Morgan Stanley Investment Banking Pitch Book

Project Roosevelt

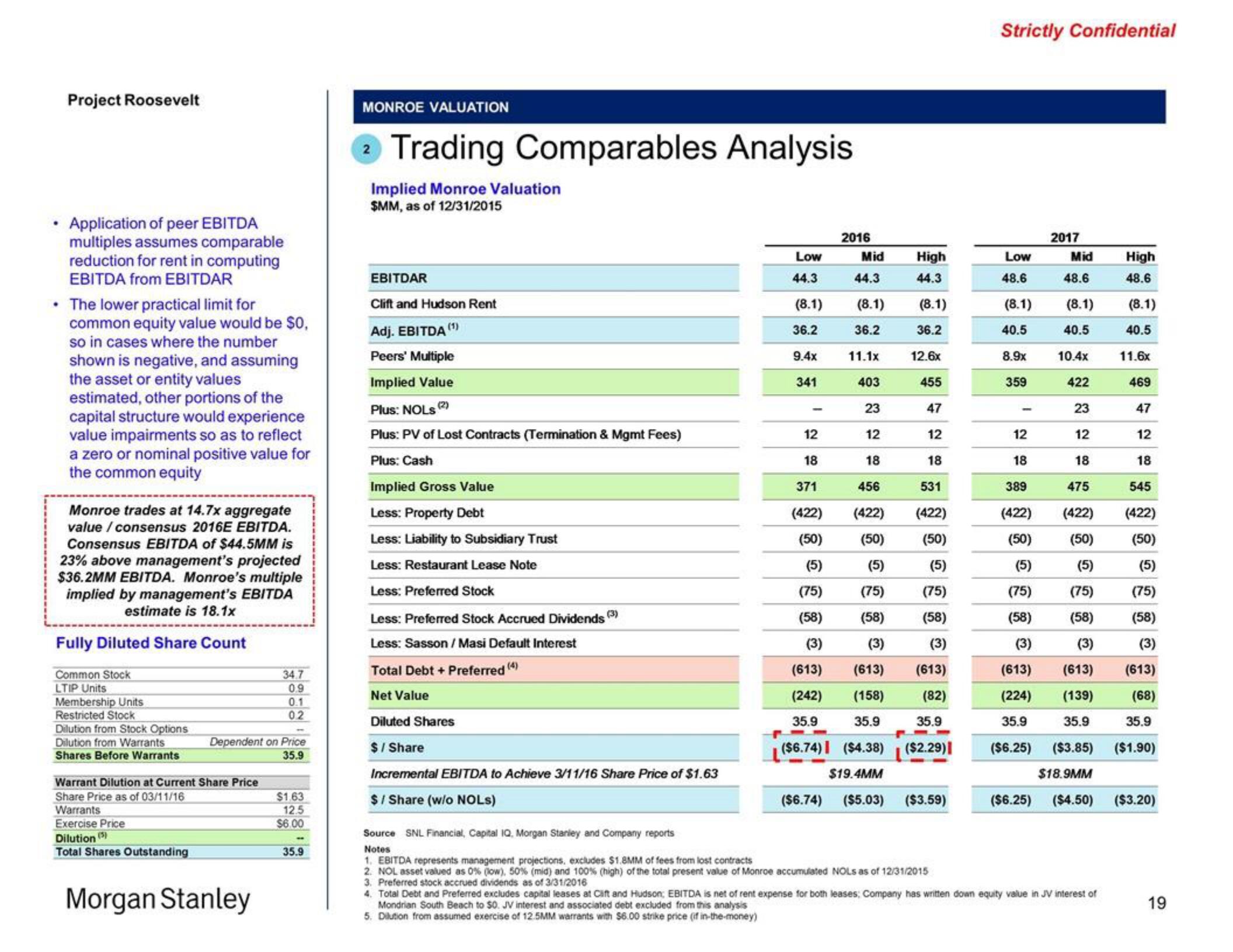

Application of peer EBITDA

multiples assumes comparable

reduction for rent in computing

EBITDA from EBITDAR

• The lower practical limit for

common equity value would be $0,

so in cases where the number

shown is negative, and assuming

the asset or entity values

estimated, other portions of the

capital structure would experience

value impairments so as to reflect

a zero or nominal positive value for

the common equity

Monroe trades at 14.7x aggregate

value / consensus 2016E EBITDA.

