Apollo Global Management Investor Presentation Deck

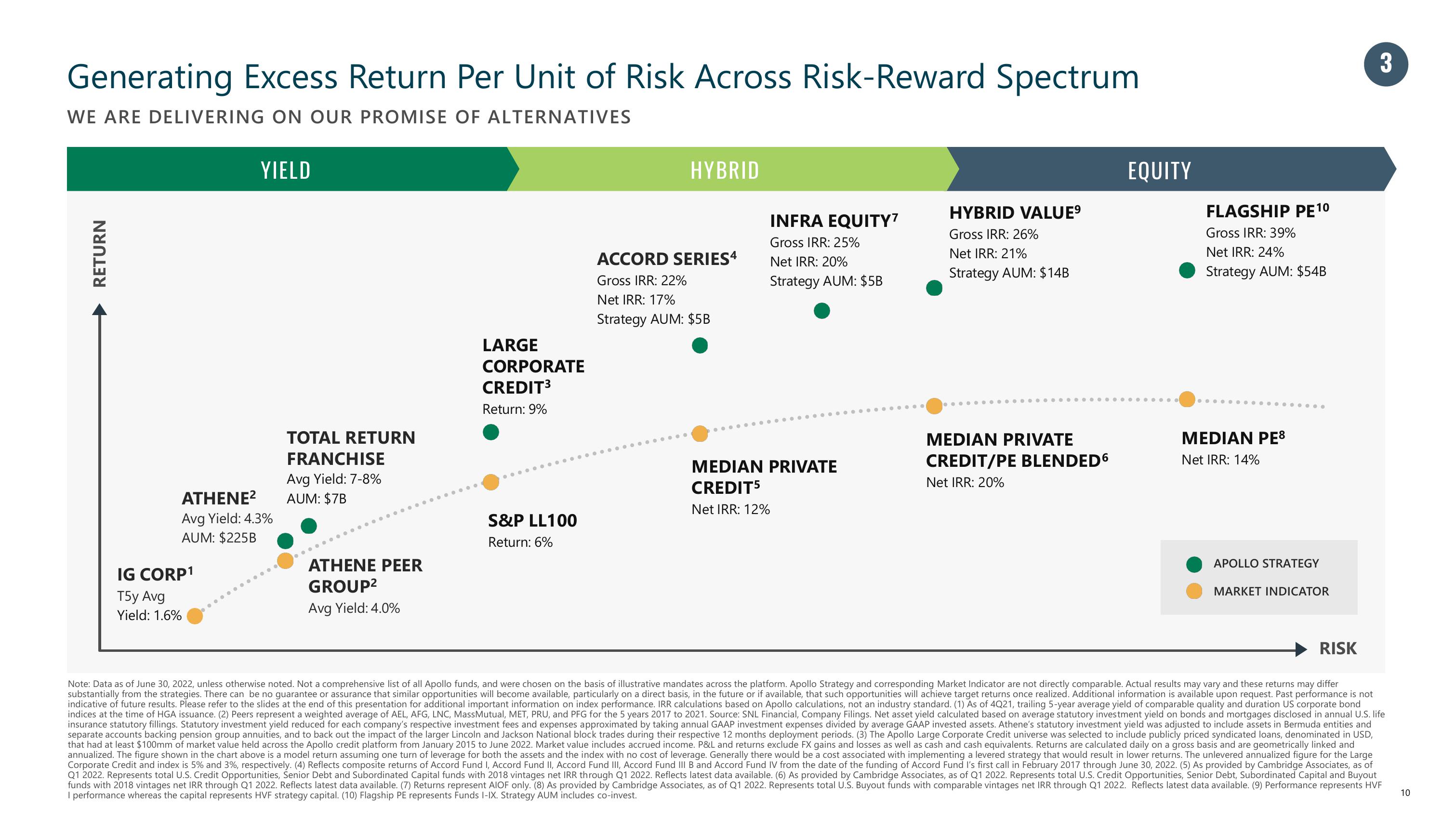

Generating Excess Return Per Unit of Risk Across Risk-Reward Spectrum

WE ARE DELIVERING ON OUR PROMISE OF ALTERNATIVES

RETURN

YIELD

ATHENE²

Avg Yield: 4.3%

AUM: $225B

IG CORP¹

T5y Avg

Yield: 1.6%

TOTAL RETURN

FRANCHISE

Avg Yield: 7-8%

AUM: $7B

ATHENE PEER

GROUP²

Avg Yield: 4.0%

LARGE

CORPORATE

CREDIT³

Return: 9%

S&P LL100

Return: 6%

HYBRID

ACCORD SERIES4

Gross IRR: 22%

Net IRR: 17%

Strategy AUM: $5B

INFRA EQUITY7

Gross IRR: 25%

Net IRR: 20%

Strategy AUM: $5B

MEDIAN PRIVATE

CREDIT5

Net IRR: 12%

HYBRID VALUE⁹

Gross IRR: 26%

Net IRR: 21%

Strategy AUM: $14B

MEDIAN PRIVATE

CREDIT/PE BLENDED6

Net IRR: 20%

EQUITY

FLAGSHIP PE 10

Gross IRR: 39%

Net IRR: 24%

Strategy AUM: $54B

...

.........

MEDIAN PE8

Net IRR: 14%

APOLLO STRATEGY

MARKET INDICATOR

RISK

3

Note: Data as of June 30, 2022, unless otherwise noted. Not a comprehensive list of all Apollo funds, and were chosen on the basis of illustrative mandates across the platform. Apollo Strategy and corresponding Market Indicator are not directly comparable. Actual results may vary and these returns may differ

substantially from the strategies. There can be no guarantee or assurance that similar opportunities will become available, particularly on a direct basis, in the future or if available, that such opportunities will achieve target returns once realized. Additional information is available upon request. Past performance is not

indicative of future results. Please refer to the slides at the end of this presentation for additional important information on index performance. IRR calculations based on Apollo calculations, not an industry standard. (1) As of 4Q21, trailing 5-year average yield of comparable quality and duration US corporate bond

indices at the time of HGA issuance. (2) Peers represent a weighted average of AEL, AFG, LNC, MassMutual, MET, PRU, and PFG for the 5 years 2017 to 2021. Source: SNL Financial, Company Filings. Net asset yield calculated based on average statutory investment yield on bonds and mortgages disclosed in annual U.S. life

