Better Results Presentation Deck

Q3 2023

Financial Review

Key Highlights

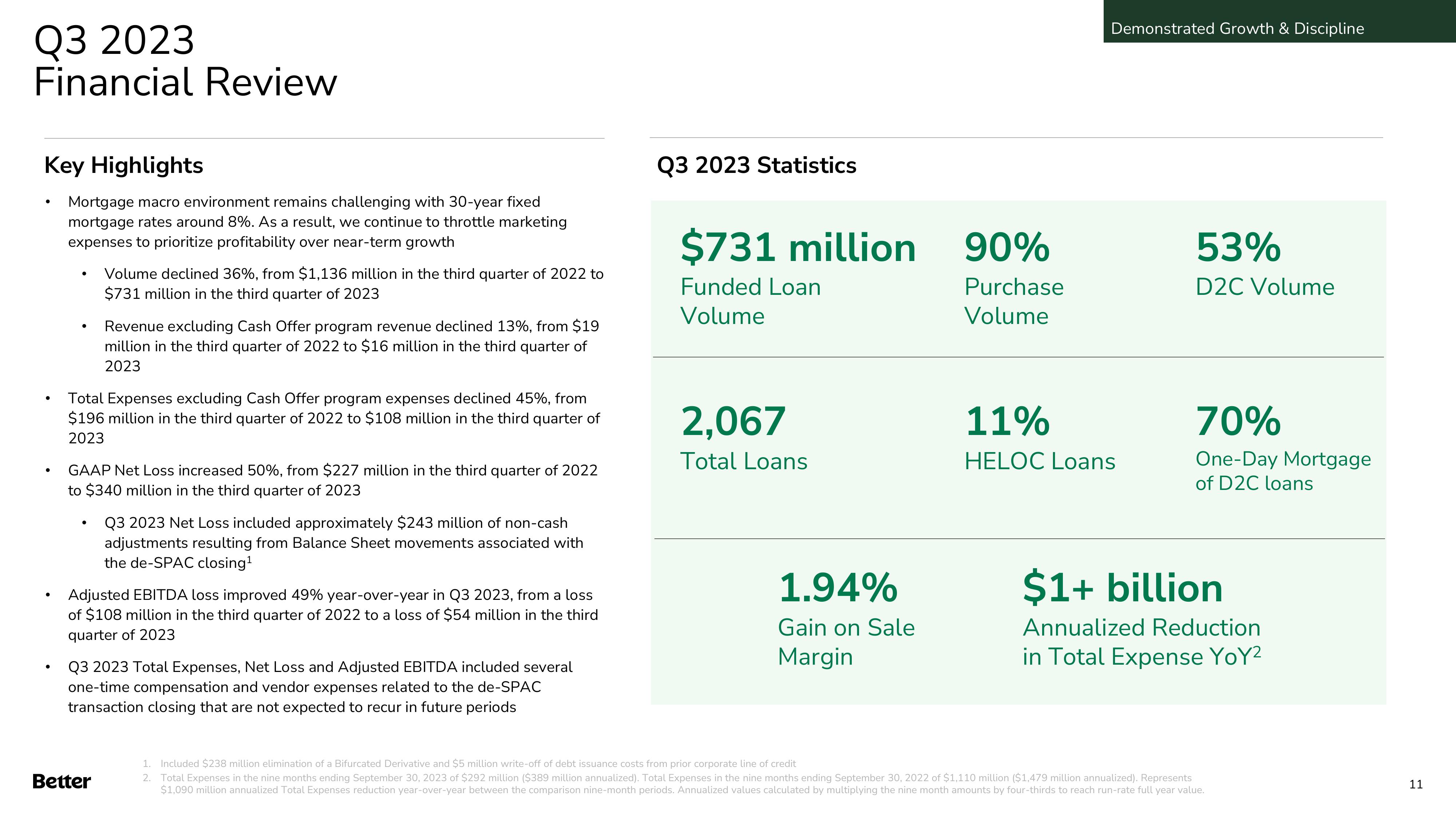

Mortgage macro environment remains challenging with 30-year fixed

mortgage rates around 8%. As a result, we continue to throttle marketing

expenses to prioritize profitability over near-term growth

●

●

●

Volume declined 36%, from $1,136 million in the third quarter of 2022 to

$731 million in the third quarter of 2023

Total Expenses excluding Cash Offer program expenses declined 45%, from

$196 million in the third quarter of 2022 to $108 million in the third quarter of

2023

●

Revenue excluding Cash Offer program revenue declined 13%, from $19

million in the third quarter of 2022 to $16 million in the third quarter of

2023

GAAP Net Loss increased 50%, from $227 million in the third quarter of 2022

to $340 million in the third quarter of 2023

Better

Q3 2023 Net Loss included approximately $243 million of non-cash

adjustments resulting from Balance Sheet movements associated with

the de-SPAC closing¹

Adjusted EBITDA loss improved 49% year-over-year in Q3 2023, from a loss

of $108 million in the third quarter of 2022 to a loss of $54 million in the third

quarter of 2023

Q3 2023 Total Expenses, Net Loss and Adjusted EBITDA included several

one-time compensation and vendor expenses related to the de-SPAC

transaction closing that are not expected to recur in future periods

Q3 2023 Statistics

$731 million

Funded Loan

Volume

2,067

Total Loans

1.94%

Gain on Sale

Margin

90%

Purchase

Volume

Demonstrated Growth & Discipline

11%

HELOC Loans

53%

D2C Volume

70%

One-Day Mortgage

of D2C loans

$1+ billion

Annualized Reduction

in Total Expense YoY²

1. Included $238 million elimination of a Bifurcated Derivative and $5 million write-off of debt issuance costs from prior corporate line of credit

2. Total Expenses in the nine months ending September 30, 2023 of $292 million ($389 million annualized). Total Expenses in the nine months ending September 30, 2022 of $1,110 million ($1,479 million annualized). Represents

$1,090 million annualized Total Expenses reduction year-over-year between the comparison nine-month periods. Annualized values calculated by multiplying the nine month amounts by four-thirds to reach run-rate full year value.

11View entire presentation