Barclays Global Financial Services Conference

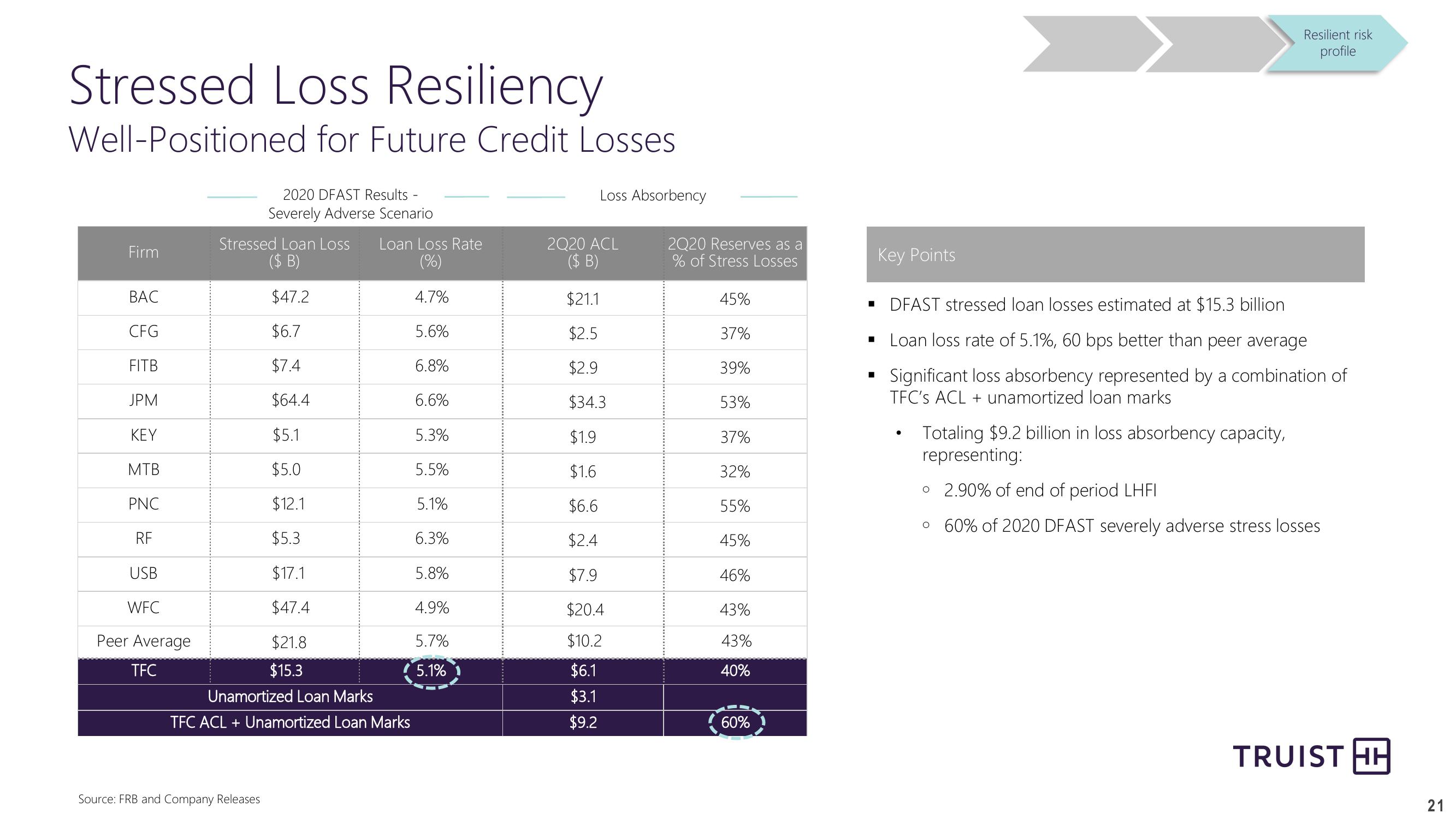

Stressed Loss Resiliency

Well-Positioned for Future Credit Losses

2020 DFAST Results -

Loss Absorbency

Resilient risk

profile

Key Points

■ DFAST stressed loan losses estimated at $15.3 billion

■Loan loss rate of 5.1%, 60 bps better than peer average

Significant loss absorbency represented by a combination of

TFC's ACL + unamortized loan marks

Totaling $9.2 billion in loss absorbency capacity,

representing:

° 2.90% of end of period LHFI

60% of 2020 DFAST severely adverse stress losses

Severely Adverse Scenario

Stressed Loan Loss Loan Loss Rate

2Q20 ACL

Firm

($ B)

(%)

($ B)

2Q20 Reserves as a

% of Stress Losses

BAC

$47.2

4.7%

$21.1

45%

CFG

$6.7

5.6%

$2.5

37%

FITB

$7.4

6.8%

$2.9

39%

JPM

$64.4

6.6%

$34.3

53%

KEY

$5.1

5.3%

$1.9

37%

•

MTB

$5.0

5.5%

$1.6

32%

PNC

$12.1

5.1%

$6.6

55%

о

RF

$5.3

6.3%

$2.4

45%

USB

$17.1

5.8%

$7.9

46%

WFC

$47.4

4.9%

$20.4

43%

Peer Average

$21.8

5.7%

$10.2

43%

TFC

$15.3

5.1%

$6.1

40%

Unamortized Loan Marks

$3.1

TFC ACL + Unamortized Loan Marks

$9.2

60%

Source: FRB and Company Releases

TRUIST HH

21View entire presentation