Kin SPAC Presentation Deck

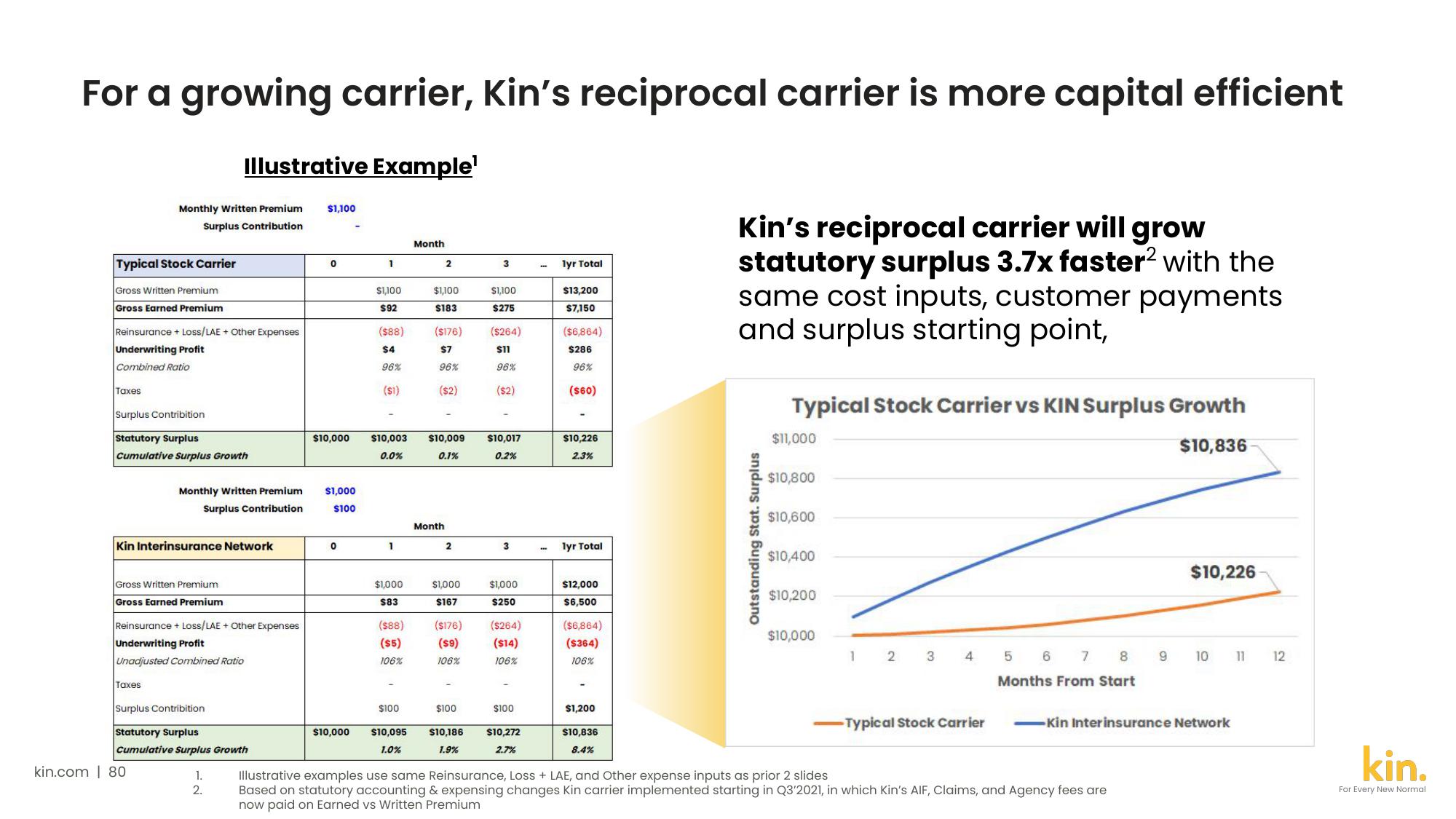

For a growing carrier, Kin's reciprocal carrier is more capital efficient

Illustrative Example¹

Typical Stock Carrier

Gross Written Premium

Gross Earned Premium

Reinsurance + Loss/LAE + Other Expenses

Underwriting Profit

Combined Ratio

Taxes

Monthly Written Premium

Surplus Contribution

Surplus Contribition

Statutory Surplus

Cumulative Surplus Growth

Kin Interinsurance Network

Monthly Written Premium

Surplus Contribution

Gross Written Premium.

Gross Earned Premium

Taxes

Reinsurance + Loss/LAE + Other Expenses

Underwriting Profit

Unadjusted Combined Ratio

kin.com | 80

Surplus Contribition

Statutory Surplus

Cumulative Surplus Growth

1.

2.

$1,100

0

$10,000

$1,000

$100

0

$10,000

1

$1,100

$92

($88)

$4

96%

($1)

$10,003

0.0%

1

$1,000

$83

($88)

($5)

106%

$100

$10,095

1.0%

Month

2

$1,100

$183

($176)

$7

96%

($2)

Month

2

$10,009 $10,017

0.1%

0.2%

$1,000

$167

3

$100

$1,100

$275

$10,186

1.9%

($264)

$11

96%

($2)

3

($176) ($264)

($9)

($14)

106%

106%

$1,000

$250

$100

$10,272

2.7%

1yr Total

$13,200

$7,150

($6,864)

$286

96%

($60)

$10,226

2.3%

lyr Total

$12,000

$6,500

($6,864)

($364)

106%

$1,200

$10,836

8.4%

Kin's reciprocal carrier will grow

statutory surplus 3.7x faster² with the

same cost inputs, customer payments

and surplus starting point,

Outstanding Stat. Surplus

Typical Stock Carrier vs KIN Surplus Growth

$10,836

$11,000

$10,800

$10,600

$10,400

$10,200

$10,000

1

2 3 4 5 6 7 8

Months From Start

-Typical Stock Carrier

9

Illustrative examples use same Reinsurance, Loss + LAE, and Other expense inputs as prior 2 slides

Based on statutory accounting & expensing changes Kin carrier implemented starting in Q3'2021, in which Kin's AIF, Claims, and Agency fees are

now paid on Earned vs Written Premium

$10,226

10 11

-Kin Interinsurance Network

12

kin.

For Every New NormalView entire presentation