Faraday Future SPAC Presentation Deck

Proposed Transaction Summary

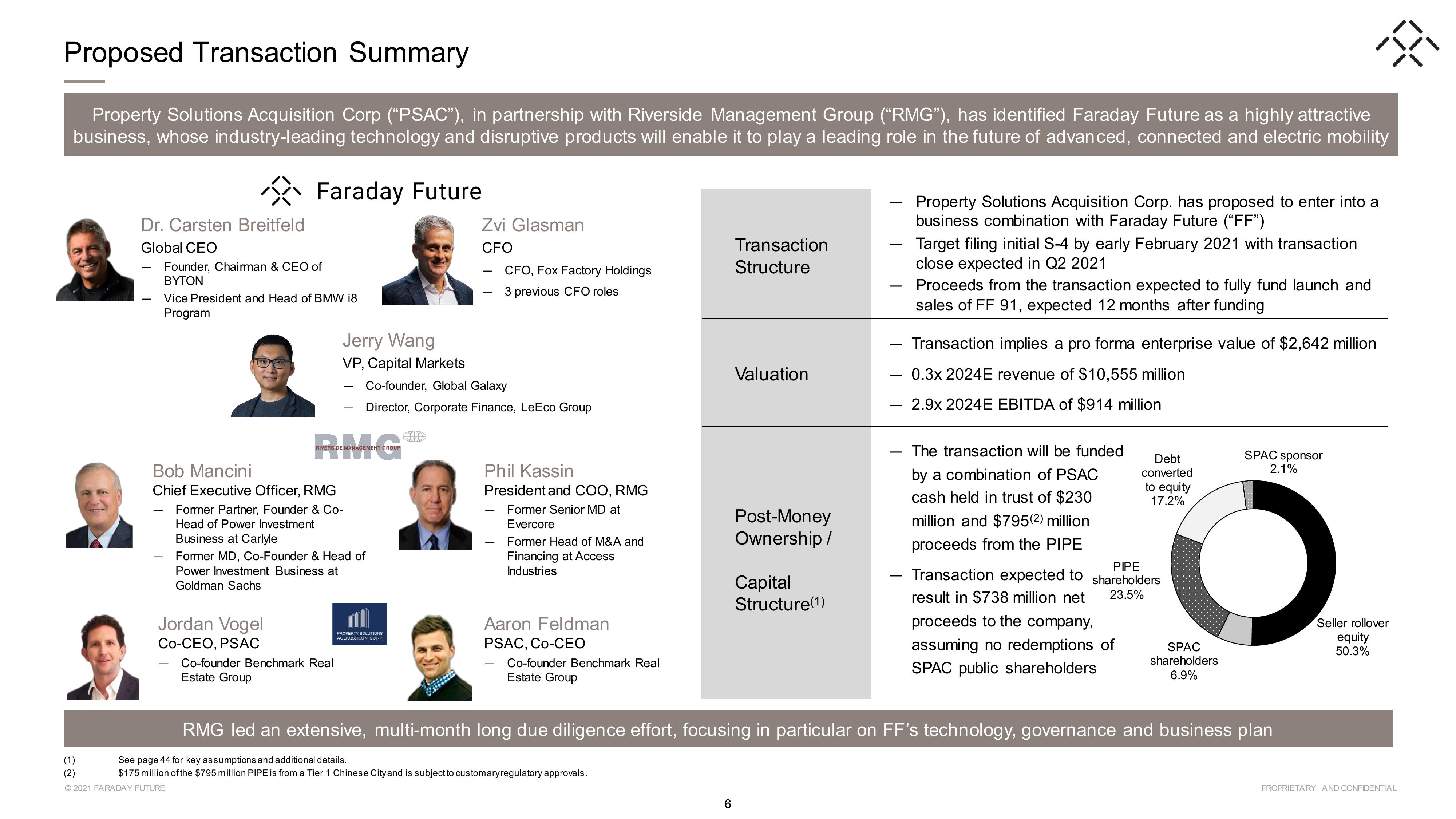

Property Solutions Acquisition Corp ("PSAC"), in partnership with Riverside Management Group ("RMG"), has identified Faraday Future as a highly attractive

business, whose industry-leading technology and disruptive products will enable it to play a leading role in the future of advanced, connected and electric mobility

Faraday Future

(1)

(2)

Dr. Carsten Breitfeld

Global CEO

Founder, Chairman & CEO of

BYTON

Vice President and Head of BMW i8

Program

Bob Mancini

Chief Executive Officer, RMG

Former Partner, Founder & Co-

Head of Power Investment

Business at Carlyle

Jordan Vogel

Co-CEO, PSAC

RMG

Ⓒ2021 FARADAY FUTURE

Former MD, Co-Founder & Head of

Power Investment Business at

Goldman Sachs

Jerry Wang

VP, Capital Markets

- Co-founder, Global Galaxy

Director, Corporate Finance, LeEco Group

Co-founder Benchmark Real

Estate Group

PROPERTY SOLUTIONS

ACQUISITION CORP

(CFD)

Zvi Glasman

CFO

izma

CFO, Fox Factory Holdings

3 previous CFO roles

Phil Kassin

President and COO, RMG

Former Senior MD at

Evercore

Former Head of M&A and

Financing at Access

Industries

Aaron Feldman

PSAC, Co-CEO

Co-founder Benchmark Real

Estate Group

Transaction

Structure

6

Valuation

Post-Money

Ownership /

Capital

Structure(1)

Property Solutions Acquisition Corp. has proposed to enter into a

business combination with Faraday Future ("FF")

Target filing initial S-4 by early February 2021 with transaction

close expected in Q2 2021

Proceeds from the transaction expected to fully fund launch and

sales of FF 91, expected 12 months after funding

- Transaction implies a pro forma enterprise value of $2,642 million

-0.3x 2024E revenue of $10,555 million

2.9x 2024E EBITDA of $914 million

The transaction will be funded

by a combination of PSAC

cash held in trust of $230

million and $795(2) million

proceeds from the PIPE

Debt

converted

to equity

17.2%

PIPE

shareholders

23.5%

- Transaction expected to

result in $738 million net

proceeds to the company,

assuming no redemptions of

SPAC public shareholders

SPAC

shareholders

6.9%

RMG led an extensive, multi-month long due diligence effort, focusing in particular on FF's technology, governance and business plan

See page 44 for key assumptions and additional details.

$175 million of the $795 million PIPE is from a Tier 1 Chinese Cityand is subject to customary regulatory approvals.

38

SPAC sponsor

2.1%

Seller rollover

equity

50.3%

PROPRIETARY AND CONFIDENTIALView entire presentation