Embracer Group Mergers and Acquisitions Presentation Deck

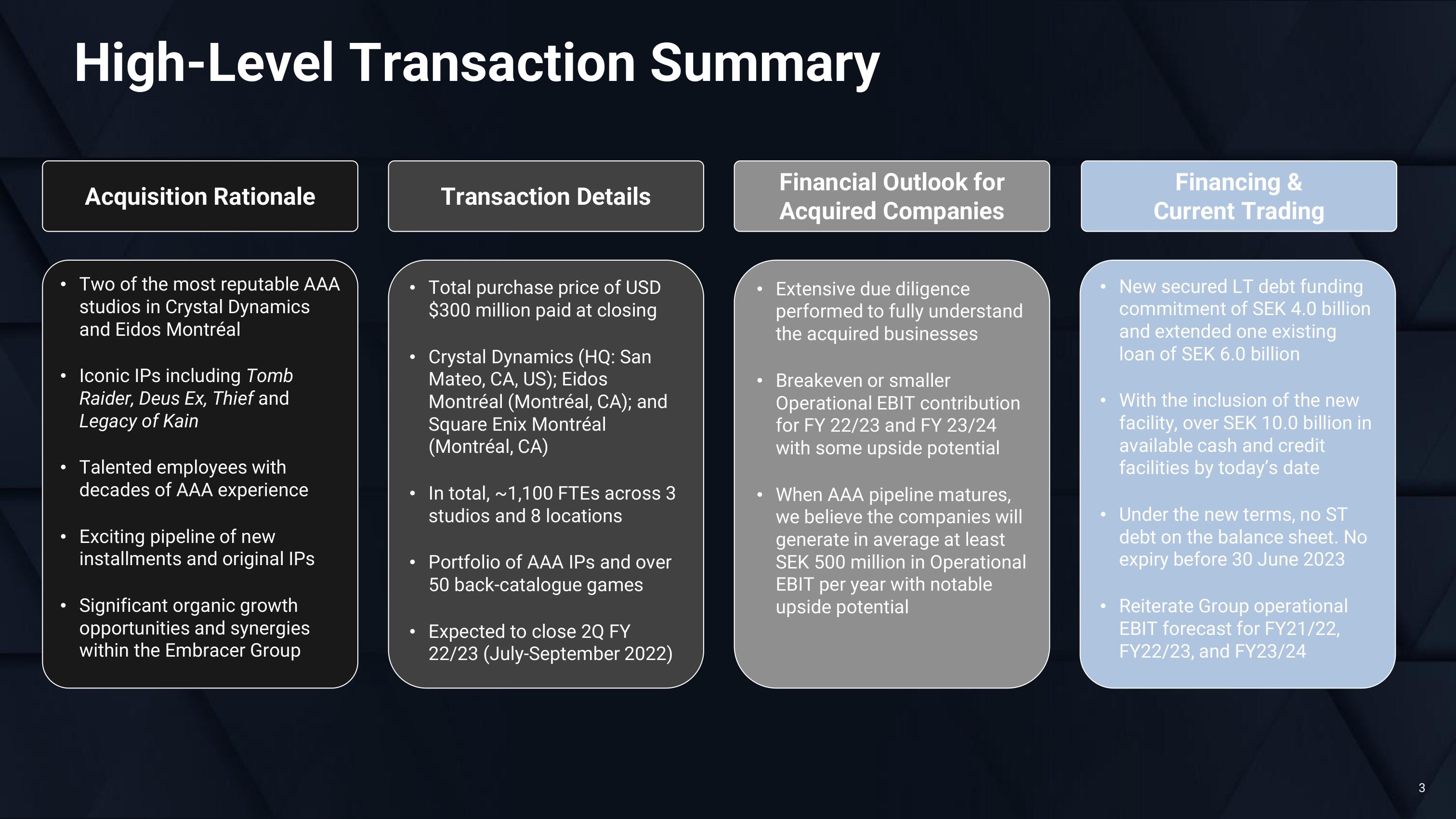

High-Level Transaction Summary

Acquisition Rationale

Two of the most reputable AAA

studios in Crystal Dynamics

and Eidos Montréal

• Iconic IPs including Tomb

Raider, Deus Ex, Thief and

Legacy of Kain

• Talented employees with

decades of AAA experience

Exciting pipeline of new

installments and original IPS

Significant organic growth

opportunities and synergies

within the Embracer Group

●

●

●

●

Transaction Details

Total purchase price of USD

$300 million paid at closing

Crystal Dynamics (HQ: San

Mateo, CA, US); Eidos

Montréal (Montréal, CA); and

Square Enix Montréal

(Montréal, CA)

In total, ~1,100 FTEs across 3

studios and 8 locations

Portfolio of AAA IPs and over

50 back-catalogue games

Expected to close 2Q FY

22/23 (July-September 2022)

●

Financial Outlook for

Acquired Companies

Extensive due diligence

performed to fully understand

the acquired businesses

Breakeven or smaller

Operational EBIT contribution

for FY 22/23 and FY 23/24

with some upside potential

• When AAA pipeline matures,

we believe the companies will

generate in average at least

SEK 500 million in Operational

EBIT per year with notable

upside potential

Financing &

Current Trading

New secured LT debt funding

commitment of SEK 4.0 billion

and extended one existing

loan of SEK 6.0 billion

With the inclusion of the new

facility, over SEK 10.0 billion in

available cash and credit

facilities by today's date

Under the new terms, no ST

debt on the balance sheet. No

expiry before 30 June 2023

Reiterate Group operational

EBIT forecast for FY21/22,

FY22/23, and FY23/24

3View entire presentation