Paysafe Results Presentation Deck

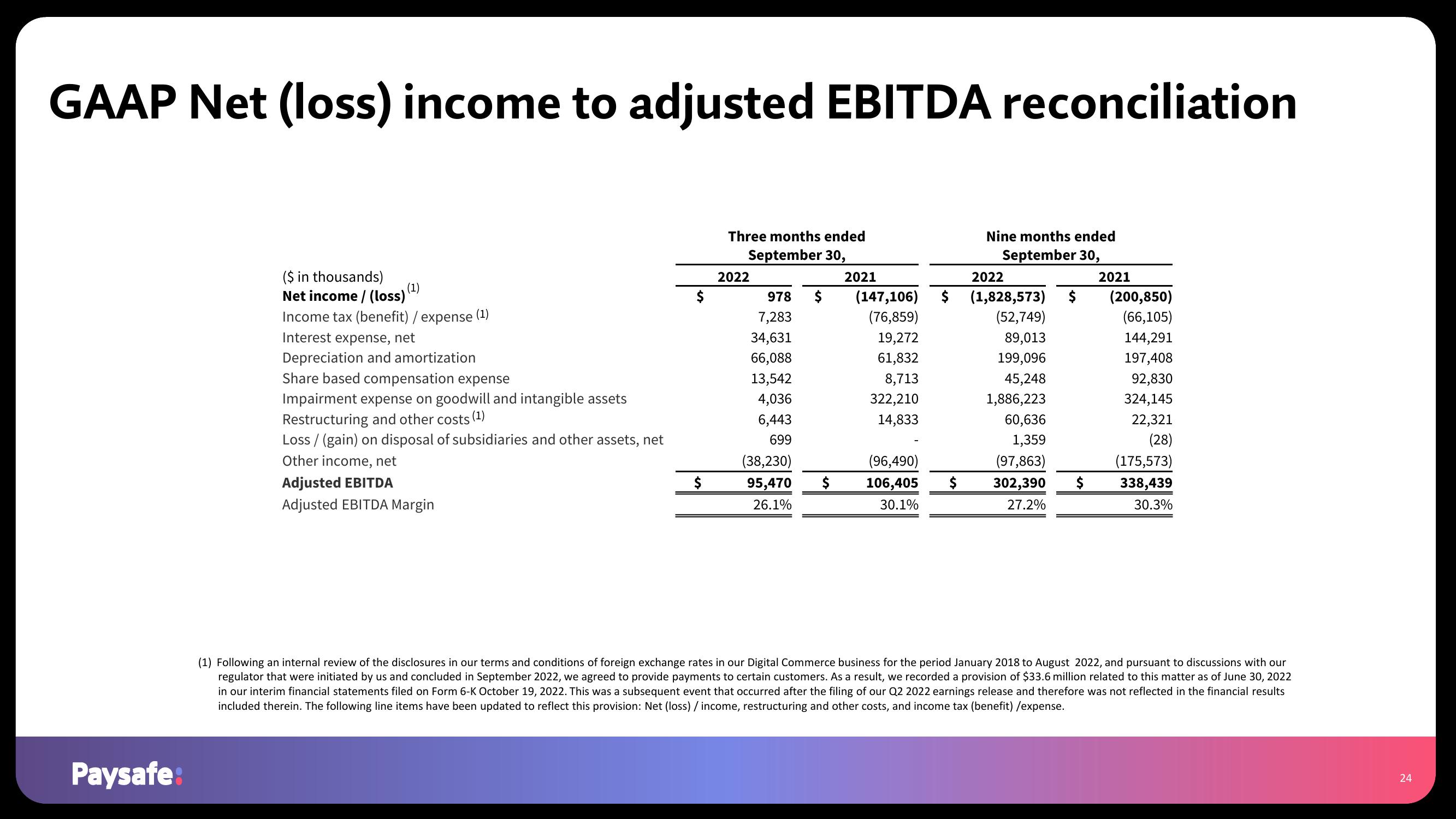

GAAP Net (loss) income to adjusted EBITDA reconciliation

Paysafe:

($ in thousands)

Net income / (loss)

Income tax (benefit) / expense

Interest expense, net

Depreciation and amortization

(1)

(1)

Share based compensation expense

Impairment expense on goodwill and intangible assets

Restructuring and other costs

Loss / (gain) on disposal of subsidiaries and other assets, net

Other income, net

Adjusted EBITDA

Adjusted EBITDA Margin

$

$

Three months ended

September 30,

2022

978 $

7,283

34,631

66,088

13,542

4,036

6,443

699

(38,230)

95,470

26.1%

2021

(147,106)

(76,859)

19,272

61,832

8,713

322,210

14,833

(96,490)

$ 106,405

30.1%

Nine months ended

September 30,

2022

$ (1,828,573) $

(52,749)

89,013

199,096

45,248

1,886,223

60,636

1,359

(97,863)

302,390

27.2%

$

$

2021

(200,850)

(66,105)

144,291

197,408

92,830

324,145

22,321

(28)

(175,573)

338,439

30.3%

(1) Following an internal review of the disclosures in our terms and conditions of foreign exchange rates in our Digital Commerce business for the period January 2018 to August 2022, and pursuant to discussions with our

regulator that were initiated by us and concluded in September 2022, we agreed to provide payments to certain customers. As a result, we recorded a provision of $33.6 million related to this matter as of June 30, 2022

in our interim financial statements filed on Form 6-K October 19, 2022. This was a subsequent event that occurred after the filing of our Q2 2022 earnings release and therefore was not reflected in the financial results

included therein. The following line items have been updated to reflect this provision: Net (loss) / income, restructuring and other costs, and income tax (benefit) /expense.

24View entire presentation