AngloAmerican Results Presentation Deck

Strong liquidity & issued first sustainability-linked bond

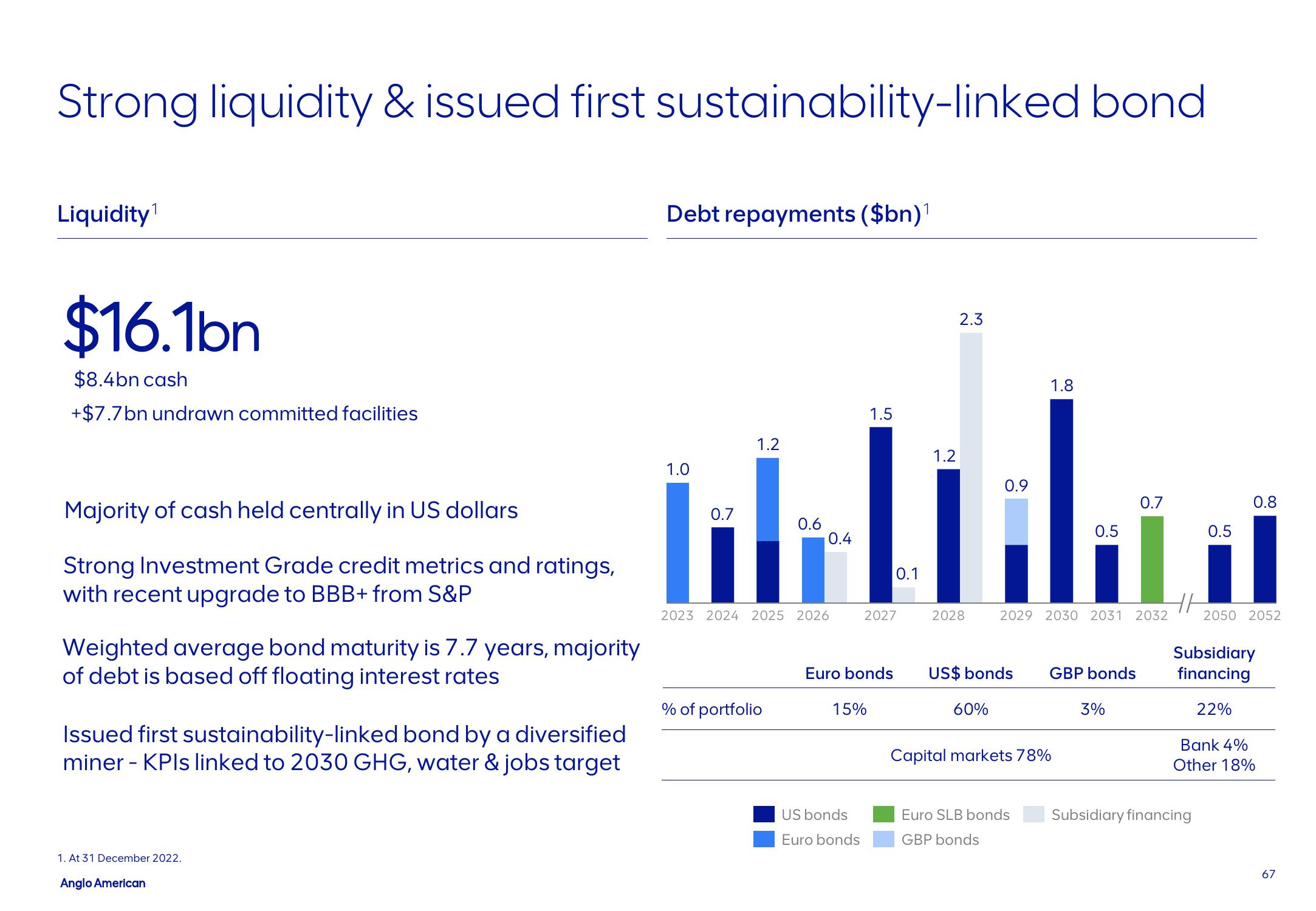

Liquidity¹

$16.1bn

$8.4bn cash

+$7.7 bn undrawn committed facilities

Majority of cash held centrally in US dollars

Strong Investment Grade credit metrics and ratings,

with recent upgrade to BBB+ from S&P

Weighted average bond maturity is 7.7 years, majority

of debt is based off floating interest rates

Issued first sustainability-linked bond by a diversified

miner - KPIs linked to 2030 GHG, water & jobs target

1. At 31 December 2022.

Anglo American

Debt repayments ($bn)¹

1.0

0.7

1.2

1.2

0.9

inbettik.

0.4

0.1

2028

0.6

2023 2024 2025 2026

% of portfolio

1.5

2027

Euro bonds

15%

US bonds

Euro bonds

2.3

US$ bonds

60%

1.8

Capital markets 78%

2029 2030 2031 2032

Euro SLB bonds

GBP bonds

0.5

GBP bonds

0.7

3%

HH

0.5

Subsidiary financing

0.8

2050 2052

Subsidiary

financing

22%

Bank 4%

Other 18%

67View entire presentation