J.P.Morgan Shareholder Engagement Presentation Deck

A Say-on-Pay Response

We responded to shareholders' concerns by enhancing our executive

compensation

program in several ways

Shareholder Feedback

Most shareholders disfavor one-time

special awards and requested a

commitment of no more special

grants to the current CEO

Most shareholders felt the one-time

special awards lacked direct

performance conditions that would

have mitigated their concerns

Some shareholders wanted to better

understand how the CMDC

assesses Operating Committee

member performance

Some shareholders requested

limitations, guardrails and

disclosure on the CMDC's

discretion in determining cash

incentives

For additional information and footnotes, please see slide 15

JPMORGAN CHASE & CO.

Our Response: New policy and compensation structures informed by shareholder feedback

• One-time awards are not a common practice and the CMDC has unequivocally committed to shareholders that future special

awards will not be granted to Mr. Dimon

• The CMDC has also extended this commitment to Mr. Pinto, and for 2022 and going forward the CMDC has decided to align

Mr. Pinto's compensation structure with that of Mr. Dimon, such that Mr. Pinto will no longer receive equity in RSUS, only PSUs

The CMDC has confirmed that no one-time special awards are currently under consideration for the Firm's other Named Executive

Officers ("NEOS")

• The CMDC has unequivocally committed that if a future one-off special grant is considered for other NEOs it will include

direct performance conditions; for example, such as those that currently exist in our annual PSU awards

• Any such grants to NEOs would only be under appropriate and rare circumstances

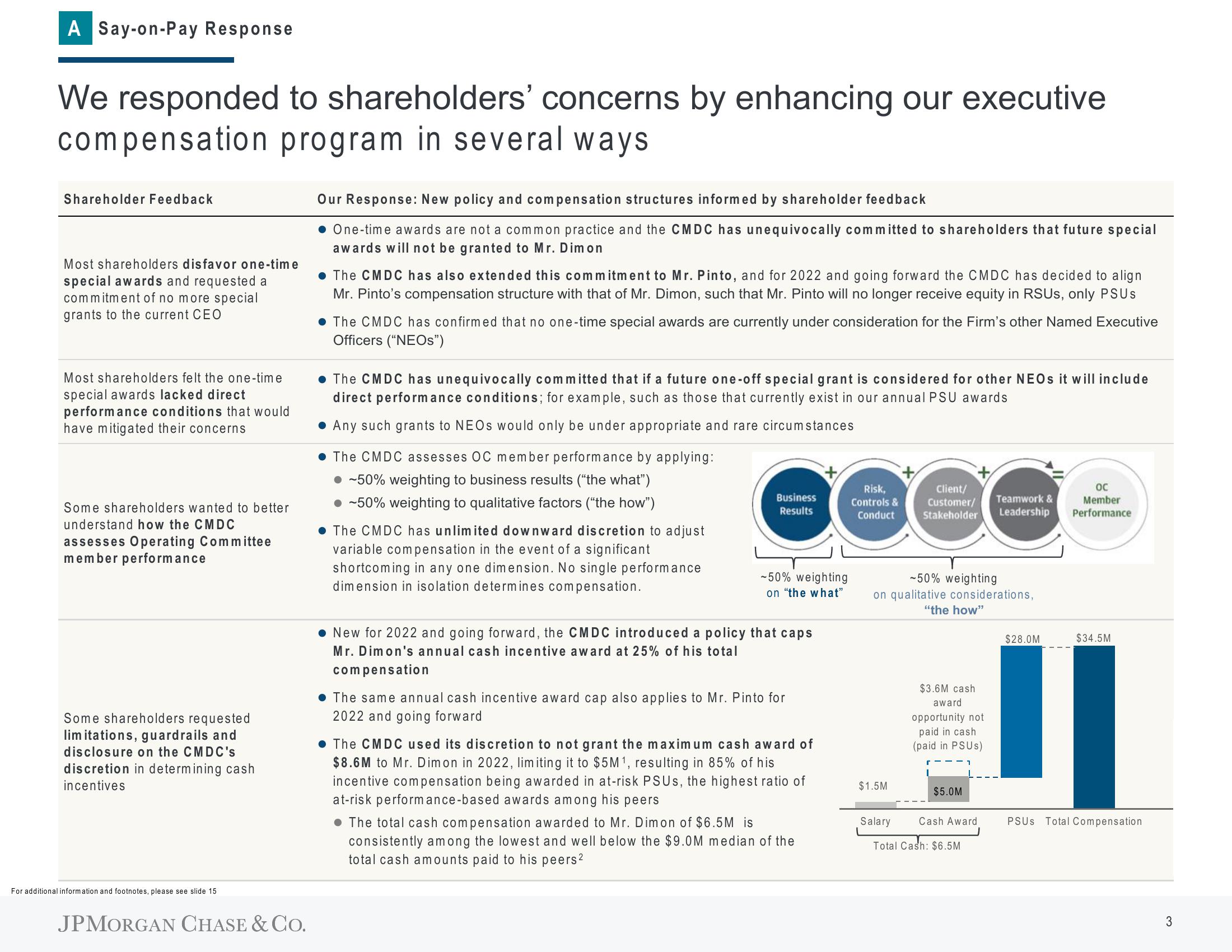

The CMDC assesses OC member performance by applying:

~50% weighting to business results ("the what")

● ~50% weighting to qualitative factors ("the how")

• The CMDC has unlimited downward discretion to adjust

variable compensation in the event of a significant

shortcoming in any one dimension. No single performance

dimension in isolation determines compensation.

Business

Results

-50% weighting

on "the what"

• New for 2022 and going forward, the CMDC introduced a policy that caps

Mr. Dimon's annual cash incentive award at 25% of his total

compensation

The same annual cash incentive award cap also applies to Mr. Pinto for

2022 and going forward

• The CMDC used its discretion to not grant the maximum cash award of

$8.6M to Mr. Dimon in 2022, limiting it to $5M¹, resulting in 85% of his

incentive compensation being awarded in at-risk PSUs, the highest ratio of

at-risk performance-based awards among his peers

• The total cash compensation awarded to Mr. Dimon of $6.5M is

consistently among the lowest and well below the $9.0M median of the

total cash amounts paid to his peers²

Risk,

Controls &

Conduct

Client/

Customer/ Teamwork &

Stakeholder Leadership

-50% weighting

Ion qualitative considerations,

"the how"

$1.5M

$3.6M cash

award

opportunity not

paid in cash

(paid in PSUS)

ו -

$28.0M

$34.5M

I

$5.0M

ос

Member

Performance

Salary Cash Award

Total Cash: $6.5M

PSUS Total Compensation

3View entire presentation