Alternus Energy SPAC Presentation Deck

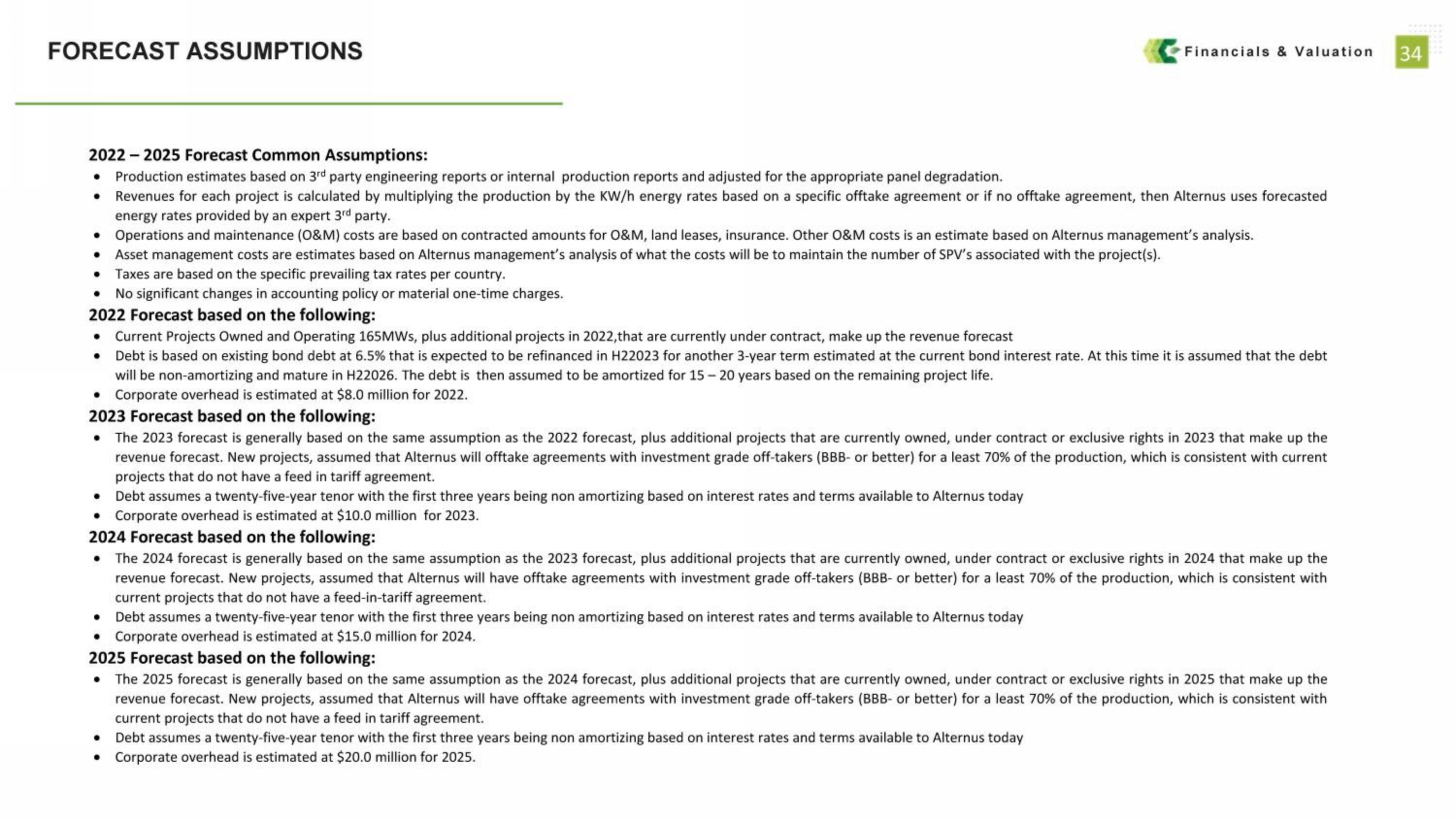

FORECAST ASSUMPTIONS

2022- 2025 Forecast Common Assumptions:

• Production estimates based on 3rd party engineering reports or internal production reports and adjusted for the appropriate panel degradation.

Financials & Valuation

• Revenues for each project is calculated by multiplying the production by the KW/h energy rates based on a specific offtake agreement or if no offtake agreement, then Alternus uses forecasted

energy rates provided by an expert 3rd party.

•

Operations and maintenance (O&M) costs are based on contracted amounts for O&M, land leases, insurance. Other O&M costs is an estimate based on Alternus management's analysis.

Asset management costs are estimates based on Alternus management's analysis of what the costs will be to maintain the number of SPV's associated with the project(s).

Taxes are based on the specific prevailing tax rates per country.

No significant changes in accounting policy or material one-time charges.

2022 Forecast based on the following:

• Current Projects Owned and Operating 165MWs, plus additional projects in 2022, that are currently under contract, make up the revenue forecast

Debt is based on existing bond debt at 6.5% that is expected to be refinanced in H22023 for another 3-year term estimated at the current bond interest rate. At this time it is assumed that the debt

will be non-amortizing and mature in H22026. The debt is then assumed to be amortized for 15-20 years based on the remaining project life.

Corporate overhead is estimated at $8.0 million for 2022.

2023 Forecast based on the following:

• The 2023 forecast is generally based on the same assumption as the 2022 forecast, plus additional projects that are currently owned, under contract or exclusive rights in 2023 that make up the

revenue forecast. New projects, assumed that Alternus will offtake agreements with investment grade off-takers (BBB- or better) for a least 70% of the production, which is consistent with current

projects that do not have a feed in tariff agreement.

Debt assumes a twenty-five-year tenor with the first three years being non amortizing based on interest rates and terms available to Alternus today

Corporate overhead is estimated at $10.0 million for 2023.

2024 Forecast based on the following:

• The 2024 forecast is generally based on the same assumption as the 2023 forecast, plus additional projects that are currently owned, under contract or exclusive rights in 2024 that make up the

revenue forecast. New projects, assumed that Alternus will have offtake agreements with investment grade off-takers (BBB- or better) for a least 70% of the production, which is consistent with

current projects that do not have a feed-in-tariff agreement.

• Debt assumes a twenty-five-year tenor with the first three years being non amortizing based on interest rates and terms available to Alternus today

Corporate overhead is estimated at $15.0 million for 2024.

2025 Forecast based on the following:

• The 2025 forecast is generally based on the same assumption as the 2024 forecast, plus additional projects that are currently owned, under contract or exclusive rights in 2025 that make up the

revenue forecast. New projects, assumed that Alternus will have offtake agreements with investment grade off-takers (BBB- or better) for a least 70% of the production, which is consistent with

current projects that do not have a feed in tariff agreement.

•

Debt assumes a twenty-five-year tenor with the first three years being non amortizing based on interest rates and terms available to Alternus today

• Corporate overhead is estimated at $20.0 million for 2025.

34View entire presentation