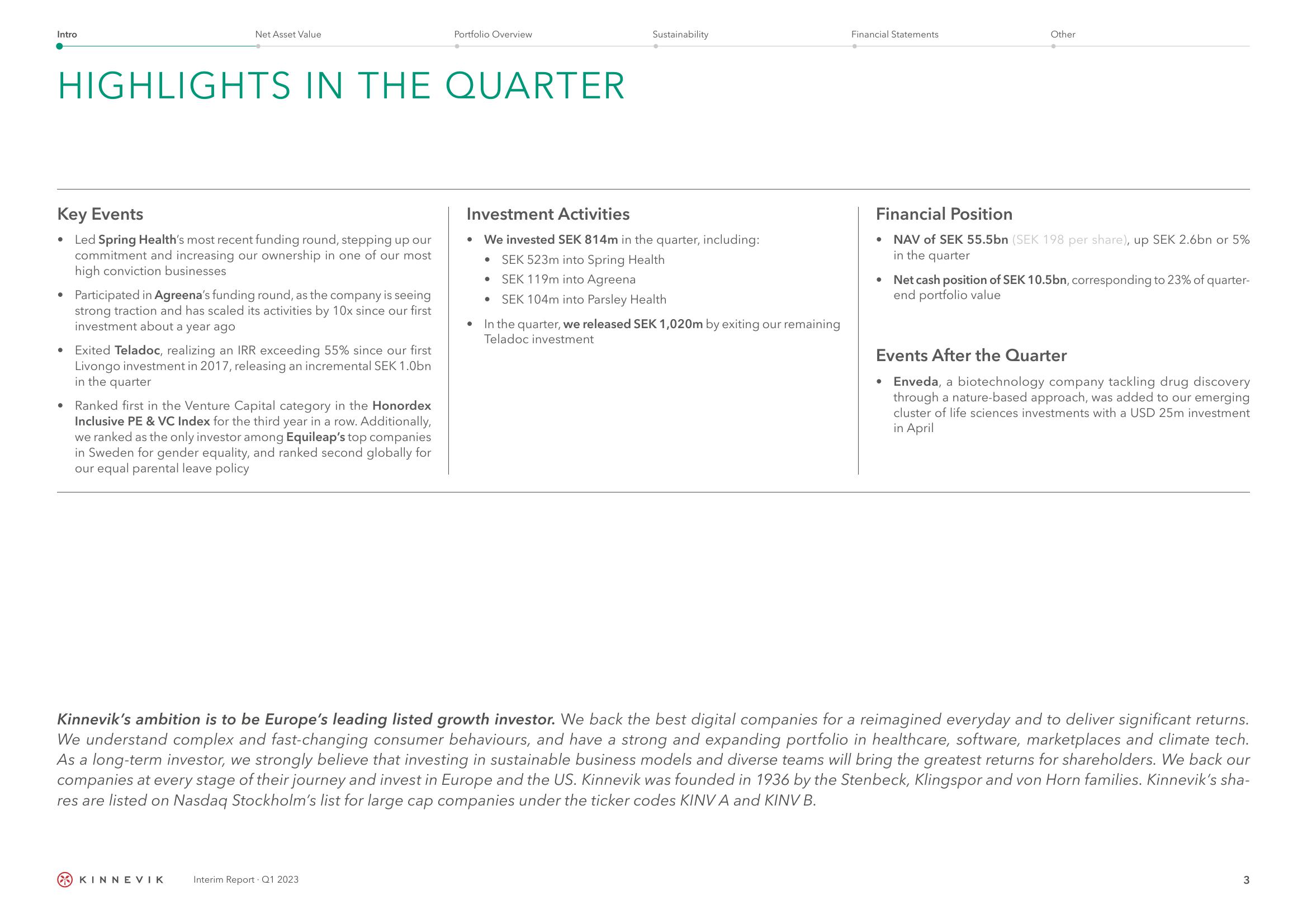

HIGHLIGHTS IN THE QUARTER

Key Events

Led Spring Health's most recent funding round, stepping up our

commitment and increasing our ownership in one of our most

high conviction businesses

●

Net Asset Value

●

Participated in Agreena's funding round, as the company is seeing

strong traction and has scaled its activities by 10x since our first

investment about a year ago

Exited Teladoc, realizing an IRR exceeding 55% since our first

Livongo investment in 2017, releasing an incremental SEK 1.0bn

in the quarter

Ranked first in the Venture Capital category in the Honordex

Inclusive PE & VC Index for the third year in a row. Additionally,

we ranked as the only investor among Equileap's top companies

in Sweden for gender equality, and ranked second globally for

our equal parental leave policy

KINNEVIK

Portfolio Overview

Interim Report Q1 2023

Sustainability

Investment Activities

We invested SEK 814m in the quarter, including:

● SEK 523m into Spring Health

SEK 119m into Agreena

• SEK 104m into Parsley Health

●

In the quarter, we released SEK 1,020m by exiting our remaining

Teladoc investment

Financial Statements

Other

Financial Position

• NAV of SEK 55.5bn (SEK 198 per share), up SEK 2.6bn or 5%

in the quarter

Net cash position of SEK 10.5bn, corresponding to 23% of quarter-

end portfolio value

Kinnevik's ambition is to be Europe's leading listed growth investor. We back the best digital companies for a reimagined everyday and to deliver significant returns.

We understand complex and fast-changing consumer behaviours, and have a strong and expanding portfolio in healthcare, software, marketplaces and climate tech.

As a long-term investor, we strongly believe that investing in sustainable business models and diverse teams will bring the greatest returns for shareholders. We back our

companies at every stage of their journey and invest in Europe and the US. Kinnevik was founded in 1936 by the Stenbeck, Klingspor and von Horn families. Kinnevik's sha-

res are listed on Nasdaq Stockholm's list for large cap companies under the ticker codes KINV A and KINV B.

Events After the Quarter

• Enveda, a biotechnology company tackling drug discovery

through a nature-based approach, was added to our emerging

cluster of life sciences investments with a USD 25m investment

in April

3View entire presentation