insurance statutory fillings. Statutory investment yield reduced for each company's respective investment fees and expenses approximated by taking annual GAAP investment expenses divided by average GAAP invested assets. Athene's statutory investment yield was adjusted to include assets in Bermuda entities and

separate accounts backing pension group annuities, and to back out the impact of the larger Lincoln and Jackson National block trades during their respective 12 months deployment periods. (3) The Apollo Large Corporate Credit universe was selected to include publicly priced syndicated loans, denominated in USD,

that had at least $100mm of market value held across the Apollo credit platform from January 2015 to June 2022. Market value includes accrued income. P&L and returns exclude FX gains and losses as well as cash and cash equivalents. Returns are calculated daily on a gross basis and are geometrically linked and

annualized. The figure shown in the chart above is a model return assuming one turn of leverage for both the assets and the index with no cost of leverage. Generally there would be a cost associated with implementing a levered strategy that would result in lower returns. The unlevered annualized figure for the Large

Corporate Credit and index is 5% and 3%, respectively. (4) Reflects composite returns of Accord Fund I, Accord Fund II, Accord Fund III, Accord Fund III B and Accord Fund IV from the date of the funding of Accord Fund I's first call in February 2017 through June 30, 2022. (5) As provided by Cambridge Associates, as of

Q1 2022. Represents total U.S. Credit Opportunities, Senior Debt and Subordinated Capital funds with 2018 vintages net IRR through Q1 2022. Reflects latest data available. (6) As provided by Cambridge Associates, as of Q1 2022. Represents total U.S. Credit Opportunities, Senior Debt, Subordinated Capital and Buyout

funds with 2018 vintages net IRR through Q1 2022. Reflects latest data available. (7) Returns represent AIOF only. (8) As provided by Cambridge Associates, as of Q1 2022. Represents total U.S. Buyout funds with comparable vintages net IRR through Q1 2022. Reflects latest data available. (9) Performance represents HVF

I performance whereas the capital represents HVF strategy capital. (10) Flagship PE represents Funds I-IX. Strategy AUM includes co-invest.

10View entire presentation