Trian Partners Activist Presentation Deck

Long Investment Idea: Danone

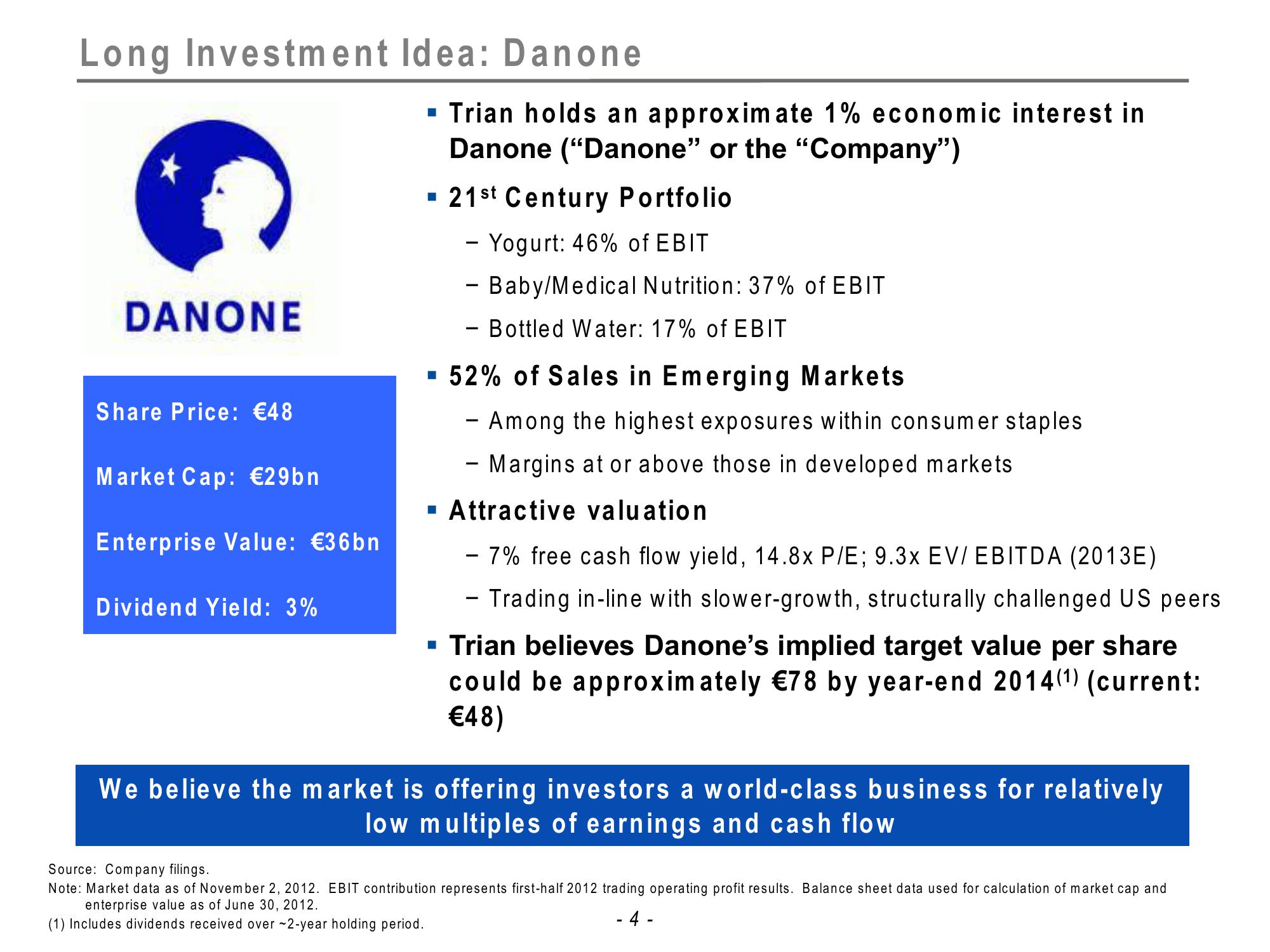

DANONE

Share Price: €48

Market Cap: €29bn

Enterprise Value: €36bn

Dividend Yield: 3%

▪ Trian holds an approximate 1% economic interest in

Danone ("Danone" or the "Company")

■

21st Century Portfolio

- Yogurt: 46% of EBIT

- Baby/Medical Nutrition: 37% of EBIT

- Bottled Water: 17% of EBIT

■

52% of Sales in Emerging Markets

- Among the highest exposures within consumer staples

- Margins at or above those in developed markets

▪ Attractive valuation

- 7% free cash flow yield, 14.8x P/E; 9.3x EV/ EBITDA (2013E)

- Trading in-line with slower-growth, structurally challenged US peers

▪ Trian believes Danone's implied target value per share

could be approximately €78 by year-end 2014 (¹) (current:

€48)

We believe the market is offering investors a world-class business for relatively

low multiples of earnings and cash flow

Source: Company filings.

Note: Market data as of November 2, 2012. EBIT contribution represents first-half 2012 trading operating profit results. Balance sheet data used for calculation of market cap and

enterprise value as of June 30, 2012.

- 4 -

(1) Includes dividends received over ~2-year holding period.View entire presentation