LSE Results Presentation Deck

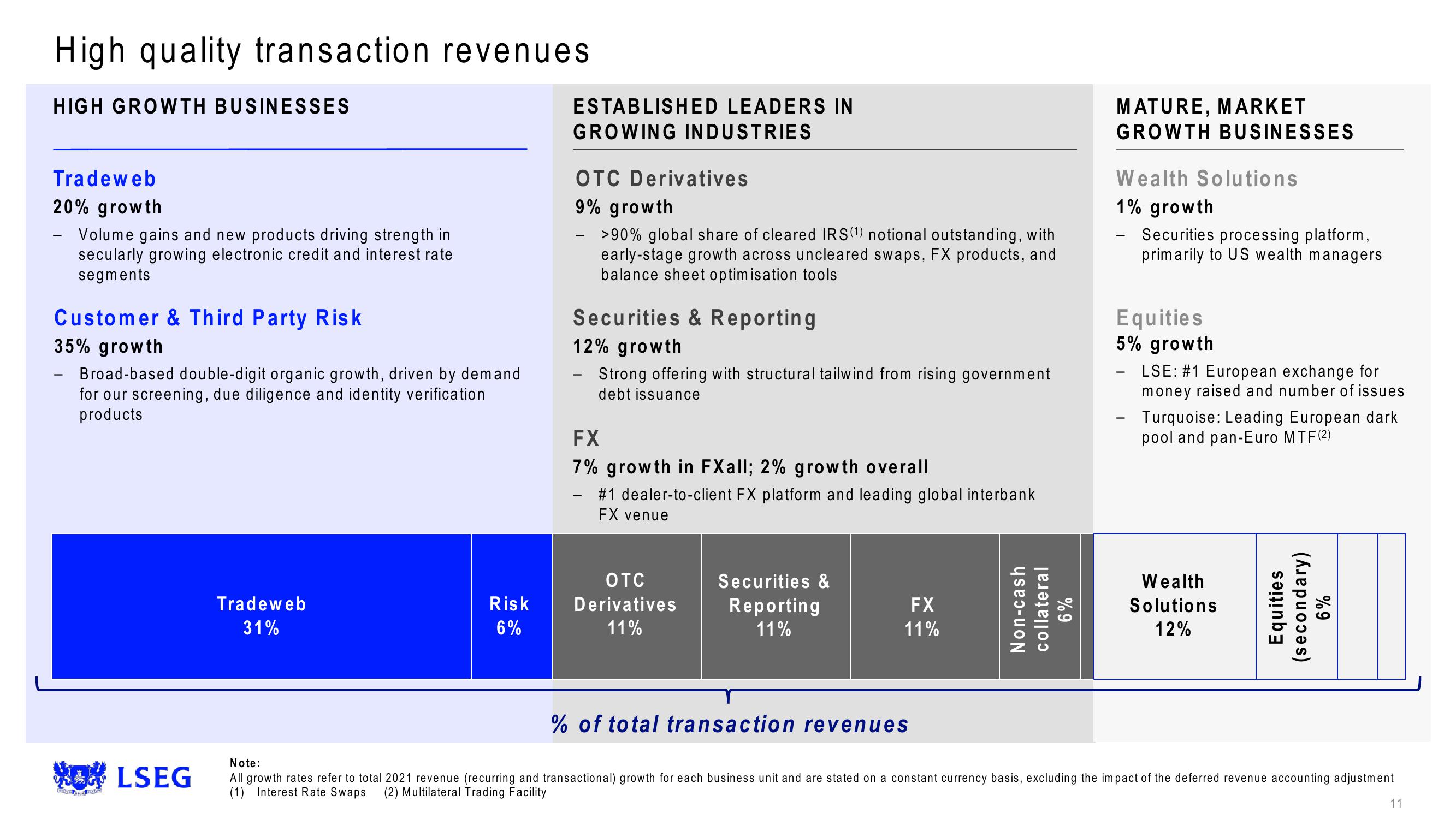

High quality transaction revenues

HIGH GROWTH BUSINESSES

Tradeweb

20% growth

Volume gains and new products driving strength in

secularly growing electronic credit and interest rate

segments

Customer & Third Party Risk

35% growth

Broad-based double-digit organic growth, driven by demand

for our screening, due diligence and identity verification

products

-

WOLSEG

Tradeweb

31%

Risk

6%

ESTABLISHED LEADERS IN

GROWING INDUSTRIES

OTC Derivatives

9% growth

-

– >90% global share of cleared IRS(¹) notional outstanding, with

early-stage growth across uncleared swaps, FX products, and

balance sheet optimisation tools

Securities & Reporting

12% growth

Strong offering with structural tailwind from rising government

debt issuance

FX

7% growth in FXall; 2% growth overall

#1 dealer-to-client FX platform and leading global interbank

FX venue

OTC

Derivatives

11%

Securities &

Reporting

11%

FX

11%

% of total transaction revenues

Non-cash

collateral

%9

MATURE, MARKET

GROWTH BUSINESSES

Wealth Solutions

1% growth

-

Securities processing platform,

primarily to US wealth managers

Equities

5% growth

-

LSE: #1 European exchange for

money raised and number of issues

- Turquoise: Leading European dark

pool and pan-Euro MTF (2)

Wealth

Solutions

12%

Equities

(secondary)

6%

Note:

All growth rates refer to total 2021 revenue (recurring and transactional) growth for each business unit and are stated on a constant currency basis, excluding the impact of the deferred revenue accounting adjustment

(1) Interest Rate Swaps (2) Multilateral Trading Facility

11View entire presentation