Morgan Stanley Investment Banking Pitch Book

Morgan Stanley

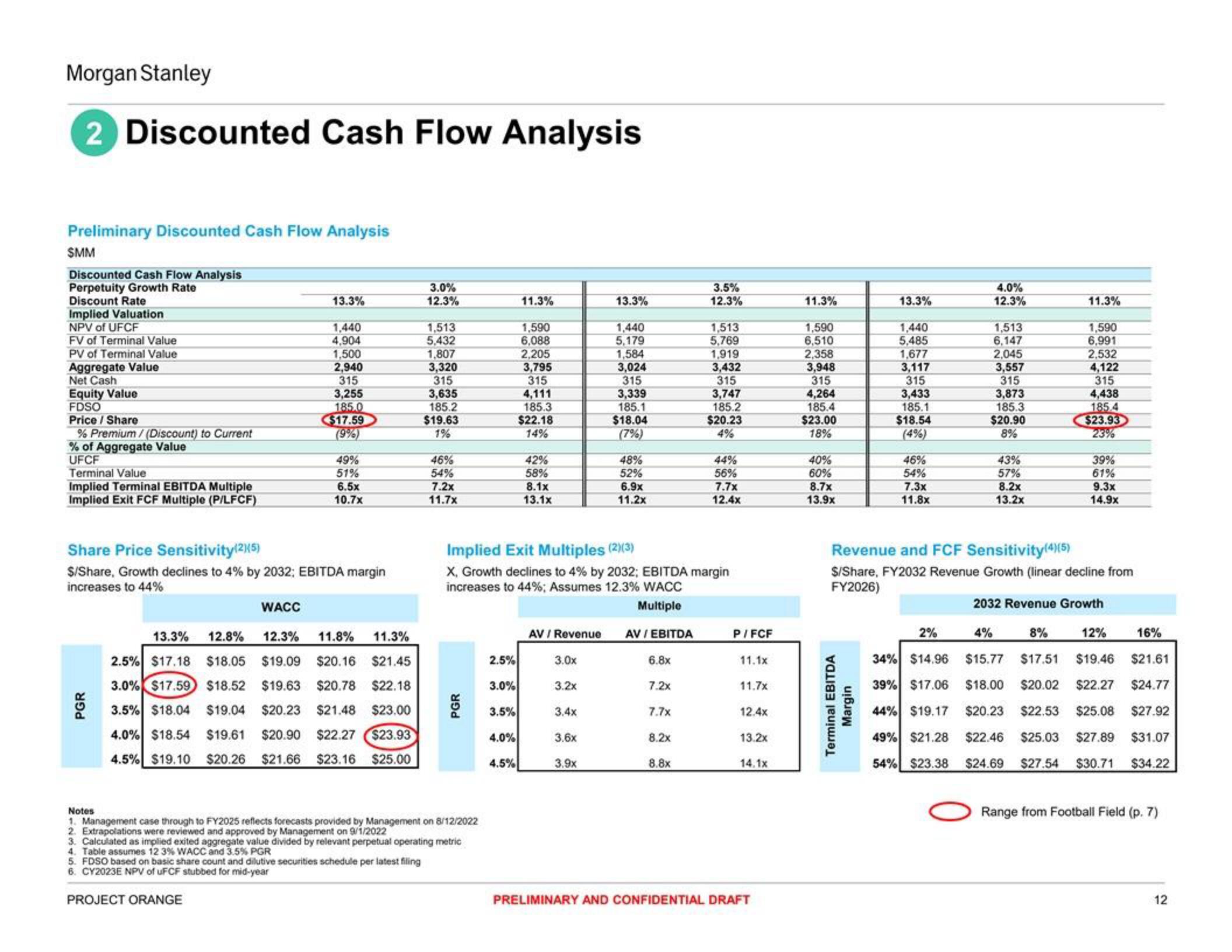

2 Discounted Cash Flow Analysis

Preliminary Discounted Cash Flow Analysis

SMM

Discounted Cash Flow Analysis

Perpetuity Growth Rate

Discount Rate

Implied Valuation

NPV of UFCF

FV of Terminal Value

PV of Terminal Value

Aggregate Value

Net Cash

Equity Value

FDSO

Price/Share

% Premium/ (Discount) to Current

% of Aggregate Value

UFCF

Terminal Value

Implied Terminal EBITDA Multiple

Implied Exit FCF Multiple (P/LFCF)