Consensus EBITDA of $44.5MM is

23% above management's projected

$36.2MM EBITDA. Monroe's multiple

implied by management's EBITDA

estimate is 18.1x

Fully Diluted Share Count

Common Stock

LTIP Units

Membership Units

Restricted Stock

Dilution from Stock Options

Dilution from Warrants

Shares Before Warrants

Warrant Dilution at Current Share Price

Share Price as of 03/11/16

Warrants

Exercise Price

Dilution (5)

Total Shares Outstanding

Dependent on Price

35.9

34.7

0.9

0.1

02

Morgan Stanley

$1.63

12.5

$6.00

35.9

MONROE VALUATION

2 Trading Comparables Analysis

Implied Monroe Valuation

$MM, as of 12/31/2015

EBITDAR

Clift and Hudson Rent

Adj. EBITDA (¹)

Peers' Multiple

Implied Value

Plus: NOLS (2)

Plus: PV of Lost Contracts (Termination & Mgmt Fees)

Plus: Cash

Implied Gross Value

Less: Property Debt

Less: Liability to Subsidiary Trust

Less: Restaurant Lease Note

Less: Preferred Stock

Less: Preferred Stock Accrued Dividends

Less: Sasson / Masi Default Interest

Total Debt +Preferred (4)

Net Value

(3)

Diluted Shares

$ / Share

Incremental EBITDA to Achieve 3/11/16 Share Price of $1.63

$/Share (w/o NOLS)

Low

44.3

(8.1)

36.2

9.4x

341

12 18

371

2016

Mid

44.3

(8.1)

(8.1)

36.2

12.6x

455

23

47

12

12

18

18

456

531

(422)

(422)

(50) (50)

(5)

(5)

(75)

(58)

(3)

High

44.3

36.2

11.1x

403

(422)

(50)

(5)

(75)

(58)

(3)

(613)

(613)

(242)

(158)

35.9

35.9

35.9

($6.74) ($4.38) ($2.29)

$19.4MM

($6.74) ($5.03) ($3.59)

(75)

(58)

(3)

(613)

(82)

Source SNL Financial, Capital IQ, Morgan Stanley and Company reports

Notes

1. EBITDA represents management projections, excludes $1.8MM of fees from lost contracts

2. NOL asset valued as 0 % (low), 50% (mid) and 100% (high) of the total present value of Monroe accumulated NOLS as of 12/31/2015

3. Preferred stock accrued dividends as of 3/31/2016

Strictly Confidential

Low

48.6

(8.1)

40.5

8.9x

359

2017

48.6

(8.1)

40.5

10.4x

422

23

12

18

475

(422)

(50)

(5)

(75)

(58)

(3)

(613)

(139)

35.9

35.9

($6.25) ($3.85) ($1.90)

$18.9MM

($6.25) ($4.50) ($3.20)

12

18

389

(422)

(50)

(5)

(75)

(58)

(3)

(613)

(224)

35.9

Mid

High

48.6

4. Total Debt and Preferred excludes capital leases at Clift and Hudson; EBITDA is net of rent expense for both leases; Company has written down equity value in JV interest of

Mondrian South Beach to $0. JV interest and associated debt excluded from this analysis

5. Dilution from assumed exercise of 12.5MM warrants with $6.00 strike price (if in-the-money)

(8.1)

40.5

11.6x

469

47

12

18

545

(422)

(50)

(5)

(75)

(58)

(3)

(613)

(68)

19View entire presentation