Kinnevik Results Presentation Deck

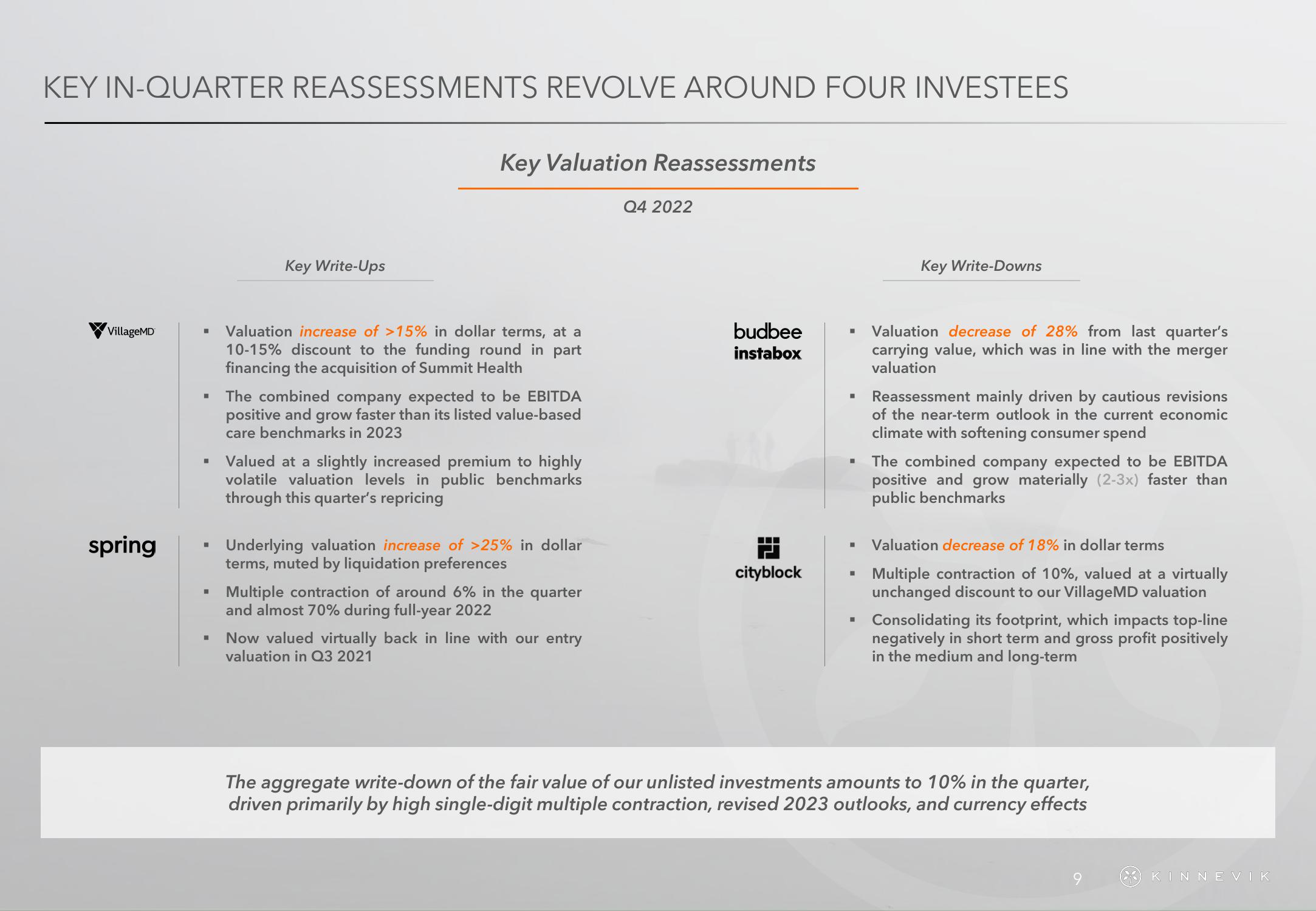

KEY IN-QUARTER REASSESSMENTS REVOLVE AROUND FOUR INVESTEES

VillageMD

spring

" Valuation increase of >15% in dollar terms, at a

10-15% discount to the funding round in part

financing the acquisition of Summit Health

■

▪ The combined company expected to be EBITDA

positive and grow faster than its listed value-based

care benchmarks in 2023

"

Key Write-Ups

M

Key Valuation Reassessments

"

Valued at a slightly increased premium to highly

volatile valuation levels in public benchmarks

through this quarter's repricing

Underlying valuation increase of >25% in dollar

terms, muted by liquidation preferences

Multiple contraction of around 6% in the quarter

and almost 70% during full-year 2022

Now valued virtually back in line with our entry

valuation in Q3 2021

Q4 2022

budbee

instabox

4

cityblock

■

I

I

Key Write-Downs

Valuation decrease of 28% from last quarter's

carrying value, which was in line with the merger

valuation

Reassessment mainly driven by cautious revisions

of the near-term outlook in the current economic

climate with softening consumer spend

The combined company expected to be EBITDA

positive and grow materially (2-3x) faster than

public benchmarks

Valuation decrease of 18% in dollar terms

Multiple contraction of 10%, valued at a virtually

unchanged discount to our VillageMD valuation

Consolidating its footprint, which impacts top-line

negatively in short term and gross profit positively

in the medium and long-term

The aggregate write-down of the fair value of our unlisted investments amounts to 10% in the quarter,

driven primarily by high single-digit multiple contraction, revised 2023 outlooks, and currency effects

9

KINNEVIKView entire presentation