LSE Results Presentation Deck

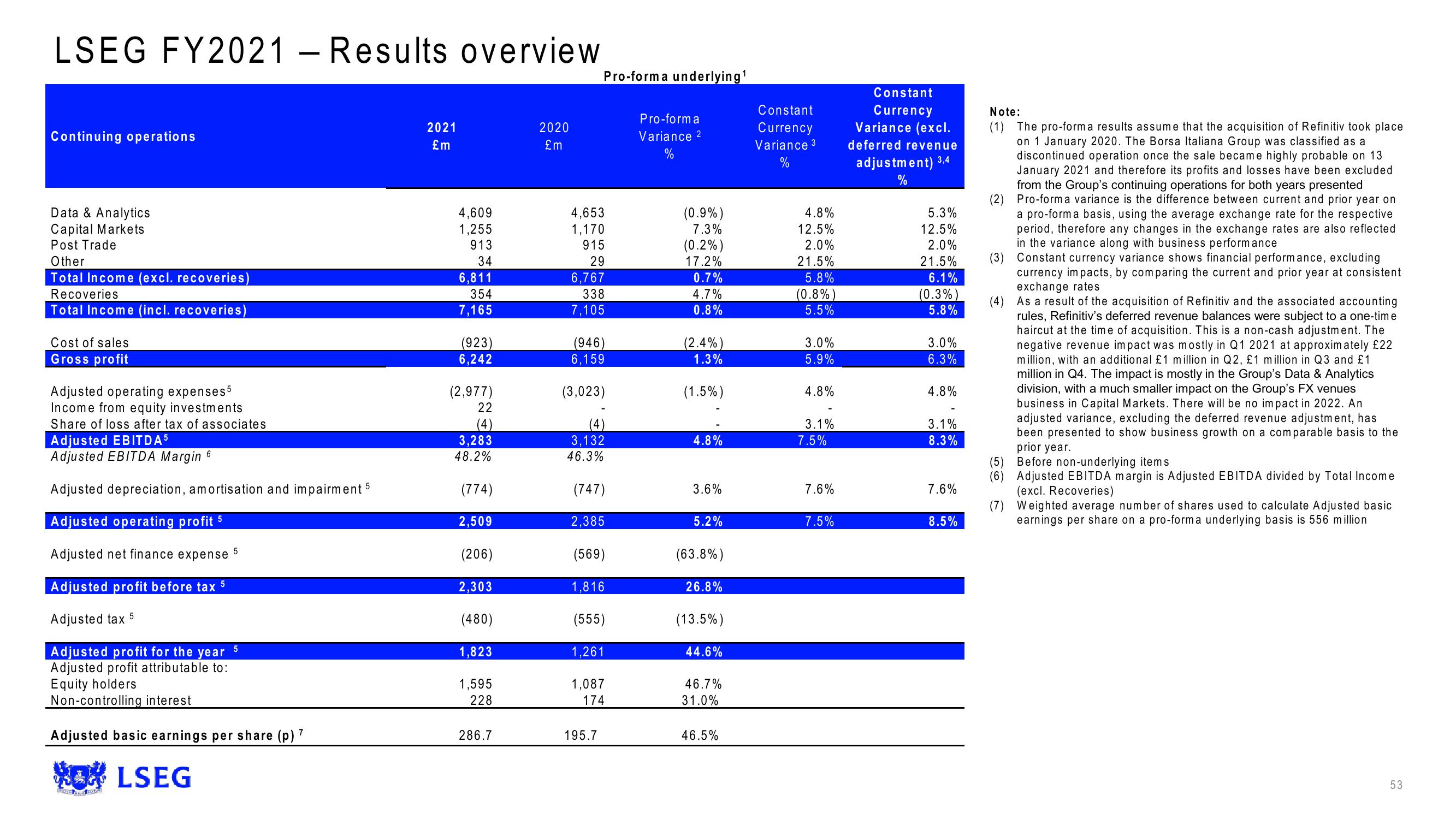

LSEG FY2021 - Results overview

Continuing operations

Data & Analytics

Capital Markets

Post Trade

Other

Total Income (excl. recoveries)

Recoveries

Total Income (incl. recoveries)

Cost of sales

Gross profit

Adjusted operating expenses5

Income from equity investments

Share of loss after tax of associates

Adjusted EBITDA5

Adjusted EBITDA Margin 6

Adjusted depreciation, amortisation and impairment 5

Adjusted operating profit 5

Adjusted net finance expense 5

Adjusted profit before tax

5

Adjusted tax

Adjusted profit for the year

Adjusted profit attributable to:

Equity holders

Non-controlling interest

Adjusted basic earnings per share (p) 7

WOLSEG

5

2021

£m

4,609

1,255

913

34

6,811

354

7,165

(923)

6,242

(2,977)

22

(4)

3,283

48.2%

(774)

2,509

(206)

2,303

(480)

1,823

1,595

228

286.7

2020

£m

Pro-forma underlying¹

4,653

1,170

915

29

6,767

338

7,105

(946)

6,159

(3,023)

(4)

3,132

46.3%

(747)

2,385

(569)

1,816

(555)

1,261

1,087

174

195.7

Pro-forma

Variance 2

%

(0.9%)

7.3%

(0.2%)

17.2%

0.7%

4.7%

0.8%

(2.4%)

1.3%

(1.5%)

4.8%

3.6%

5.2%

(63.8%)

26.8%

(13.5%)

44.6%

46.7%

31.0%

46.5%

Constant

Currency

Variance 3

%

4.8%

12.5%

2.0%

21.5%

5.8%

(0.8%)

5.5%

3.0%

5.9%

4.8%

3.1%

7.5%

7.6%

7.5%

Constant

Currency

Variance (excl.

deferred revenue

adjustment) 3,4

%

5.3%

12.5%

2.0%

21.5%

6.1%

(0.3%)

5.8%

3.0%

6.3%

4.8%

3.1%

8.3%

7.6%

8.5%

Note:

(1) The pro-form a results assume that the acquisition of Refinitiv took place

on 1 January 2020. The Borsa Italiana Group was classified as a

discontinued operation once the sale became highly probable on 13

January 2021 and therefore its profits and losses have been excluded

from the Group's continuing operations for both years presented

(2) Pro-form a variance is the difference between current and prior year on

a pro-form a basis, using the average exchange rate for the respective

period, therefore any changes in the exchange rates are also reflected

in the variance along with business performance

(3) Constant currency variance shows financial performance, excluding

currency impacts, by comparing the current and prior year at consistent

exchange rates

(4) As a result of the acquisition of Refinitiv and the associated accounting

rules, Refinitiv's deferred revenue balances were subject to a one-time

haircut at the time of acquisition. This is a non-cash adjustment. The

negative revenue impact was mostly in Q1 2021 at approximately £22

million, with an additional £1 million in Q2, £1 million in Q3 and £1

million in Q4. The impact is mostly in the Group's Data & Analytics

division, with a much smaller impact on the Group's FX venues

business in Capital Markets. There will be no impact in 2022. An

adjusted variance, excluding the deferred revenue adjustment, has

been presented to show business growth on a comparable basis to the

prior year.

(5)

Before non-underlying items

(6) Adjusted EBITDA margin is Adjusted EBITDA divided by Total Income

(excl. Recoveries)

(7) Weighted average number of shares used to calculate Adjusted basic

earnings per share on a pro-forma underlying basis is 556 million

53View entire presentation