Baird Investment Banking Pitch Book

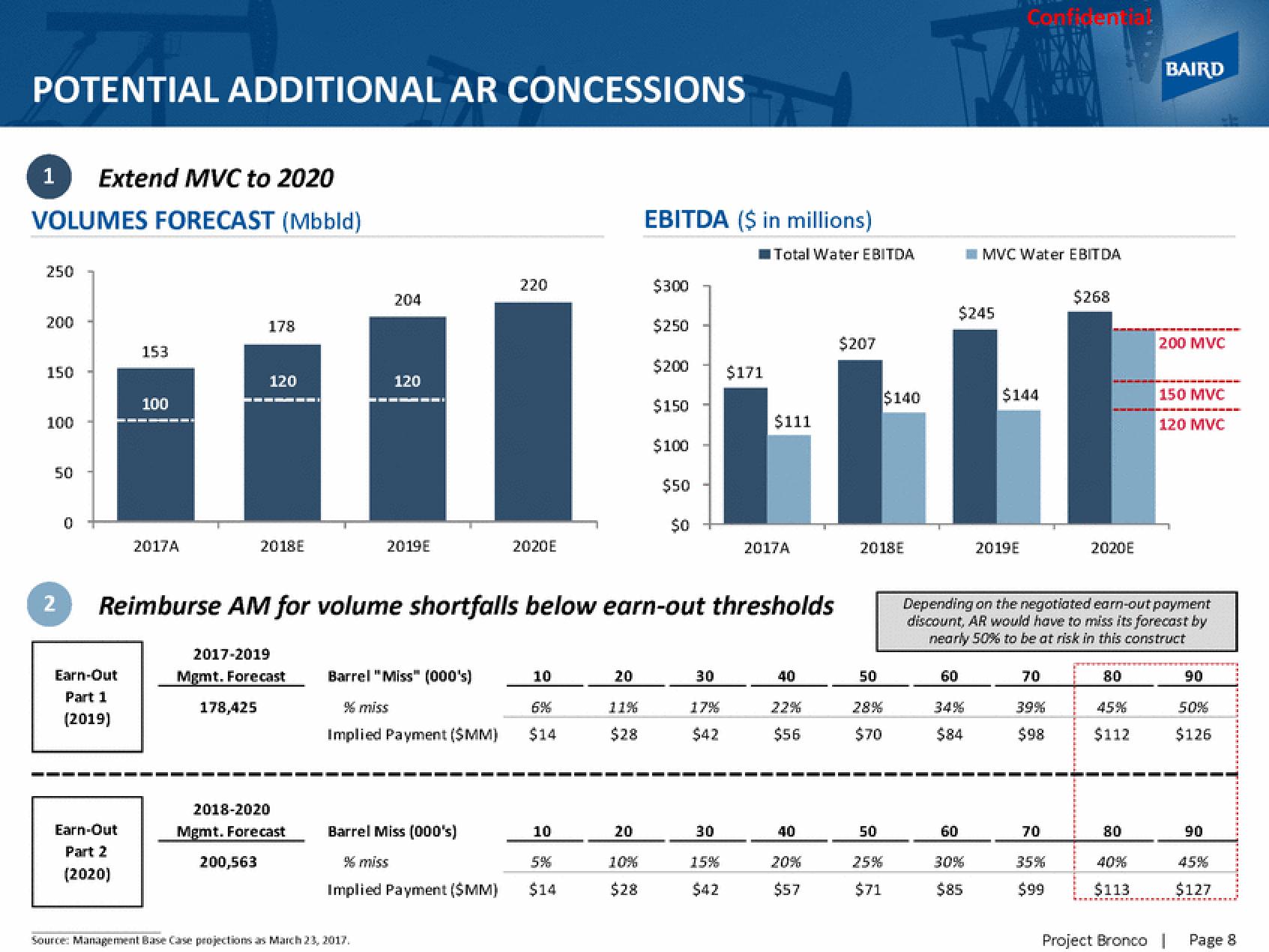

POTENTIAL ADDITIONAL AR CONCESSIONS

1 Extend MVC to 2020

VOLUMES FORECAST (Mbbld)

250

200

150

100

50

2

0

153

========

Earn-Out

Part 1

(2019)

100

Earn-Out

Part 2

(2020)

2017A

178

2017-2019

178,425

120

2018E

Mgmt. Forecast

200,563

2018-2020

Mgmt. Forecast

204

120

▬▬▬▬ILI

2019E

Source: Management Base Case projections as March 23, 2017.

Barrel "Miss" (000's)

% miss

Implied Payment ($MM)

Barrel Miss (000's)

% miss

Implied Payment ($MM)

220

2020E

Reimburse AM for volume shortfalls below earn-out thresholds

10

6%

$14

10

5%

$14

20

11%

$28

20

EBITDA ($ in millions)

10%

$28

$300

$250

$200

$150

$100

$50

$0

30

17%

$42

30

$171

15%

$42

Total Water EBITDA

$111

2017A

40

22%

$56

40

$57

$207

2018E

50

28%

$70

$140

50

25%

$71

$245

60

34%

$84

60

MVC Water EBITDA

30%

$85

Confidentia!

$144

2019E

70

39%

$98

Depending on the negotiated earn-out payment

discount, AR would have to miss its forecast by

nearly 50% to be at risk in this construct

70

$268

35%

$99

2020E

80

45%

$112

80

40%

$113

BAIRD

Project Bronco

200 MVC

150 MVC

120 MVC

90

50%

$126

90

45%

$127

Page 8View entire presentation