Q2 Quarter 2023

Income Summary

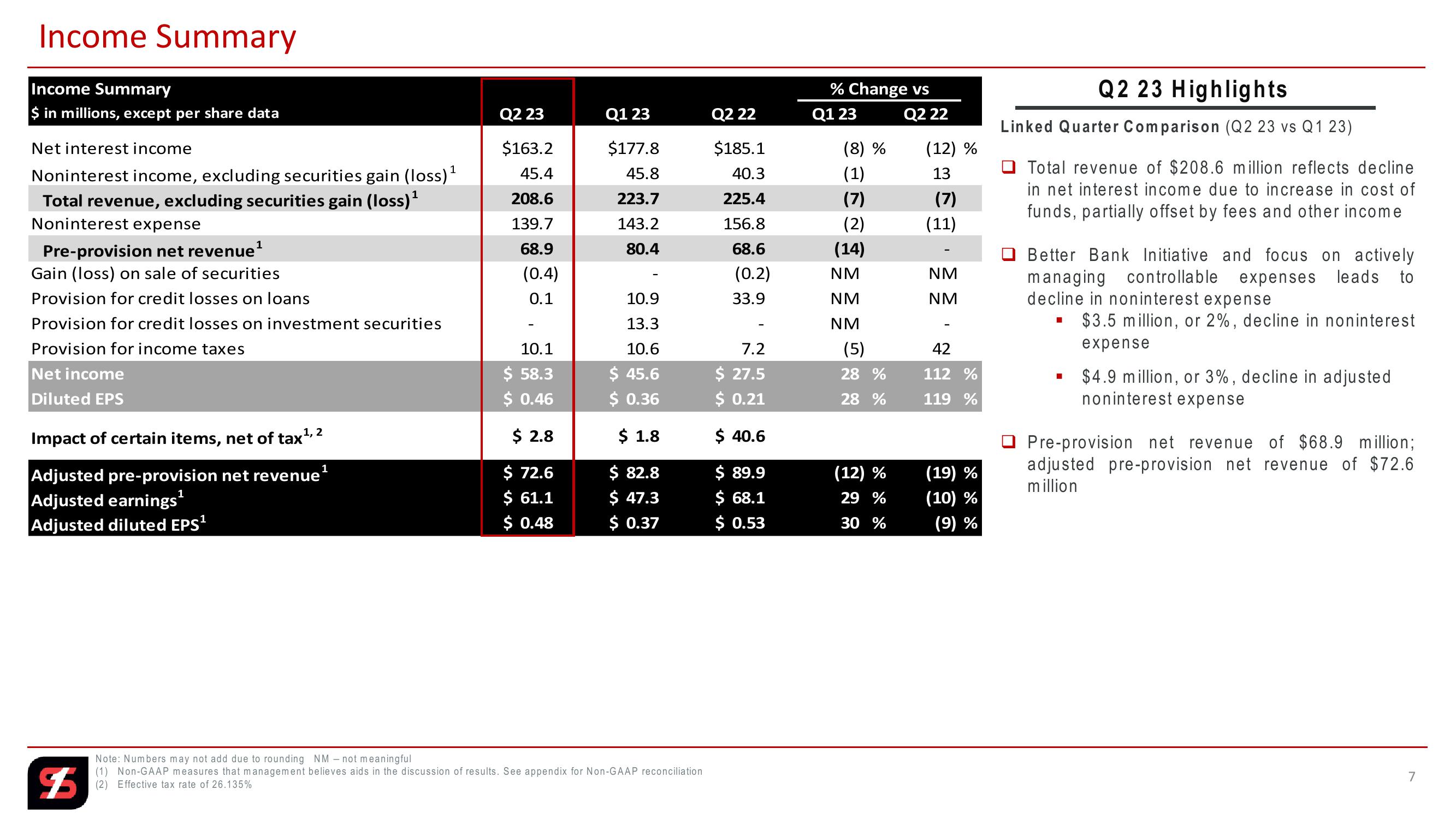

Income Summary

$ in millions, except per share data

Q2 23

Q1 23

Q2 22

Q1 23

% Change vs

Q2 22

Net interest income

$163.2

$177.8

$185.1

(8) %

(12) %

Noninterest income, excluding securities gain (loss) 1

45.4

45.8

40.3

(1)

13

Total revenue, excluding securities gain (loss) ¹

1

208.6

223.7

225.4

(7)

(7)

Noninterest expense

139.7

143.2

156.8

(2)

(11)

Pre-provision net revenue¹

68.9

80.4

68.6

(14)

Gain (loss) on sale of securities

(0.4)

(0.2)

NM

NM

Provision for credit losses on loans

0.1

10.9

33.9

NM

NM

Provision for credit losses on investment securities

13.3

NM

Provision for income taxes

10.1

10.6

7.2

(5)

42

Net income

$ 58.3

$ 45.6

$ 27.5

28 %

112 %

Diluted EPS

$ 0.46

$ 0.36

$ 0.21

28 %

119 %

Impact of certain items, net of tax ¹, 2

$ 2.8

$ 1.8

$ 40.6

Adjusted pre-provision net revenue¹

$ 72.6

$ 82.8

$ 89.9

(12) %

(19) %

Adjusted earnings¹

$ 61.1

$ 47.3

$ 68.1

29%

(10) %

Adjusted diluted EPS¹

$ 0.48

$ 0.37

$ 0.53

30%

(9) %

$5

Note: Numbers may not add due to rounding NM - not meaningful

(1) Non-GAAP measures that management believes aids in the discussion of results. See appendix for Non-GAAP reconciliation

(2) Effective tax rate of 26.135%

Q2 23 Highlights

Linked Quarter Comparison (Q2 23 vs Q1 23)

Total revenue of $208.6 million reflects decline

in net interest income due to increase in cost of

funds, partially offset by fees and other income

Better Bank Initiative and focus on actively

managing controllable expenses leads to

decline in noninterest expense

$3.5 million, or 2%, decline in noninterest

expense

$4.9 million, or 3%, decline in adjusted

noninterest expense

Pre-provision net revenue of $68.9 million;

adjusted pre-provision net revenue of $72.6

million

7View entire presentation