Avantor Results Presentation Deck

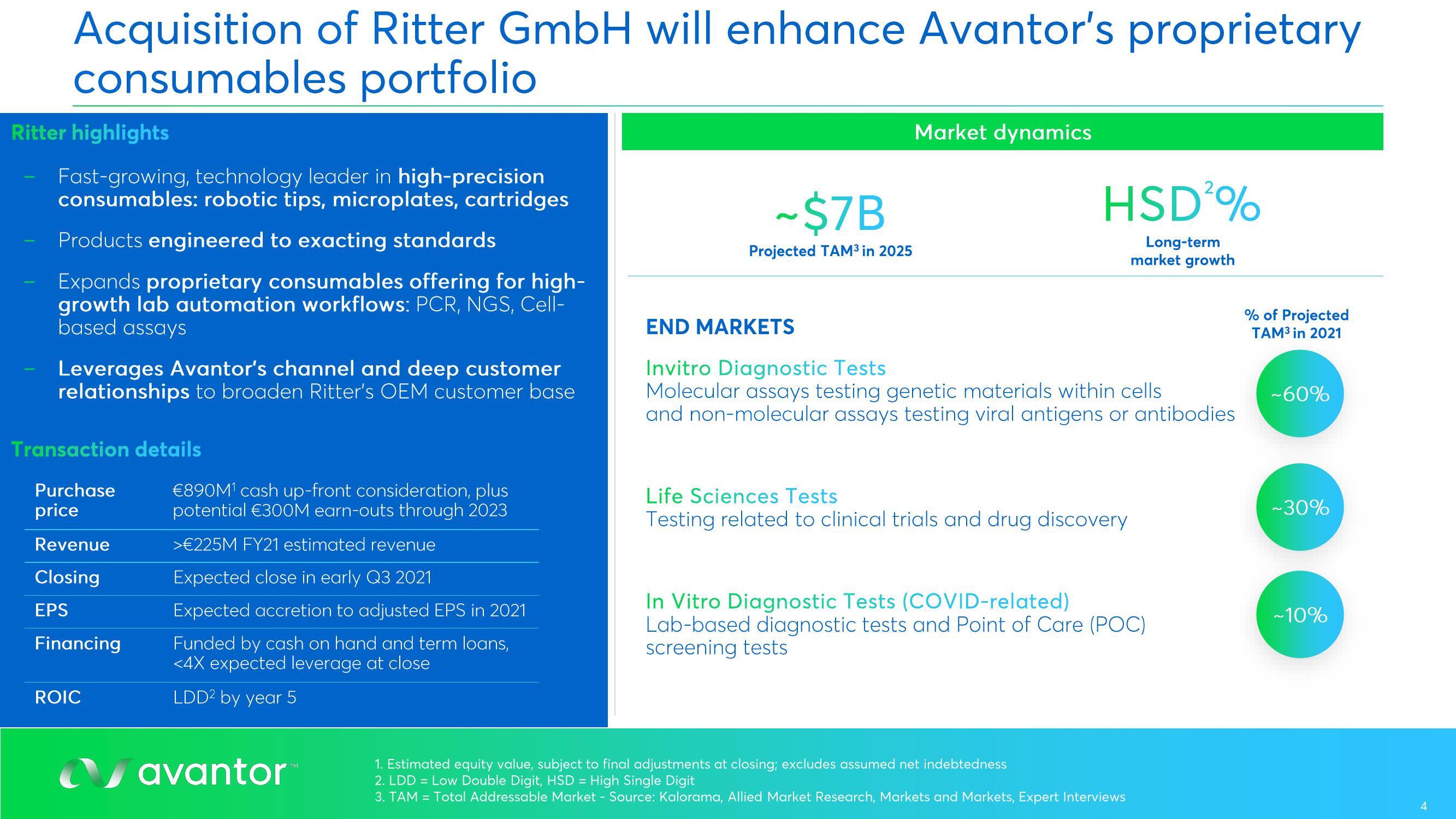

Acquisition of Ritter GmbH will enhance Avantor's proprietary

consumables portfolio

Ritter highlights

Fast-growing, technology leader in high-precision

consumables: robotic tips, microplates, cartridges

Products engineered to exacting standards

Expands proprietary consumables offering for high-

growth lab automation workflows: PCR, NGS, Cell-

based assays

Leverages Avantor's channel and deep customer

relationships to broaden Ritter's OEM customer base

Transaction details

Purchase

price

Revenue

Closing

EPS

Financing

ROIC

€890M¹ cash up-front consideration, plus

potential €300M earn-outs through 2023

>€225M FY21 estimated revenue

Expected close in early Q3 2021

Expected accretion to adjusted EPS in 2021

Funded by cash on hand and term loans,

<4X expected leverage at close

LDD² by year 5

avantor

M

~$7B

Projected TAM³ in 2025

Market dynamics

HSD²%

Long-term

market growth

END MARKETS

Invitro Diagnostic Tests

Molecular assays testing genetic materials within cells

and non-molecular assays testing viral antigens or antibodies

Life Sciences Tests

Testing related to clinical trials and drug discovery

In Vitro Diagnostic Tests (COVID-related)

Lab-based diagnostic tests and Point of Care (POC)

screening tests

1. Estimated equity value, subject to final adjustments at closing; excludes assumed net indebtedness

2. LDD = Low Double Digit, HSD = High Single Digit

3. TAM = Total Addressable Market - Source: Kalorama, Allied Market Research, Markets and Markets, Expert Interviews

% of Projected

TAM³ in 2021

~60%

-30%

~10%

4View entire presentation