Zenvia IPO

1

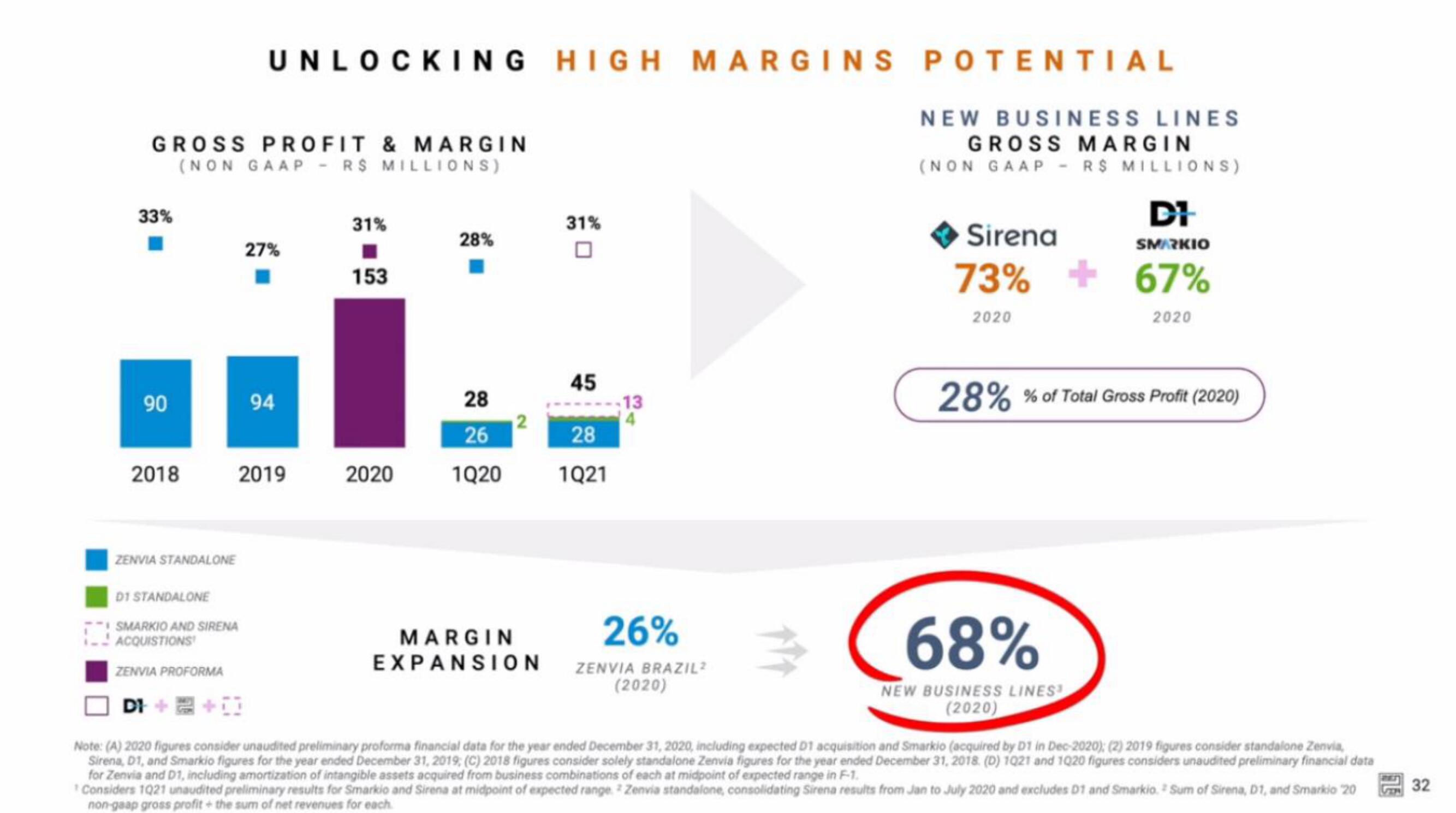

GROSS PROFIT & MARGIN

(NON GAAP R$ MILLIONS)

33%

90

2018

ZENVIA STANDALONE

UNLOCKING HIGH MARGINS POTENTIAL

D1 STANDALONE

SMARKIO AND SIRENA

ACQUISTIONS

ZENVIA PROFORMA

DI ++

27%

94

2019

31%

153

2020

28%

28

26

1Q20

31%

MARGIN

EXPANSION

45

28

1Q21

13

4

26%

3

Note: (A) 2020 figures consider unaudited preliminary proforma financial data for the year ended December 31, 2020, including expected D1 acquisition and Smarkio (acquired by D1 in Dec-2020); (2) 2019 figures consider standalone Zenvia,

Sirena, D1, and Smarkio figures for the year ended December 31, 2019; (C) 2018 figures consider solely standalone Zenvia figures for the year ended December 31, 2018. (D) 1021 and 1020 figures considers unaudited preliminary financial data

for Zenvia and D1, including amortization of intangible assets acquired from business combinations of each at midpoint of expected range in F-1.

ZENVIA BRAZIL²

NEW BUSINESS LINES

GROSS MARGIN

(NON GAAP - R$ MILLIONS)

(2020)

Sirena

73%

2020

DI

SMARKIO

67%

2020

28% % of Total Gross Profit (2020)

68%

NEW BUSINESS LINES

(2020)

Considers 1021 unaudited preliminary results for Smarkio and Sirena at midpoint of expected range. Zenvia standalone, consolidating Sirena results from Jan to July 2020 and excludes D1 and Smarkio. Sum of Sirena, D1, and Smarkio 20

non-gaap gross profit + the sum of net revenues for each

32View entire presentation