Melrose Mergers and Acquisitions Presentation Deck

Interim results: Melrose Group cash generation in the first half

Melrose

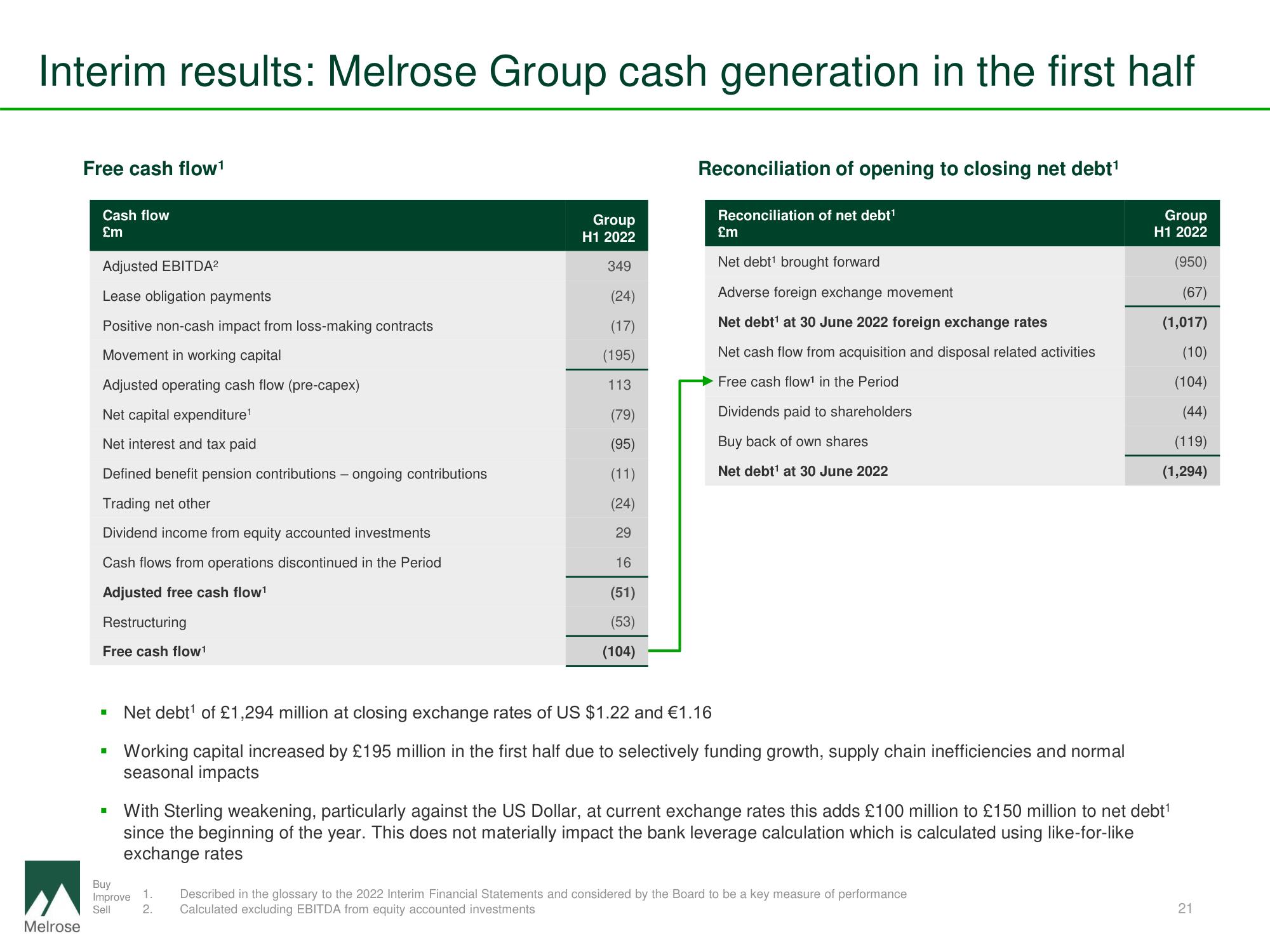

Free cash flow¹

Cash flow

£m

Adjusted EBITDA²

Lease obligation payments

Positive non-cash impact from loss-making contracts

Movement in working capital

Adjusted operating cash flow (pre-capex)

Net capital expenditure¹

Net interest and tax paid

Defined benefit pension contributions - ongoing contributions

Trading net other

Dividend income from equity accounted investments

Cash flows from operations discontinued in the Period

Adjusted free cash flow¹

Restructuring

Free cash flow¹

■

I

I

Group

H1 2022

349

(24)

(17)

(195)

113

(79)

(95)

(11)

(24)

29

16

(51)

(53)

(104)

Buy

Improve

Sell

Reconciliation of opening to closing net debt¹

Reconciliation of net debt¹

£m

Net debt¹ brought forward

Adverse foreign exchange movement

Net debt¹ at 30 June 2022 foreign exchange rates

Net cash flow from acquisition and disposal related activities

Free cash flow¹ in the Period

Dividends paid to shareholders

Buy back of own shares

Net debt¹ at 30 June 2022

Net debt¹ of £1,294 million at closing exchange rates of US $1.22 and €1.16

Working capital increased by £195 million in the first half due to selectively funding growth, supply chain inefficiencies and normal

seasonal impacts

With Sterling weakening, particularly against the US Dollar, at current exchange rates this adds £100 million to £150 million to net debt¹

since the beginning of the year. This does not materially impact the bank leverage calculation which is calculated using like-for-like

exchange rates

Group

H1 2022

(950)

(67)

(1,017)

(10)

(104)

(44)

(119)

(1,294)

1.

Described in the glossary to the 2022 Interim Financial Statements and considered by the Board to be a key measure of performance

2. Calculated excluding EBITDA from equity accounted investments

21View entire presentation