REE SPAC Presentation Deck

Pro Forma Equity Ownership

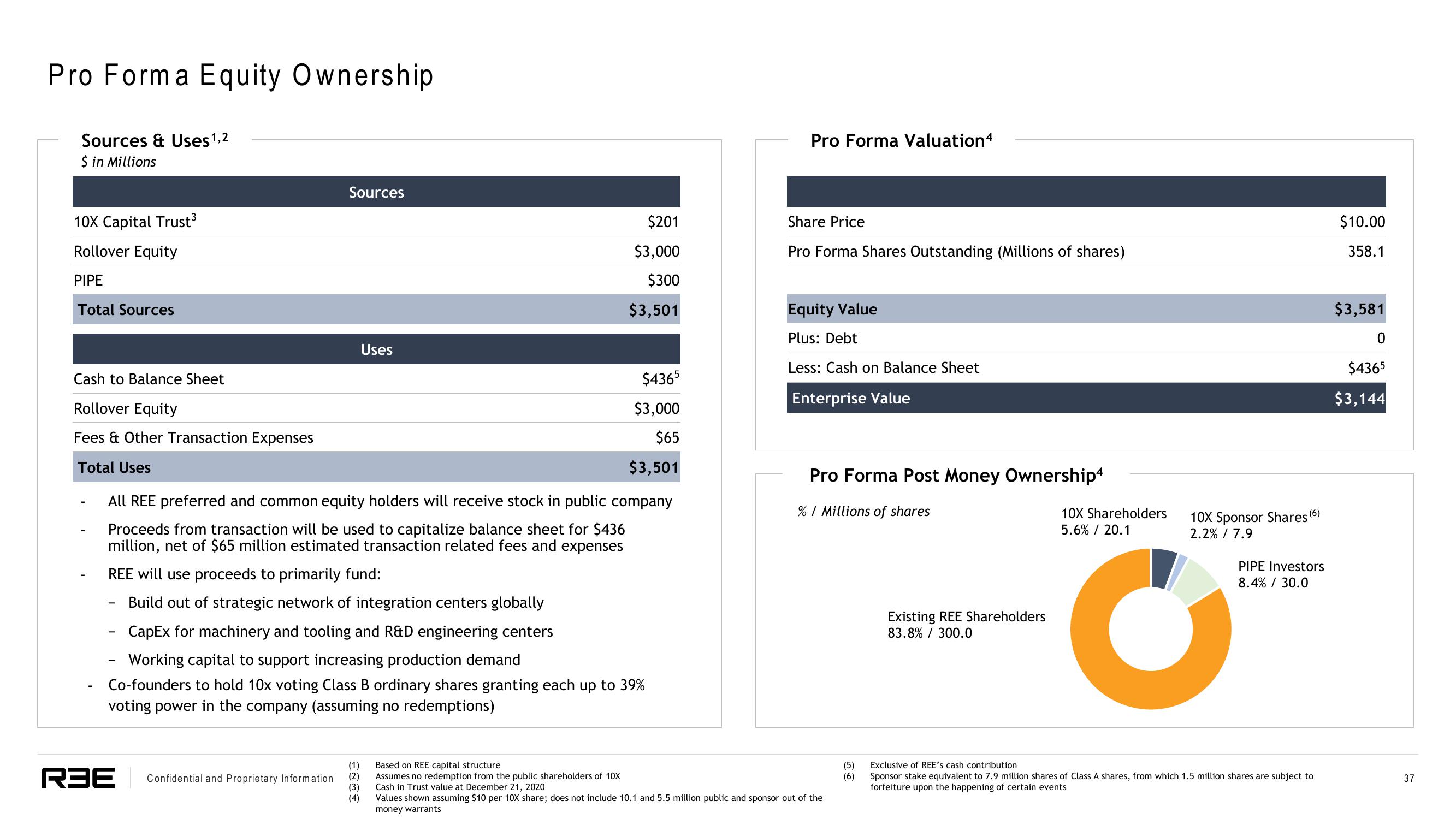

Sources & Uses 1,2

$ in Millions

10X Capital Trust³

Rollover Equity

PIPE

Total Sources

Cash to Balance Sheet

Rollover Equity

Fees & Other Transaction Expenses

Total Uses

-

$4365

$3,000

$65

$3,501

All REE preferred and common equity holders will receive stock in public company

Proceeds from transaction will be used to capitalize balance sheet for $436

million, net of $65 million estimated transaction related fees and expenses

REE will use proceeds to primarily fund:

Build out of strategic network of integration centers globally

CapEx for machinery and tooling and R&D engineering centers

Working capital to support increasing production demand

Co-founders to hold 10x voting Class B ordinary shares granting each up to 39%

voting power in the company (assuming no redemptions)

RBE

Sources

Confidential and Proprietary Information

Uses

(1)

(2)

(3)

(4)

$201

$3,000

$300

$3,501

Pro Forma Valuation4

Share Price

Pro Forma Shares Outstanding (Millions of shares)

Equity Value

Plus: Debt

Less: Cash on Balance Sheet

Enterprise Value

Pro Forma Post Money Ownership4

% / Millions of shares

Based on REE capital structure

Assumes no redemption from the public shareholders of 10X

Cash in Trust value at December 21, 2020

Values shown assuming $10 per 10X share; does not include 10.1 and 5.5 million public and sponsor out of the

money warrants

(5)

(6)

Existing REE Shareholders

83.8% / 300.0

10X Shareholders

5.6% / 20.1

10X Sponsor Shares (6)

2.2% / 7.9

C

PIPE Investors

8.4% / 30.0

Exclusive of REE's cash contribution

Sponsor stake equivalent to 7.9 million shares of Class A shares, from which 1.5 million shares are subject to

forfeiture upon the happening of certain events

$10.00

358.1

$3,581

$4365

$3,144

37View entire presentation