J.P.Morgan Investment Banking Pitch Book

PRELIMINARY VALUATION ANALYSIS

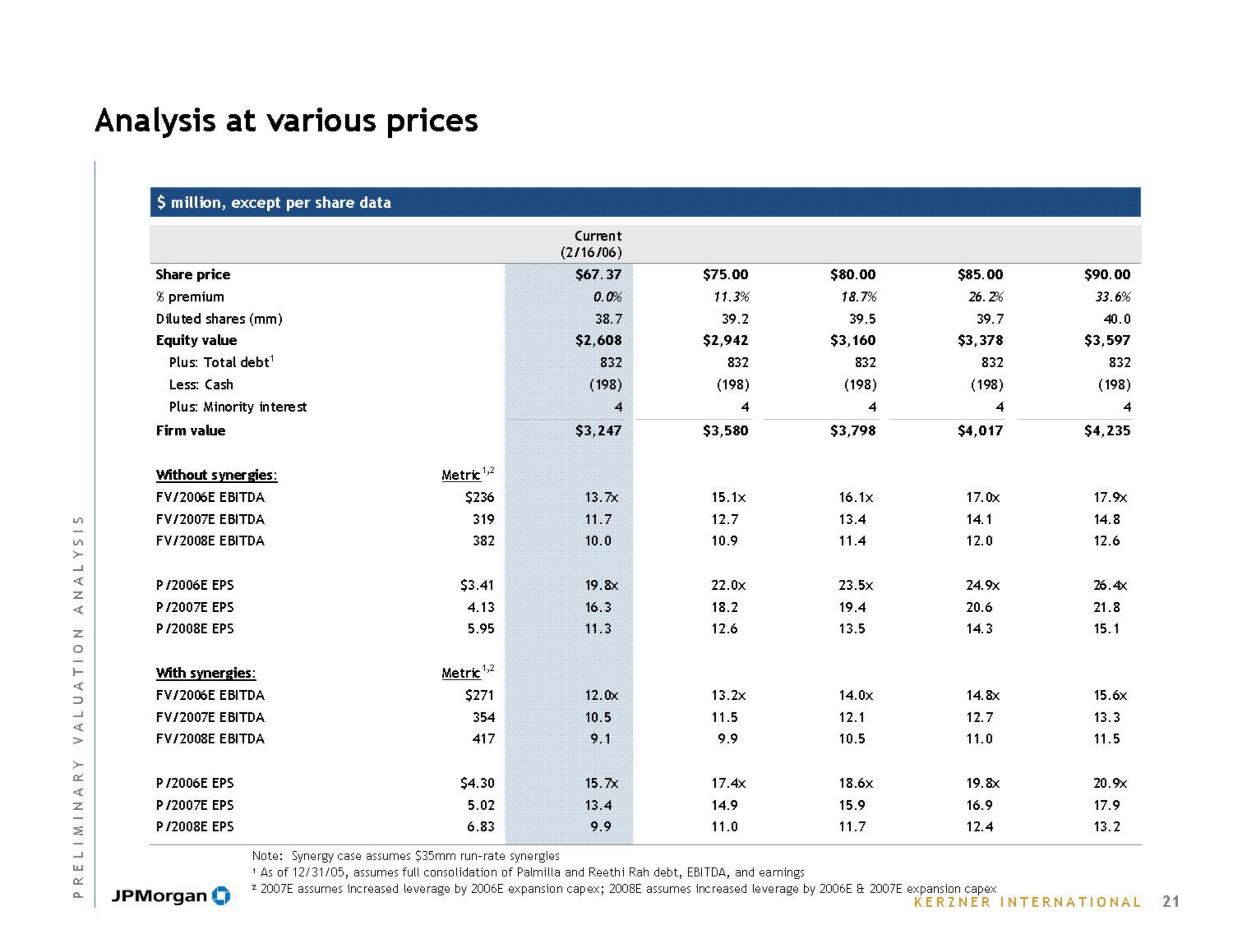

Analysis at various prices

$ million, except per share data

Share price

% premium

Diluted shares (mm)

Equity value

Plus: Total debt¹

Less: Cash

Plus: Minority interest

Firm value

Without synergies:

FV/2006E EBITDA

FV/2007E EBITDA

FV/2008E EBITDA

P/2006E EPS

P/2007E EPS

P/2008E EPS

With synergies:

FV/2006E EBITDA

FV/2007E EBITDA

FV/2008E EBITDA

P/2006E EPS

P/2007E EPS

P/2008E EPS

JPMorgan

Metric

1,2

$236

319

382

$3.41

4.13

5.95

Metric 1,2

$271

354

417

$4.30

5.02

6.83

Current

(2/16/06)

$67.37

0.0%

38.7

$2,608

832

(198)

4

$3,247

13.7x

11.7

10.0

19.8x

16.3

11.3

12.0x

10.5

9.1

15.7x

13.4

9.9

$75.00

11.3%

39.2

$2,942

832

(198)

4

$3,580

15.1x

12.7

10.9

22.0x

18.2

12.6

13.2x

11.5

9.9

17.4x

14.9

11.0

$80.00

18.7%

39.5

$3,160

832

(198)

4

$3,798

16.1x

13.4

11.4

23.5x

19.4

13.5

14.0x

12.1

10.5

18.6x

15.9

11.7

$85.00

26.2%

39.7

$3,378

832

(198)

4

$4,017

17.0x

14.1

12.0

24.9x

20.6

14.3

14.8x

12.7

11.0

19.8x

16.9

12.4

Note: Synergy case assumes $35mm run-rate synergies

1 As of 12/31/05, assumes full consolidation of Palmilla and Reethi Rah debt, EBITDA, and earnings

2 2007E assumes increased leverage by 2006E expansion capex; 2008E assumes increased leverage by 2006E & 2007E expansion capex

$90.00

33.6%

40.0

$3,597

832

(198)

4

$4,235

17.9x

14.8

12.6

26.4x

21.8

15.1

15.6x

13.3

11.5

20.9x

17.9

13.2

KERZNER INTERNATIONAL

21View entire presentation