Coppersmith Presentation to Alere Inc Stockholders

PAGE 27 |

Health Management: Capital Allocation

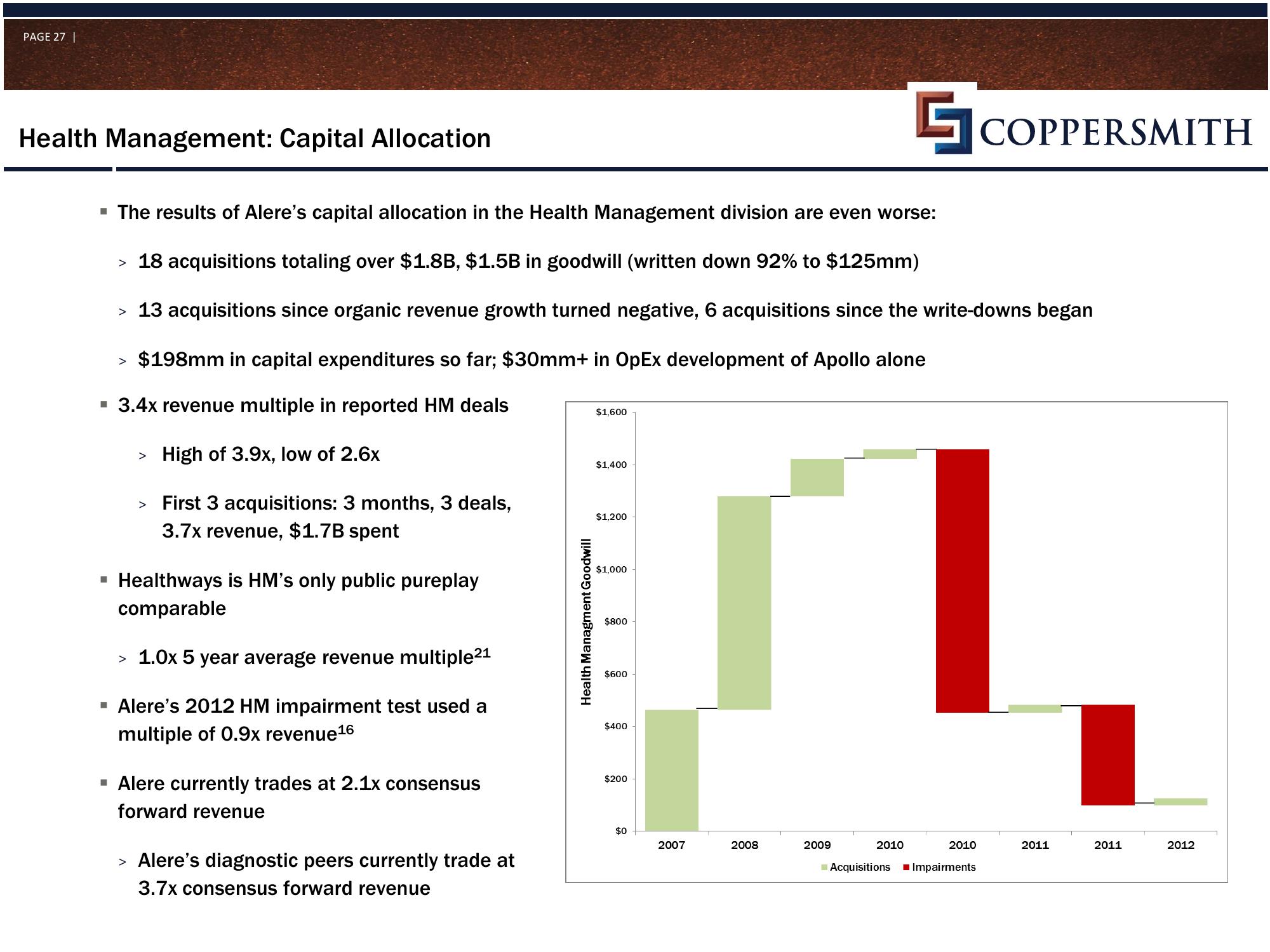

▪ The results of Alere's capital allocation in the Health Management division are even worse:

> 18 acquisitions totaling over $1.8B, $1.5B in goodwill (written down 92% to $125mm)

> 13 acquisitions since organic revenue growth turned negative, 6 acquisitions since the write-downs began

> $198mm in capital expenditures so far; $30mm+ in OpEx development of Apollo alone

▪ 3.4x revenue multiple in reported HM deals

High of 3.9x, low of 2.6x

First 3 acquisitions: 3 months, 3 deals,

3.7x revenue, $1.7B spent

Healthways is HM's only public pureplay

comparable

> 1.0x 5 year average revenue multiple²¹

▪ Alere's 2012 HM impairment test used a

multiple of 0.9x revenue ¹6

I

▪ Alere currently trades at 2.1x consensus

forward revenue

> Alere's diagnostic peers currently trade at

3.7x consensus forward revenue

Health Managment Goodwill

$1,600

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

2007

2008

2009

2010

2010

COPPERSMITH

Acquisitions ■Impairments

2011

2011

2012View entire presentation