PGR

13.3%

1,440

4,904

1.500

2,940

315

3,255

185.0

$17.59

(9%)

Share Price Sensitivity(2)(5)

$/Share, Growth declines to 4% by 2032; EBITDA margin

increases to 44%

49%

51%

6.5x

10.7x

PROJECT ORANGE

WACC

13.3% 12.8%

12.3% 11.8% 11.3%

2.5% $17.18 $18.05 $19.09 $20.16 $21.45

3.0% $17.59 $18.52 $19.63 $20.78 $22.18

3.5% $18.04 $19.04 $20.23 $21.48 $23.00

4.0% $18.54 $19.61 $20.90 $22.27 $23.93

4.5% $19.10 $20.26 $21.66 $23.16 $25.00

5. FDSO based on basic share count and dilutive securities schedule per latest filing

6. CY2023E NPV of uFCF stubbed for mid-year

3.0%

12.3%

1,513

5,432

1.807

3,320

315

3,635

185.2

$19.63

1%

46%

54%

7.2x

11.7x

Notes

1. Management case through to FY2025 reflects forecasts provided by Management on 8/12/2022

2. Extrapolations were reviewed and approved by Management on 9/1/2022

3. Calculated as implied exited aggregate value divided by relevant perpetual operating metric

4. Table assumes 12 3% WACC and 3.5% PGR

PGR

2.5%

3.0%

3.5%

11.3%

4.0%

4.5%

1,590

6,088

2,205

3,795

315

4,111

185.3

$22.18

14%

42%

58%

8.1x

13.1x

AV / Revenue

Implied Exit Multiples (2)(3)

X, Growth declines to 4% by 2032; EBITDA margin

increases to 44%; Assumes 12.3% WACC

Multiple

3.0x

3.2x

13.3%

3.4x

3.6x

3.9x

1,440

5,179

1,584

3,024

315

3,339

185.1

$18.04

(7%)

48%

52%

6.9x

11.2x

AV / EBITDA

6.8x

3.5%

12.3%

7.2x

7.7x

8.2x

8.8x

1,513

5,769

1,919

3,432

315

3,747

185.2

$20.23

4%

44%

56%

7.7x

12.4x

P/FCF

11.1x

11.7x

12.4x

13.2x

14.1x

PRELIMINARY AND CONFIDENTIAL DRAFT

11.3%

1,590

6,510

2,358

3,948

315

4,264

185.4

$23.00

18%

40%

60%

8.7x

13.9x

13.3%

Terminal EBITDA

Margin

1,440

5,485

1,677

3,117

315

3,433

185.1

$18.54

46%

54%

7.3x

11.8x

4.0%

12.3%

2%

1,513

6,147

2,045

3,557

315

3,873

185.3

$20.90

8%

43%

57%

8.2x

13.2x

11.3%

1,590

6,991

2,532

4,122

315

4,438

185.4

$23.93

23%

Revenue and FCF Sensitivity(4)(5)

$/Share, FY2032 Revenue Growth (linear decline from

FY2026)

2032 Revenue Growth

39%

61%

9.3x

14.9x

4%

8%

12%

16%

34% $14.96 $15.77 $17.51 $19.46 $21.61

39% $17.06 $18.00 $20.02 $22.27 $24.77

44% $19.17 $20.23 $22.53 $25.08 $27.92

49% $21.28 $22.46 $25.03 $27.89 $31.07

$24.69 $27.54 $30.71 $34.22

54% $23.38

Range from Football Field (p. 7)

12View entire presentation