Vale Results Presentation Deck

Vale's Performance in 2022: We are building a better Vale

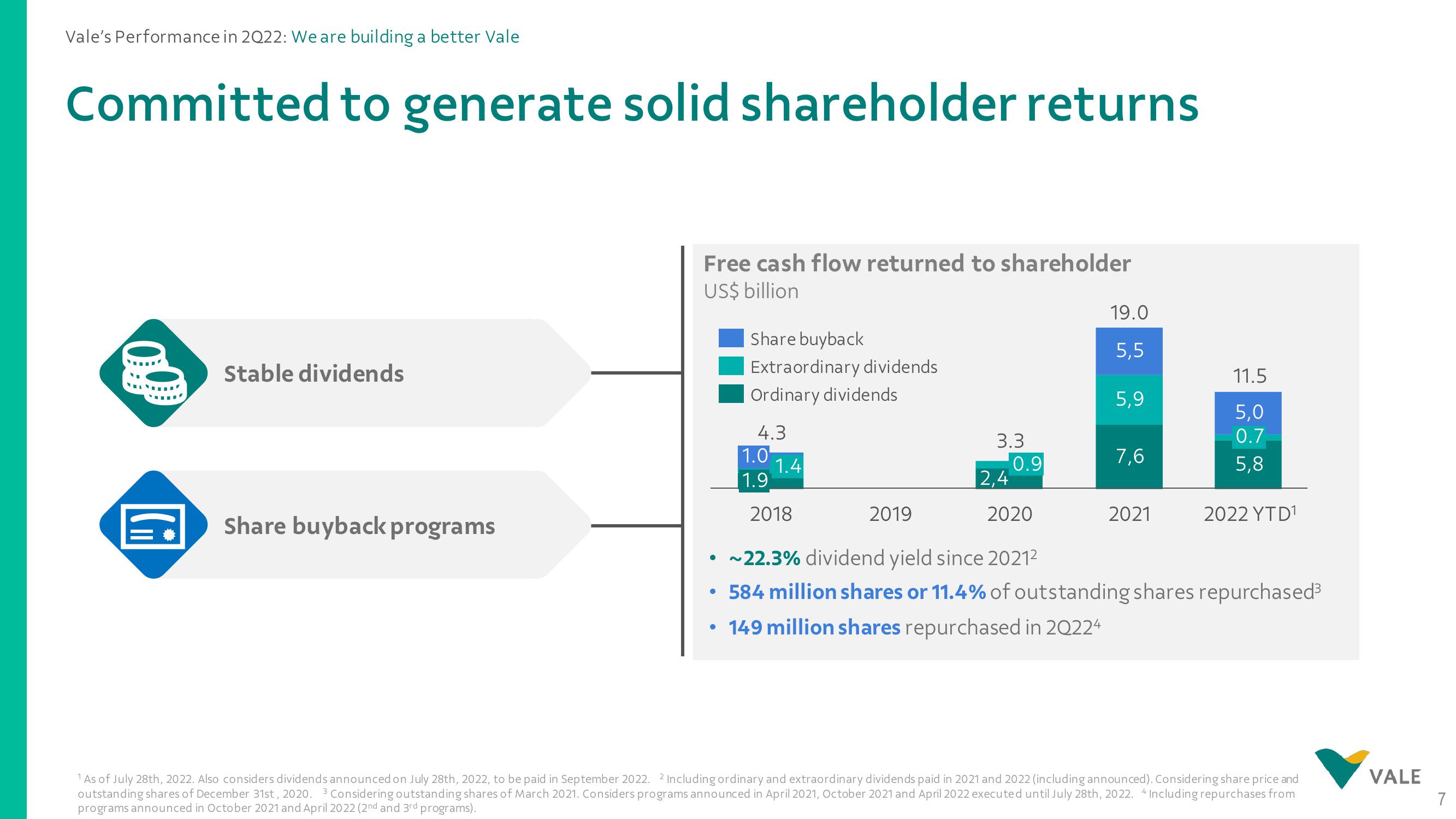

Committed to generate solid shareholder returns

5.

Stable dividends

Share buyback programs

Free cash flow returned to shareholder

US$ billion

Share buyback

Extraordinary dividends

Ordinary dividends

●

4.3

1.0

1.9

1.4

2018

2019

3.3

2,4

0.9

2020

19.0

5,5

5,9

7,6

2021

11.5

5,0

0.7.

5,8

LO5

2022 YTD¹

~22.3% dividend yield since 2021²

• 584 million shares or 11.4% of outstanding shares repurchased³

• 149 million shares repurchased in 20224

¹ As of July 28th, 2022. Also considers dividends announced on July 28th, 2022, to be paid in September 2022. 2 Including ordinary and extraordinary dividends paid in 2021 and 2022 (including announced). Considering share price and

outstanding shares of December 31st, 2020. ³ Considering outstanding shares of March 2021. Considers programs announced in April 2021, October 2021 and April 2022 executed until July 28th, 2022. 4 Including repurchases from

programs announced in October 2021 and April 2022 (2nd and 3rd programs).

VALE

7View entire presentation